Concept explainers

YTM is the yield to maturity. It is the rate earned by the investor if he holds the bond till maturity.

Calculate the YTM by using the following formula:

Where,

M is the par value or face value,

INT is the dollar interest payment,

N is the number of years of interest payment.

After tax cost of debt: Interest expenses are tax deductible. So, after tax cost of debt is obtained after deducting the tax expenses from the cost of debt.

Calculate the after tax cost of debt by using the following formula:

T is the tax rate,

G products is plan to issue new bonds for new growth opportunity. Interest payment is $60, maturity 10 years, current price is $1,077 and tax rate is 40%

Explanation of Solution

a.

Calculate the YTM as follows:

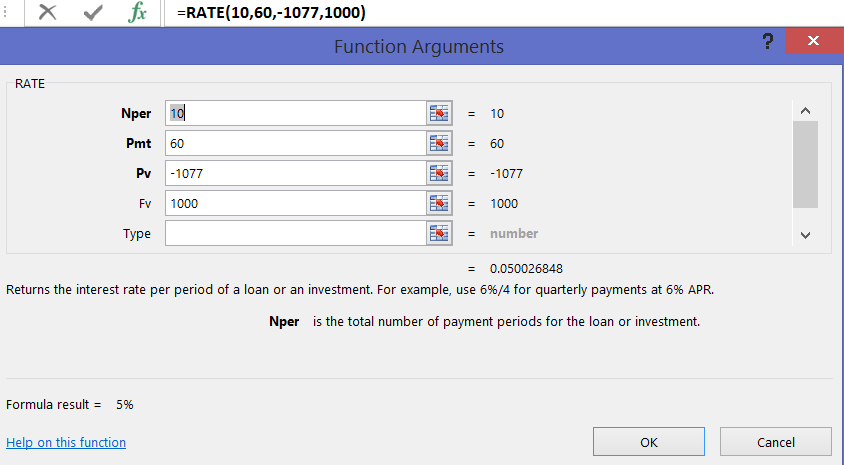

Using Excel calculate YTM:

Therefore, the YTM is

a.

Calculate the after tax cost of debt as follows:

Therefore, the after tax cost of debt is

Want to see more full solutions like this?

Chapter 11 Solutions

CFIN -STUDENT EDITION-W/ACCESS >CUSTOM<

- About this Assignment For the Corporate Finance 301 assignment, you will submit a research paper that analyzes and discusses organizational financial risks. You will apply knowledge acquired in the course and use the concepts of multiple financial risks as the basis of research and analysis. The research paper should follow APA formatting style. Audience: upper-level business students. Project Prompt Write a 1,000-1,200-word analysis discussing financial risk concepts and assess the impact of the different financial risks on an organization. For this assignment, you will structure your assignment using four research paper sections associated with corporate risk management, as studied in the course. Base your research paper on the financial statements analyzed in Corporate Finance 301 assignment 2 and apply the knowledge acquired in the analysis. Define each financial risk, discuss the risk associated components, and evaluate the financial risks and how they affect the corporation's…arrow_forwardBobby Nelson, made deposits of $880 at the end of each year for 6 years. Interest is 6% compounded annually. What is the value of Bobby’s annuity at the end of 6 years?arrow_forward1. Find the future value if $1,250 is invested in Simple interest account paying 6.5%: a. for 5 years b. for 20 years 2. Find the future amount $ 35,000 is invested for 30 years at 4.25% compounded: a. annually b. Quarterly c. monthly d. weekly 3. How much should be put into an account today that pays 7.75% compounded monthly if you need $10,000 in 5 years. 4. Find the effective rate for: a. 5.75% compounded quarterly b. 6.25% compounded daily. 5. $50 is invested at the end of each month into an account paying 7.5% compounded monthly. How much will be in the account after 5 years?…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education