Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 23E

Quick ratio

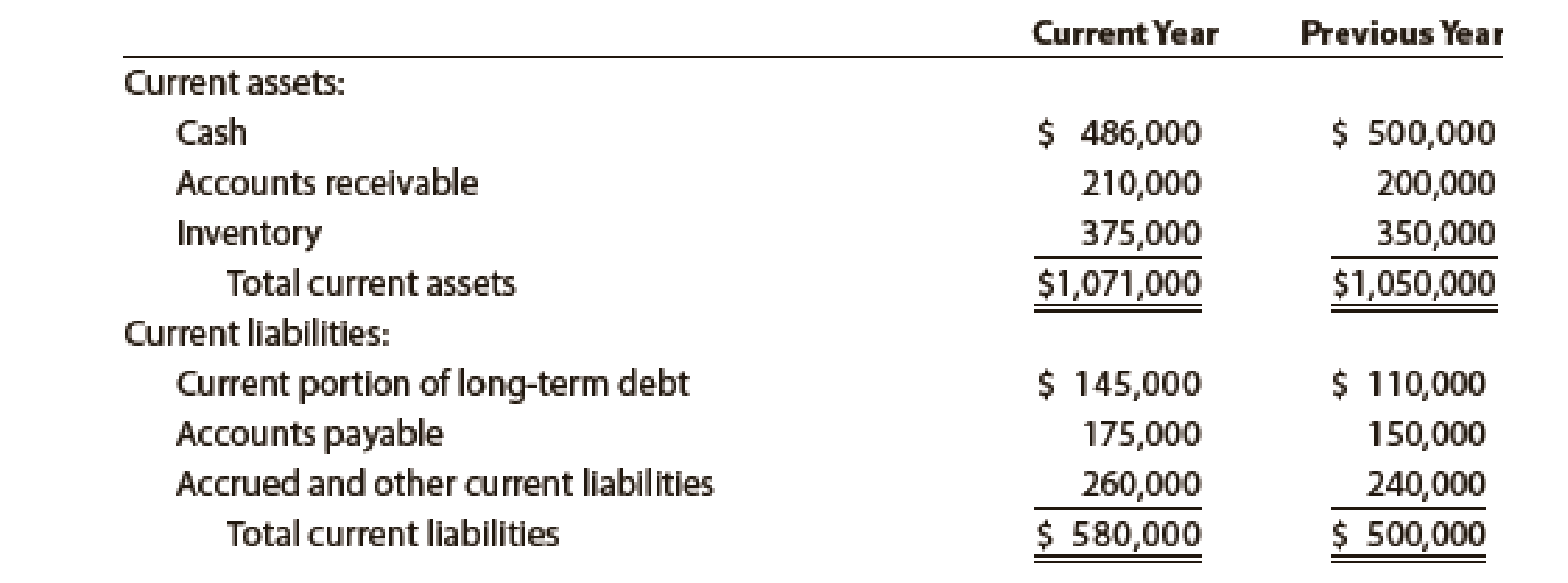

Gmeiner Co. had the following current assets and liabilities on December 31 of two recent years:

- a. Determine the quick ratio for December 31 of both years.

- b.

Interpret the change in the quick ratio between the two

Interpret the change in the quick ratio between the two balance sheet dates.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cornell Corporation plans to generate $960,000 of sales revenue if a capital project is implemented. Assuming a 30% tax rate, the sales revenue should be reflected in the analysis by: need Answer

Can you solve this general accounting problem with appropriate steps and explanations?

I need help solving this financial accounting question with the proper methodology.

Chapter 11 Solutions

Financial Accounting

Ch. 11 - Does a discounted note payable provide credit...Ch. 11 - Employees are subject to taxes withheld from their...Ch. 11 - Prob. 3DQCh. 11 - Prob. 4DQCh. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Prob. 8DQCh. 11 - When should the liability associated with a...Ch. 11 - Prob. 10DQ

Ch. 11 - Proceeds from notes payable On May 15, Maynard Co....Ch. 11 - Proceeds from notes payable On January 26, Nyree...Ch. 11 - Prob. 2PEACh. 11 - Prob. 2PEBCh. 11 - Prob. 3PEACh. 11 - Prob. 3PEBCh. 11 - Journalize period payroll The payroll register of...Ch. 11 - Journalize period payroll The payroll register of...Ch. 11 - Journalize payroll tax The payroll register of...Ch. 11 - Journalize payroll tax The payroll register of...Ch. 11 - Prob. 6PEACh. 11 - Prob. 6PEBCh. 11 - Prob. 7PEACh. 11 - Prob. 7PEBCh. 11 - Quick ratio Nabors Company reported the following...Ch. 11 - Quick ratio Adieu Company reported the following...Ch. 11 - Current liabilities Bon Nebo Co. sold 25,000...Ch. 11 - Entries for notes payable Cosimo Enterprises...Ch. 11 - Entries for discounting notes payable Ramsey...Ch. 11 - Evaluating alternative notes A borrower has two...Ch. 11 - Entries for notes payable A business issued a...Ch. 11 - Entries for discounted note payable A business...Ch. 11 - Entries for notes payable Bull City Industries is...Ch. 11 - Prob. 8ECh. 11 - Calculate payroll An employee earns 25 per hour...Ch. 11 - Prob. 10ECh. 11 - Summary payroll data In the following summary of...Ch. 11 - Payroll tax entries According to a summary of the...Ch. 11 - Payroll entries The payroll register for Gamble...Ch. 11 - Prob. 14ECh. 11 - Prob. 15ECh. 11 - Prob. 16ECh. 11 - Accrued vacation pay A business provides its...Ch. 11 - Prob. 18ECh. 11 - Prob. 19ECh. 11 - Prob. 20ECh. 11 - Accrued product warranty General Motors...Ch. 11 - Prob. 22ECh. 11 - Quick ratio Gmeiner Co. had the following current...Ch. 11 - Prob. 24ECh. 11 - Liability transactions The following items were...Ch. 11 - Entries for payroll and payroll taxes The...Ch. 11 - Wage and tax statement data on employer FICA tax...Ch. 11 - Prob. 4PACh. 11 - Payroll accounts and year-end entries The...Ch. 11 - Prob. 1PBCh. 11 - Entries for payroll and payroll taxes The...Ch. 11 - Wage and tax statement data and employer FICA tax...Ch. 11 - Prob. 4PBCh. 11 - Payroll accounts and year-end entries The...Ch. 11 - Prob. 3CPPCh. 11 - Ethics in Action Tonya Latirno is a staff...Ch. 11 - Prob. 2CPCh. 11 - Communication WBM Motorworks is a manufacturer of...Ch. 11 - Recognizing pension expense The annual examination...Ch. 11 - Prob. 7CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardVistar Manufacturing bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 8,200 direct labor-hours will be required in July. The variable overhead rate is $4.85 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $125,000 per month, which includes depreciation of $10,500. All other fixed manufacturing overhead costs represent current cash flows. What should be the July cash disbursements for manufacturing overhead on the manufacturing overhead budget?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardIn June, one of the processing departments at Amy Manufacturing had beginning work in process inventory of $45,000 and ending work in process inventory of $21,000. During the month, the cost of units transferred out from the department was $632,000. In the department's cost reconciliation report for June, the total cost to be accounted for under the weighted-average method would be____.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Oakridge Manufacturing applies overhead to jobs using a predetermined rate of 125% of direct labor cost. At year-end, the company had actual overhead costs of $487,500, while applied overhead totaled $512,500. The company's unadjusted cost of goods sold was $1,250,000. If the company closes any over- or underapplied overhead to cost of goods sold, what is the adjusted cost of goods sold? Need helparrow_forwardMartin Manufacturing prepared a fixed budget of 85,000 direct labor hours, with estimated overhead costs of $425,000 for variable overhead and $120,000 for fixed overhead. Martin then prepared a flexible budget of 78,000 labor hours. How much are total overhead costs at this level of activity?arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License