Sell or Process Further Decisions

Come-Clean Corporation produces a variety of cleaning compounds and solutions for both industrial and household use. While most of its products are processed independently, a few are related, such as the company. Grit 337 and its Sparkle silver polish.

Grit 337 is a coarse cleaning powder with many industrial uses. It costs $1.60 a pound to make, and it has a selling price of $2.00 a pound. A small portion of the annual production of Grit 337 is retained in the factory for further processing. It is combined with several other ingredients to form a paste that is marketed as Sparkle silver polish. The silver polish sells for $4.00 per jar.

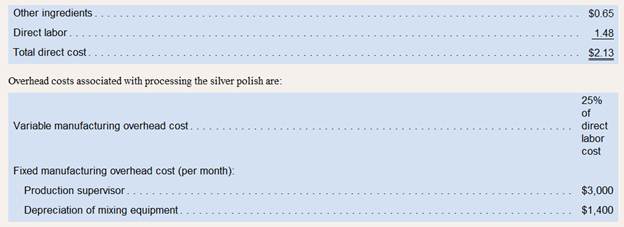

This further processing requires one-fourth pound of Grit 337 per jar of silver polish. The additional direct variable costs involved in the processing of a jar of silver polish are:

The production supervisor has no duties other than to oversee production of the silver polish. The mixing equipment is special-purpose equipment acquired specifically to produce the silver polish. It can produce up to 15,000 jars of polish per month. Its resale value is negligible and it does not wear out through use.

Advertising costs for the silver polish total $4,000 per month. Variable selling costs associated with the silver polish are 7.5% of sales.

Due to a recent decline in the demand for silver polish, the company is wondering whether its continued production is advisable. The sales manager feels that it would be more profitable to sell all of the Grit 337 as a cleaning powder.

Required:

1. How much incremental revenue does the company earn per jar of polish by further processing Grit 337 rather than selling it as a cleaning powder?

2. How much incremental contribution margin does the company earn per jar of polish by further processing Grit 337 rather than selling it as a cleaning powder?

3. How many jars of silver polish must be sold each month to exactly offset the avoidable fixed costs incurred to produce and sell the polish? Explain.

4. If the company sells 9,000 jars of polish, what is the financial advantage (disadvantage) of choosing to further process Grit 337 rather than selling is as a cleaning powder?

5. If the company sells 11,500 jars of polish, what is the financial advantage (disadvantage) of choosing to further process Grit 337 rather than selling is as a cleaning powder?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Introduction to Managerial Accounting - Connect Access

- Which of the following does not affect retained earnings directly?A. Net incomeB. Issuance of stockC. Net lossD. Dividendsarrow_forwardNo Ai Which of the following does not affect retained earnings directly?A. Net incomeB. Issuance of stockC. Net lossD. Dividendsarrow_forwardWhich document is used to track the movement of inventory into and out of the warehouse?A. InvoiceB. Purchase OrderC. Goods Received NoteD. Inventory Ledgerarrow_forward

- No chatgpt Which document is used to track the movement of inventory into and out of the warehouse?A. InvoiceB. Purchase OrderC. Goods Received NoteD. Inventory Ledgerarrow_forwardWhich document is used to track the movement of inventory into and out of the warehouse?A. InvoiceB. Purchase OrderC. Goods Received NoteD. Inventory Ledgerhelparrow_forwardNeed help If total liabilities are $25,000 and owner’s equity is $15,000, total assets equal:A. $10,000B. $25,000C. $40,000D. $15,000arrow_forward

- Solve it If total liabilities are $25,000 and owner’s equity is $15,000, total assets equal:A. $10,000B. $25,000C. $40,000D. $15,000arrow_forwardIf total liabilities are $25,000 and owner’s equity is $15,000, total assets equal:A. $10,000B. $25,000C. $40,000D. $15,000 help.arrow_forwardWhen a company pays rent in advance, it should record:A. Rent ExpenseB. Unearned Rent RevenueC. Prepaid Rent (Asset)D. Accrued Rentarrow_forward

- If total liabilities are $25,000 and owner’s equity is $15,000, total assets equal:A. $10,000B. $25,000C. $40,000D. $15,000arrow_forwardDon't use chatgpt When a company pays rent in advance, it should record:A. Rent ExpenseB. Unearned Rent RevenueC. Prepaid Rent (Asset)D. Accrued Rentarrow_forwardNo Chatgpt please 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education