To describe:The marginal propensity to consume, multiplier, equilibrium

Answer to Problem 1TY

The results showed that if 75% of the income is consumed, then its multiplier effect on income will be 4%.Since, the multiplier effect on consumption is 4, the reduction in government purchases by $60 will reduce the consumption expenditure by $240.

Explanation of Solution

In table (2), the GDP of an economy equals to consumption expenditure when both are at $1,720; hence the equilibrium level of GDP is $1,720

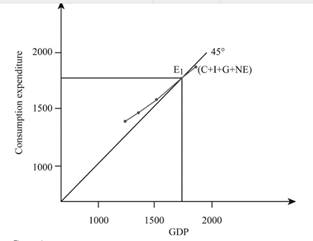

In figure (1) , GDP is measured on horizontal axis and consumption expenditure is measured on vertical axis

Graphical representation of equilibrium level of GDP

Figure 1 indicates that the consumption expenditure and GDP obtain equilibrium at E1 when both values are at $1,720 and intersects the 45 degree line.

The increase in personal consumption per increase in additional amount of disposable income is described by the marginal propensity to consume (MPC).

The marginal propensity to consume can be calculated using the following formula:

The following table presents the marginal propensity to consume using the formula in equation (1)

Table- 3

| DI | C | ΔDI | Δ C | MPC |

| 960 | 720 | - | - | - |

| 1080 | 810 | 120 | 90 | 0.75 |

| 1200 | 900 | 120 | 90 | 0.75 |

| 1320 | 990 | 120 | 90 | 0.75 |

| 1440 | 1080 | 120 | 90 | 0.75 |

Fifth column of table 1 shows the marginal propensity to consume is $0.75.

The consumption multiplier can be calculated using the following formula:

Using equation (2) calculate the multiplier:

The results showed that if 75% of the income is consumed, then its multiplier effect on income will be 4%.

Since the multiplier effect on consumption is 4, the reduction in government purchases by $60 will reduce the consumption expenditure by $240.

Introduction:The balance yield of an economy is the degree of yield at which the aggregate sum of planned spending is simply equivalent to that of output, or GDP. That isequilibrium GDP = C + Ig. Consumption expenditures rise with GDP while arranged gross speculation expenditures are autonomous of the degree of GDP.

Want to see more full solutions like this?

- Critically analyse the five (5) characteristics of Ubuntu and provide examples of how they apply to the National Health Insurance (NHI) in South Africa.arrow_forwardCritically analyse the five (5) characteristics of Ubuntu and provide examples of how they apply to the National Health Insurance (NHI) in South Africa.arrow_forwardOutline the nine (9) consumer rights as specified in the Consumer Rights Act in South Africa.arrow_forward

- In what ways could you show the attractiveness of Philippines in the form of videos/campaigns to foreign investors? Cite 10 examples.arrow_forwardExplain the following terms and provide an example for each term: • Corruption • Fraud • Briberyarrow_forwardIn what ways could you show the attractiveness of a country in the form of videos/campaigns?arrow_forward

Survey of Economics (MindTap Course List)EconomicsISBN:9781305260948Author:Irvin B. TuckerPublisher:Cengage Learning

Survey of Economics (MindTap Course List)EconomicsISBN:9781305260948Author:Irvin B. TuckerPublisher:Cengage Learning