Make or Buy Decision

Silven Industries, which manufactures and sells a highly successful line of summer lotions and insect repellents, has decided to diversify in order to stabilize sales throughout out the war. A natural area for the company to consider is the production of winter lotions and creams to prevent dry and chapped skin.

After considerable research, a winter products line has been developed. However, Silvens president has decided to introduce only one of the new products for this coming winter If the product is a success, further expansion in future years will be initiated. The product selected (called Chap-Off) is a lip balm that will be sold in a lipstick-type true The product will be sold to wholesalers in boxes of 24 tubes for $8 per box. Because of excess capacity, no additional fixed manufacturing

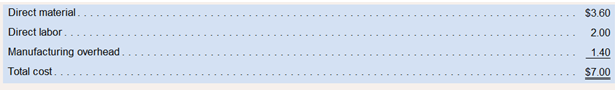

Using the estimated sales and production of 100,000 boxes of Chap-Off the Accounting Department has developed the following manufacturing cost per box:

The costs above relate to making both the lip balm and the tube that contains it. As an alternative to making the tubes for Chap. Off, Silven has approached a supplier to discuss the possibility of buying the tubes. The purchase price of the supplier’s empty tubes would be $135 per box of 24 tubes. If Silven Industries stops making the tubes and but them from the outside supplier, its direct labor and variable manufacturing overhead costs per box of Chap-Off would be reduced by 10% and its direct materials costs would be reduced by 25%.

Required:

1. If Silven buys its tubes from the outside supplier, bow much of its own Chap-Off

2. That is the financial advantage (disadvantage) per box of Chap-Off if Silven buys its tubes from the outside supplier?

3. What is the financial advantage (disadvantage) in total (not per box) if Silven buys 100000 boxes of tubes from the outside supplier?

4. Should Silven Industries make or buy the tubes’

5. What is the maximum price that Silven should be willing to pay the outside supplier (os a box of 24 tubes? Explain.

6. Instead of sales of 100,000 boxes, revised estimates show a sales volume of 120000 boxes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $40,000 per year to make the additional 20,000 boxes of tubes. Assuming that the outside supplier will not accept an order for less than 120,000 boxes. what is the financial advantage (disadvantage) in total (not per box) if Silven buys 120,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes?

7. Refer to the data in (6) above. Assume that the out side supplier will accept an order of any size for the tubes at a price of $l.35 per box. How many boxes of tubes should Silven make? How many boxes of tubes should it buy from the outside supplier?

8. What qualitative factors should Silven Industries consider in determining whether they should make or buy the tubes?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

BREWER ND LL INTRO MGRL ACTG CON+ AC

- Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings StatementNo Aiarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrectarrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrect solutuarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentarrow_forward

- Choose the items of income or expense that belong in the described areas of Form 1120, Schedule M-1 (Sections: Income subject to tax not recorded on books, Expenses recorded on books this year not deducted on this return, Income recorded on books this year not included on this return, and Deductions on this return not charged against book income.) Note the appropriate amount for the item selected under each section. If the amount decreases taxable income relative to book income, provide the amount as a negative number. If the amount increases taxable income relative to book income, provide the amount as a positive number. The following adjusted revenue and expense accounts appeared in the accounting records of Pashi, Inc., an accrual basis taxpayer, for the year ended December 31, Year 2. Revenues Net sales $3,000,000 Interest 18,000 Gains on sales of stock 5,000 Key-man life insurance proceeds 100,000 Subtotal $3,123,000 Costs and Expenses Cost of…arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardSolve this Question Accurate with General Accounting Solving methodarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning