(a)

To Discuss:

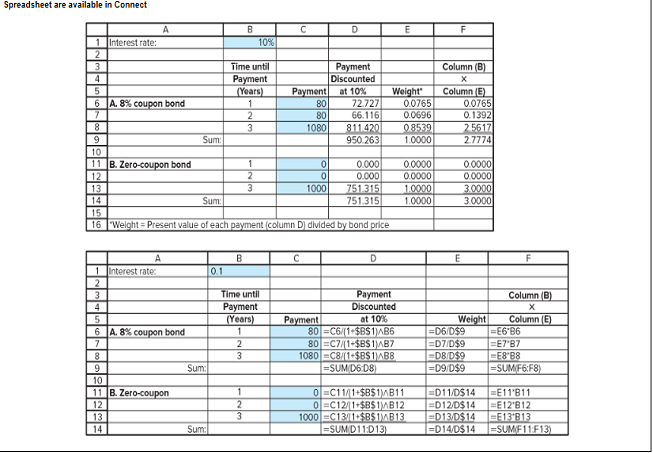

To use a spreadsheet to calculate the duration of the two bonds in Spreadsheet 11.1 if the market interest rate increases to 12%.The explanation of the reason of the fall in the duration of the coupon bond while the duration of the zero-coupon bond remaining unchanged is to be given.

Spreadsheet 11.1

Introduction:

A bond is a security that creates an obligation on the issuer to make specified payments to the holder for a given period of time. The face value of the bond is the amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond.A zero-coupon bond is a bond where the face value is repaid at the time of maturity.

Yield to maturity means the discount rate which makes the present payments from the bond equal to the price, in simple terms it is the average

(b)

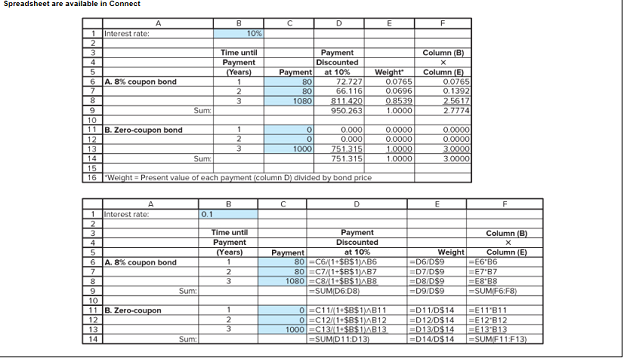

To Discuss:

To use the same spreadsheet to calculate the duration of the coupon bond if the coupon were 12% instead of 8%.The explanation of the reason of the duration of the coupon bond being lower is to be given.

Spreadsheet 11.1

Introduction:

A bond is a security that creates an obligation on the issuer to make specified payments to the holder for a given period of time. The face value of the bond is the amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond. A zero-coupon bond is a bond where the face value is repaid at the time of maturity.

Yield to maturity means the discount rate which makes the present payments from the bond equal to the price, in simple terms it is the average rate of return a holder can expect from that bond. Duration is a measure of the sensitivity of the price -- the value of principal -- of a bond to a change in interest rates. The duration of a zero-coupon bond is equal to the time to maturity of the bond.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

ESSEN.OF INVESTMENTS(LOOSE)W/CONNECT<BI>

- King’s Park, Trinidad is owned and operated by a private company,Windy Sports Ltd. You work as the Facilities Manager of the Park andthe CEO of the company has asked you to evaluate whether Windy shouldembark on the expansion of the facility given there are plans by theGovernment to host next cricket championship.The project seeks to increase the number of seats by building fournew box seating areas for VIPs and an additional 5,000 seats for thegeneral public. Each box seating area is expected to generate $400,000in incremental annual revenue, while each of the new seats for thegeneral public will generate $2,500 in incremental annual revenue.The incremental expenses associated with the new boxes and seatingwill amount to 60 percent of the revenues. These expenses includehiring additional personnel to handle concessions, ushering, andsecurity. The new construction will cost $15 million and will be fullydepreciated (to a value of zero dollars) on a straight-line basis overthe 5-year…arrow_forwardYou are called in as a financial analyst to appraise the bonds of Ollie’s Walking Stick Stores. The $5,000 par value bonds have a quoted annual interest rate of 8 percent, which is paid semiannually. The yield to maturity on the bonds is 12 percent annual interest. There are 12 years to maturity. a. Compute the price of the bonds based on semiannual analysis. b. With 8 years to maturity, if yield to maturity goes down substantially to 6 percent, what will be the new price of the bonds?arrow_forwardLonnie is considering an investment in the Cat Food Industries. The $10,000 par value bonds have a quoted annual interest rate of 12 percent and the interest is paid semiannually. The yield to maturity on the bonds is 14 percent annual interest. There are seven years to maturity. Compute the price of the bonds based on semiannual analysis.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education