(a)

The graphical representation of the planned expenditure as a function of income.

(a)

Explanation of Solution

The Keynesian cross model is a basic model of income determination, which describes that there is one level of

Now substitute the respective values in Equation (1) to get the value of planned expenditure.

Therefore, the planned expenditure as a function of income is

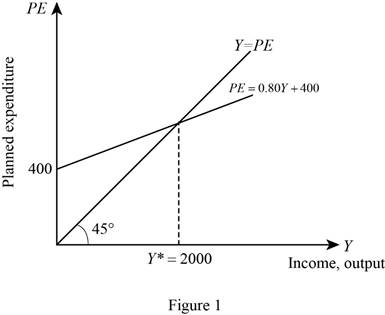

Figure 1 illustrates the planned expenditure as a function of income.

In Figure 1, the vertical axis measures the planned expenditure (PE), and the horizontal axis measures the income and output levels where the interaction between the planned expenditure curve and the actual expenditure curve determines the equilibrium level of income and output.

Planned expenditure: The planned expenditure is the amount households, firms, and the government would like to spend on goods and services.

Actual expenditure: The actual expenditure is the actual amount households, firms, and the government spend on goods and services.

(b)

The equilibrium income.

(b)

Explanation of Solution

In Keynesian cross model, the level of equilibrium national income occurs at the point where the planned expenditure equals the actual expenditure.

Now, substitute the respective values in Equation (2) to solve the value of equilibrium level of income.

Therefore, the equilibrium level of income is $2,000, which is shown in Figure 1.

(c)

The impact of an increase in the government purchases on equilibrium

(c)

Explanation of Solution

As described in part (a), the initial planned expenditure is

Now, substitute the respective values in Equation (2) to solve the new equilibrium income.

Therefore, the new equilibrium level of income is $2,100, which indicates that an increase in government purchases of 20 increases income by 100. This is because of the multiplier effect of government purchase on national income.

This multiplier effect on income due to an increase in government purchase can be calculated using the following formula.

Substitute the respective values into Equation (3).

Therefore, the value of government purchases multiplier is 5.

Government purchases multiplier: The government purchases multiplier indicates the ratio of change in equilibrium income to the change in government spending.

(d)

Explain that the level of government purchases is needed to achieve an income of 2,400.

(d)

Explanation of Solution

As described in part (b), the original equilibrium income is 2,000 to achieve an income level of 2,400; there is a need for an increase of 400

Now, the increase in government purchase to achieve an income level of 2,400 can be calculated as follows:

Therefore, the government purchases must increase by 80 to achieve a level of 480 for achieving an income of 2,400.

Now, substitute the respective values in Equation (2) to solve the new equilibrium income.

Therefore, an increase of government purchases of 80 increases income by 400.

Government purchases multiplier: The government purchases multiplier indicates the ratio of change in equilibrium income to the change in government spending.

(e)

Explain the level of government taxes needed to achieve an income of 2,400.

(e)

Explanation of Solution

As described in part (b), the original equilibrium income is 2,000 to achieve an income level of 2,400; there is a need for an increase of 400

Now the value of tax multiplier can be calculated as follows:

Therefore, the value of tax multiplier is

Now, the value of government taxes can be calculated as follows:

Therefore, the government taxes must decrease by 100 to achieve an income of 2,400, which means the government taxes must be 300.

Tax multiplier: The tax multiplier indicates that the amount income changes in response to a $1 change in taxes.

Want to see more full solutions like this?

- As indicated in the attached image, U.S. earnings for high- and low-skill workers as measured by educational attainment began diverging in the 1980s. The remaining questions in this problem set use the model for the labor market developed in class to walk through potential explanations for this trend. 1. Assume that there are just two types of workers, low- and high-skill. As a result, there are two labor markets: supply and demand for low-skill workers and supply and demand for high-skill workers. Using two carefully drawn labor-market figures, show that an increase in the demand for high skill workers can explain an increase in the relative wage of high-skill workers. 2. Using the same assumptions as in the previous question, use two carefully drawn labor-market figures to show that an increase in the supply of low-skill workers can explain an increase in the relative wage of high-skill workers.arrow_forwardPublished in 1980, the book Free to Choose discusses how economists Milton Friedman and Rose Friedman proposed a one-sided view of the benefits of a voucher system. However, there are other economists who disagree about the potential effects of a voucher system.arrow_forwardThe following diagram illustrates the demand and marginal revenue curves facing a monopoly in an industry with no economies or diseconomies of scale. In the short and long run, MC = ATC. a. Calculate the values of profit, consumer surplus, and deadweight loss, and illustrate these on the graph. b. Repeat the calculations in part a, but now assume the monopoly is able to practice perfect price discrimination.arrow_forward

- how commond economies relate to principle Of Economics ?arrow_forwardCritically analyse the five (5) characteristics of Ubuntu and provide examples of how they apply to the National Health Insurance (NHI) in South Africa.arrow_forwardCritically analyse the five (5) characteristics of Ubuntu and provide examples of how they apply to the National Health Insurance (NHI) in South Africa.arrow_forward

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc