Concept explainers

YTM is the yield to maturity. It is the rate earned by the investor if he holds the bond till maturity.

Calculate the YTM by using the following formula:

Where,

M is the par value or face value,

INT is the dollar interest payment,

N is the number of years of interest payment.

After tax cost of debt: Interest expenses are tax deductible. So, after tax cost of debt is obtained after deducting the tax expenses from the cost of debt.

Calculate the after tax cost of debt by using the following formula:

T is the tax rate,

G products is plan to issue new bonds for new growth opportunity. Interest payment is $60, maturity 10 years, current price is $1,077 and tax rate is 40%

Explanation of Solution

a.

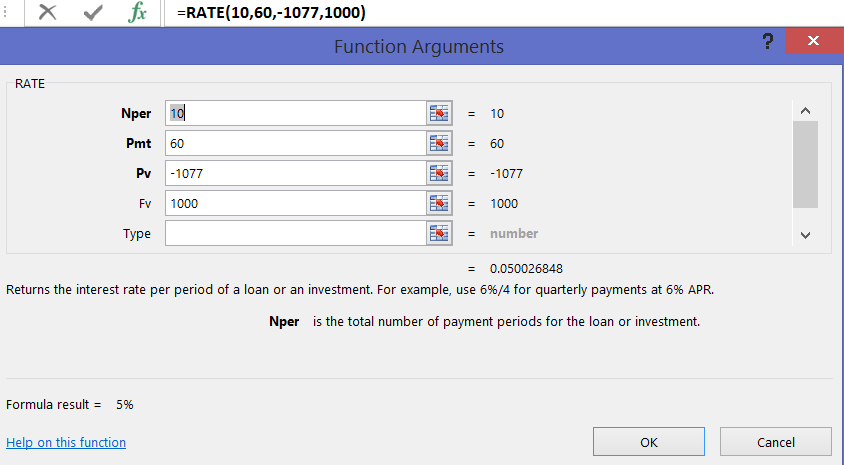

Calculate the YTM as follows:

Using Excel calculate YTM:

Therefore, the YTM is

a.

Calculate the after tax cost of debt as follows:

Therefore, the after tax cost of debt is

Want to see more full solutions like this?

- A company pays an annual dividend of $3 per share, and the current stock price is $50. What is the dividend yield?arrow_forwardYou invest $1,000 in a stock, and after 2 years, it grows to $1,200. What is the annual return?arrow_forwardYou invest $1,000 in a stock, and after 2 years, it grows to $1,200. What is the annual return? Exparrow_forward

- Wells and Associates has EBIT of $ 72800. Interest costs are $ 18400, and the firm has 15600 shares of common stock outstanding. Assume a 40 % tax rate. a. Use the degree of financial leverage (DFL) formula to calculate the DFL for the firm. b. Using a set of EBIT -EPS axes, plot Wells and Associates' financing plan. c. If the firm also has 1200 shares of preferred stock paying a $ 5.75 annual dividend per share, what is the DFL? d. Plot the financing plan, including the 1200 shares of $ 5.75 preferred stock, on the axes used in part (b). e. Briefly discuss the graph of the two financing plans.arrow_forwardYou invest $5,000 for 3 years at an annual interest rate of 6%. The interest is compounded annually. Need helparrow_forwardWhat is the future value of $500 invested for 3 years at an annual compound interest rate of 4%? Explarrow_forward

- You invest $5,000 for 3 years at an annual interest rate of 6%. The interest is compounded annually.arrow_forwardWhat is the future value of $500 invested for 3 years at an annual compound interest rate of 4%?arrow_forwardA loan of $10,000 is taken at an annual interest rate of 6% for 5 years. What is the total interest payable under simple interest? Expalarrow_forward

- A loan of $10,000 is taken at an annual interest rate of 6% for 5 years. What is the total interest payable under simple interest?arrow_forwardYou borrow $8,000 at an annual interest rate of 7%, and it compounds yearly for 2 years. What is the total amount payable? Helparrow_forwardYou borrow $8,000 at an annual interest rate of 7%, and it compounds yearly for 2 years. What is the total amount payable?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education