Southward Company has implemented a JIT flexible manufacturing system. John Richins, controller of the company, has decided to reduce the accounting requirements given the expectation of lower inventories. For one thing, he has decided to treat direct labor cost as a part of

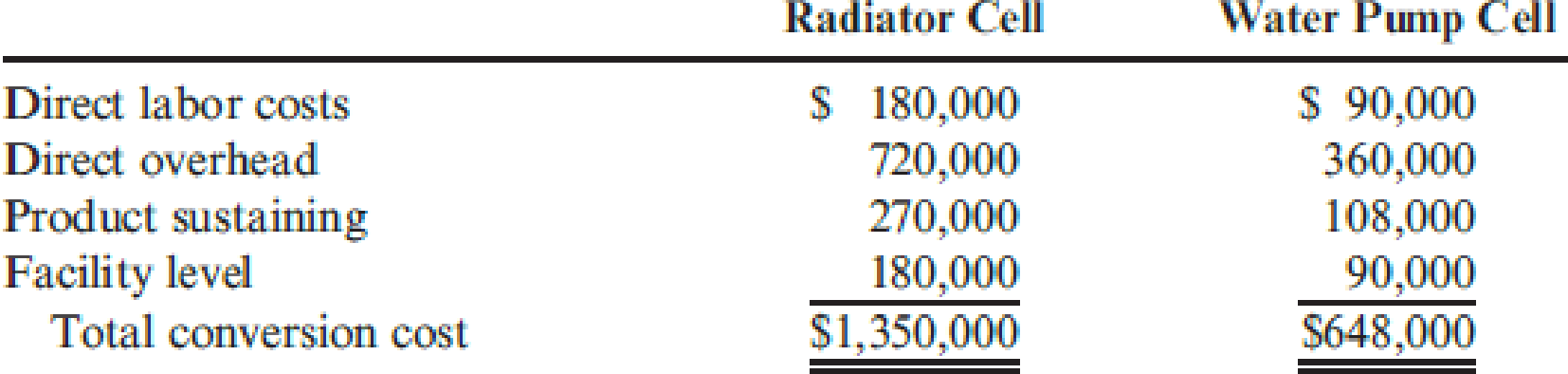

The predetermined conversion cost rate is based on available production hours in each cell. The radiator cell has 45,000 hours available for production, and the water pump cell has 27,000 hours. Conversion costs are applied to the units produced by multiplying the conversion rate by the actual time required to produce the units. The radiator cell produced 81,000 units, taking 0.5 hour to produce one unit of product (on average). The water pump cell produced 90,000 units, taking 0.25 hour to produce one unit of product (on average).

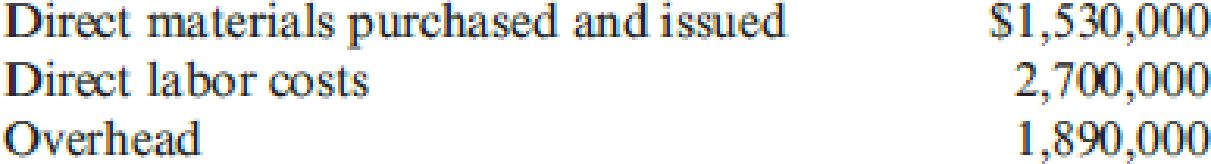

Other actual results for the year are as follows:

All units produced were sold. Any conversion cost variance is closed to Cost of Goods Sold.

Required:

- 1. Calculate the predetermined conversion cost rates for each cell.

- 2. Prepare

journal entries using backflush accounting. Assume two trigger points, with completion of goods as the second trigger point. - 3. Repeat Requirement 2, assuming that the second trigger point is the sale of the goods.

- 4. Explain why there is no need to have a work-in-process inventory account.

- 5. Two variants of backflush costing were presented in which each used two trigger points, with the second trigger point differing. Suppose that the only trigger point for recognizing

manufacturing costs occurs when the goods are sold. How would the entries be listed here? When would this backflush variant be considered appropriate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- what is the present value of the note provide correct answerarrow_forwardBradford Enterprises sells two products, blue pens and green notebooks. Bradford predicts that it will sell 3,200 blue pens and 900 green notebooks in the next period. The unit contribution margins for blue pens and green notebooks are $2.80 and $4.20, respectively. What is the weighted average unit contribution margin? Helparrow_forward!!???arrow_forward

- Next year, a business estimates that it will sell 30,000 units at a selling price of $15 per unit. Variable costs per unit are 40% of the selling price, and the business estimates that it will make a profit of $100,000. Calculate the fixed costs of the business for next year.arrow_forwardWhat is the company's Return on Equity?arrow_forwardMercer Corp uses the FIFO (first in first out) method in its process costing system. The cutting department had $6,000 in the material cost in its beginning work in process inventory and $75,000 in material cost was added during the period. The equivalent units of production for the material for the period were 20,000. The cost per equivalent unit for materials would be: A) $1.30 B) $3.30 C) $3.75 D) $4.05arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning