Concept explainers

a)

The computation of magnitude of operating leverage utilising contribution margin approach of each firm.

a)

Answer to Problem 27P

the operating leverage of L Company and B Company are 1.5 times and 3 times.

Explanation of Solution

Given information:

The formula to calculate the magnitudes of operating leverage are as follows:

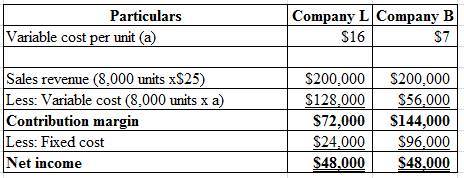

Calculate the magnitude of operating leverage of L Company and B Company:

Hence, the operating leverage of L Company and B Company are 1.5 times and 3 times.

b)

Determine the change in net income in amount and change in percentage of net income

b)

Explanation of Solution

Given information:

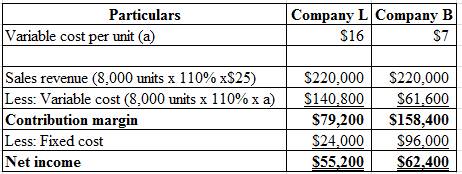

The sales increased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to calculate the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is 15% and 30%

c)

Determine the change in net income in amount and change in percentage of net income.

c)

Explanation of Solution

Given information:

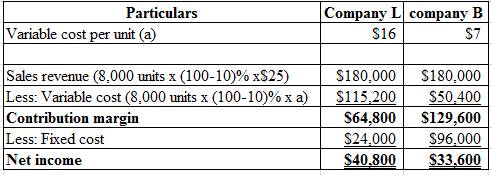

The sales decreased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to compute the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is −15% and −30%

d)

Write a memo regarding the analyses and advice by Person JD.

d)

Explanation of Solution

To,

Person A

From,

Person JD

Subject:

Analysis and recommendation regarding the investment

Date: 11/29/2018

The rewards and risk of both the companies are different even though they have same amount of sales and net income. From the analysis of Person JD the operating leverage is 1.5 for Company L and 3 for Company B.

The analytical data indicates that income of Company B is more volatile than Company L.

Investment in Company B will be the better choice in a economy boom situation. Otherwise, Company L is considering better. An aggressive investor can choice Company B and a conservative investor can go for Company L.

Want to see more full solutions like this?

Chapter 11 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Which of the following is NOT a component of internal control? a) Control activities b) Risk assessment c) External audit d) Monitoring activities MCQarrow_forwardWhat is the correct answer with accountingarrow_forwardWhich of the following is NOT a component of internal control? a) Control activities b) Risk assessment c) External audit d) Monitoring activitiesarrow_forward

- Noble Corporation had accounts receivable of $12,000 at the beginning of the month and $6,800 at the end of the month. Credit sales totaled $68,000 during the month. Calculate the cash collected from customers during the month, assuming that all sales were made on account.arrow_forwardAccurate answerarrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub