(a)

To Discuss:

A 30-year maturity bond making annual coupon payments with a coupon rate of 12% has duration of 11.54 years and convexity of 192.4. The bond currently sells at a yield to maturity of 8%.

To use a financial calculator or spreadsheet to find the price of the bond if its yield to maturity falls to 7%.

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security,then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond.The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average

The time taken by the bond to change based on the interest rate changes is displayed by Convexity. Duration measures approximately a

Answer to Problem 26PS

Price of Bond using a financial calculator if yield to maturity falls to 7% is 1620.45.

Explanation of Solution

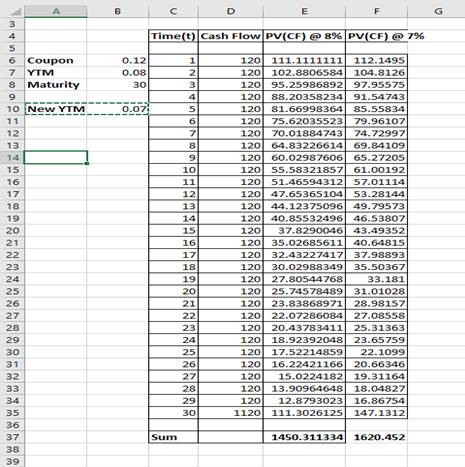

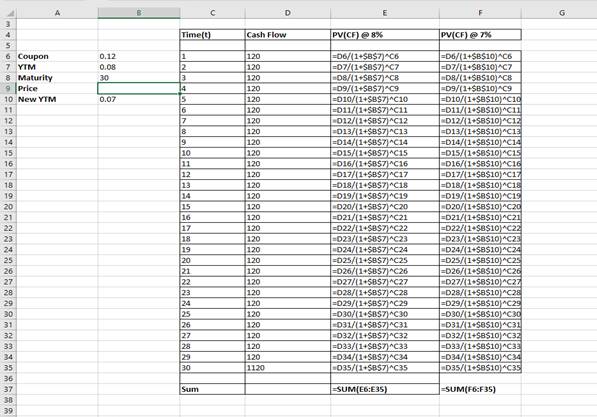

Price of the bond when the yield to maturity is 8% using a financial calculator can be calculated as below:

So, the price of the bond with 8% yield is 1450.31.

So, the price of the bond with 7% yield is 1620.45.

(b)

To Discuss:

A 30-year maturity bond making annual coupon payments with a coupon rate of 12% has duration of 11.54 years and convexity of 192.4The bond currently sells at a yield to maturity of 8%.

To predict the price using the duration rule.

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security, then that security is known as Bond. The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond. The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average rate of return which a holder can expect from a bond, is known as Yield to Maturity.

The time taken by the bond to change based on the interest rate changes are displayed by Convexity.

Duration measures approximately a bond's price sensitivity to interest rates changes.

Answer to Problem 26PS

Price of Bond using the duration rule if yield to maturity falls to 7% is 1605.28.

Explanation of Solution

The price of the bond with 8% yield is 1450.31.

Price of the Bond using the duration rule, if yield to maturity falls to 7%:

Predicted Price change =

=

=154.97

Predicted new price=1450.31+154.97=1605.28

(c)

To Discuss:

A 30-year maturity bond making annual coupon payments with a coupon rate of 12% has duration of 11.54 years and convexity of 192.4.The bond currently sells at a yield to maturity of 8%.

To predict the price using the duration with convexity rule.

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security,then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond.The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average rate of return which a holder can expect from a bond,is known as Yield to Maturity.

The time taken by the bond to change based on the interest rate changes is displayed by Convexity. Duration measures approximately a bond's price sensitivity to interest rates changes.

Answer to Problem 26PS

Price of Bond using the duration with convexity rule if yield to maturity falls to 7% is 1619.23.

Explanation of Solution

So, the price of the bond with 8% yield is 1450.31.

Price of the Bond using Duration-with-Convexity Rule, if yield to maturity falls to 7%:

Predicted price change =

=

=168.92

Predicted new price=1450.31+168.92=1619.23

(d)

To Discuss:

A 30-year maturity bond making annual coupon payments with a coupon rate of 12% has duration of 11.54 years and convexity of 192.4. The bond currently sells at a yield to maturity of 8%.

To determine the percent error for each rule and to conclude about the accuracy of the two rules.

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security,then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond.The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average rate of return which a holder can expect from a bond,is known as Yield to Maturity.

The time taken by the bond to change based on the interest rate changes is displayed by Convexity. Duration measures approximately a bond's price sensitivity to interest rates changes.

Answer to Problem 26PS

The percentage error of duration rule is -.98% and percentage error of duration with convexity rule is -.075%.

Conclusion: The duration-with-convexity rule provides more accurate approximations tothe true change in price.

Explanation of Solution

Percent error for duration rule =

= -0.0094

= -0.94%

Percent error for duration with convexity rule=

= -0.00075

= -0.075%

The duration-with-convexity rule provides more accurate approximations to

the true change in price.

Conclusion: The percentage error using convexity with duration is less than one-tenth the error using only duration to estimate the price change.

(e)

To Discuss:

A 30-year maturity bond making annual coupon payments with a coupon rate of 12% has duration of 11.54 years and convexity of 192.4The bond currently sells at a yield to maturity of 8%.

To repeat the analysis if the bond's yield to maturity increases to 9% and to determine whether the conclusions about the accuracy of the two rules with parts (a)-(d) were consistent.

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security,then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond.The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average rate of return which a holder can expect from a bond,is known as Yield to Maturity.

The time taken by the bond to change based on the interest rate changes is displayed by Convexity. Duration measures approximately a bond's price sensitivity to interest rates changes.

Answer to Problem 26PS

The conclusions about the accuracy of the two rules with parts (a)-(d) were consistent on repeating the analysis if the bond's yield to maturity increases to 9%.

Explanation of Solution

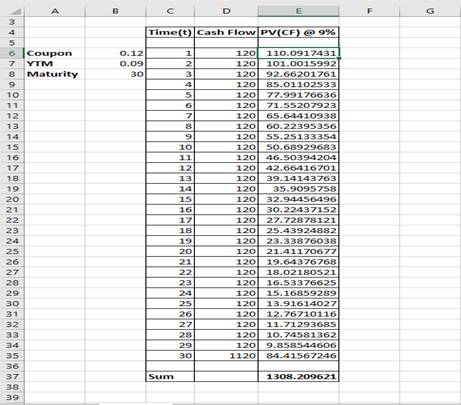

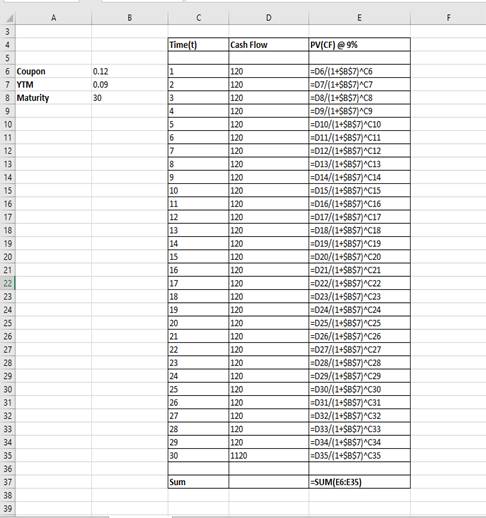

So, the price of the bond with 9% yield is 1308.21.

Price of the Bond using the duration rule, if yield to maturity rises to 9%:

Predicted Price change =

=

=-154.97

Predicted new price=1450.31-154.97

=1295.34

Percent error=

= -0.0098

= -0.98%

Price of the Bond using Duration-with-Convexity Rule, if yield to maturity rises to 9%:

Predicted price change =

=

= -141.02

Predicted new price=1450.31-141.02=1309.29

Percent error=

=0.00083

=0.083%

The percentage error using convexity with duration is less than one-tenth the error using only duration to estimate the price change.

The previous conclusion about the duration with convexity rule being more accurate is consistent with parts (a) - (d) if the bond's yield to maturity rises to 9%.

Want to see more full solutions like this?

Chapter 11 Solutions

Essentials Of Investments

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education