EBK FINANCIAL REPORTING, FINANCIAL STAT

8th Edition

ISBN: 9781337003193

Author: WAHLEN

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 14PC

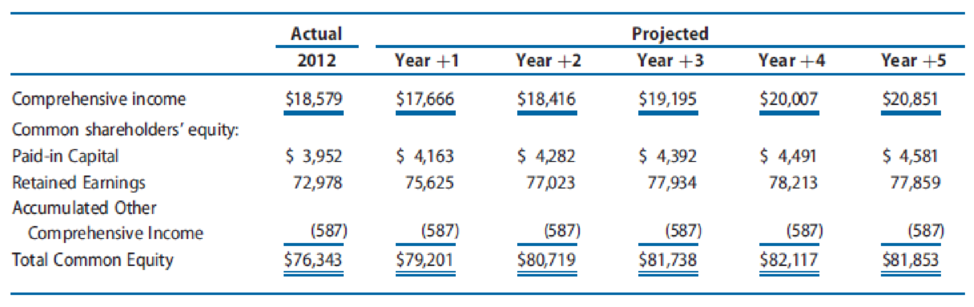

Problem 10.16 projected financial statements for Walmart for Years +1 through +5. The following data for Walmart include the actual amounts for 2012 and the projected amounts for Years +1 through +5 for comprehensive income and common shareholders’ equity, assuming it will use implied dividends as the financial flexible account to balance the

Assume that the market equity beta for Walmart at the end of 2012 was 1.00. Assume that the risk-free interest rate was 3.0% and the market risk premium was 6.0%. Also assume that Walmart had 3,314 million shares outstanding at the end of 2012, and share price was $69.09.

REQUIRED

- a. Use the

CAPM to compute the requiredrate of return on common equity capital for Walmart. - b. Compute the weighted-average cost of capital for Walmart as of the start of Year +1. At the end of 2012, Walmart had $48,222 million in outstanding interest-bearing debt on the balance sheet and no preferred stock. Assume that the balance sheet value of Walmart’s debt is approximately equal to the market value of the debt. Assume that at the start of Year +1, it will incur interest expense of 4.2% on debt capital and that its average tax rate will be 32.0%. Walmart also had $5,395 million in equity capital from noncontrolling interests. Assume that this equity capital carries a 15.0% required rate of return. (For our forecasts, we assume noncontrolling interests are similar to

preferred shares and receive dividends equal to the required rate of return each year.) - c. Use the clean surplus accounting approach to derive the projected dividends for common shareholders for Years +1 through +5 based on the projected comprehensive income and shareholders’ equity amounts. (Throughout this problem, you can ignore dividends to noncontrolling interests.)

- d. Use the clean surplus accounting approach to project the continuing dividend to common shareholders in Year +6. Assume that the steady-state long-run growth rate will be 3% in Years +6 and beyond.

- e. Using the required rate of return on common equity from Requirement a as a discount rate, compute the sum of the

present value of dividends to common shareholders for Walmart for Years +1 through +5. - f. Using the required rate of return on common equity from Requirement a as a discount rate and the long-run growth rate from Requirement d, compute the continuing value of Walmart as of the beginning of Year +6 based on its continuing dividends in Years +6 and beyond. After computing continuing value, bring continuing value back to present value at the start of Year +1.

- g. Compute the value of a share of Walmart common stock, as follows:

- (1) Compute the sum of the present value of dividends including the present value of continuing value.

- (2) Adjust the sum of the present value using the midyear discounting adjustment factor.

- (3) Compute the per-share value estimate.

- h. Using the same set of

forecast assumptions as before, recompute the value of Walmart shares under two alternative scenarios. To quantify the sensitivity of your share value estimate for Walmart to these variations in growth and discount rates, compare (in percentage terms) your value estimates under these two scenarios with your value estimate from Requirement g.- Scenario 1: Assume that Walmart’s long-run growth will be 2%, not 3% as before, and assume that its required rate of

return on equity is 1 percentage point higher than the rate you computed using the CAPM in Requirement a. - Scenario 2: Assume that Walmart’s long-run growth will be 4%, not 3% as before, and assume that its required rate of return on equity is 1 percentage point lower than the rate you computed using the CAPM in Requirement a.

- Scenario 1: Assume that Walmart’s long-run growth will be 2%, not 3% as before, and assume that its required rate of

- i. What reasonable range of share values would you expect for Walmart common stock? Where is the current price for Walmart shares relative to this range? What do you recommend?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

You've collected the following information from your favorite financial website.

52-Week Price

Dividend

Hi

77.40

Lo

Stock (Dividend)

Yield % PE Ratio Close Price Net Change

10.43

Acevedo .36

2.6

6

13.90

-.24

55.81

33.42

Georgette, Incorporated 1.54

3.8

10

40.43

-.01

131.04

70.05

YBM 2.55

2.9

10

89.08

3.07

50.24

35.00

13.95

Manta Energy .80

5.2

6

20.74

Winter Sports .32

1.5

28

15.43

??

-.26

.18

According to analysts, the growth rate in dividends for YBM for the next five years is expected to be 21 percent. Suppose YBM meets

this growth rate in dividends for the next five years and then the dividend growth rate falls to 5.75 percent, indefinitely. Assume

investors require a return of 14 percent on YBM stock. According to the dividend growth model, what should the stock price be today?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

1. Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow?

Question 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year:Net Sales $100,000Debtor’s turnover ratio (based onnet sales)2Inventory turnover ratio 1.25Fixed assets turnover ratio 0.8Debt to assets ratio 0.6Net profit margin 5%Gross profit margin 25%Return on investment 2%Use the given information to fill out the templates for incomestatement and balance sheet given below:Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $)Sales 100,000Cost of goodssoldGross profitOther expensesEarnings beforetaxTax @50%Earnings aftertaxBalance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $)Liabilities Amount Assets AmountEquity Net fixed assetsLong termdebt50,000 InventoryShort termdebtDebtorsCashTOTAL TOTAL

Chapter 11 Solutions

EBK FINANCIAL REPORTING, FINANCIAL STAT

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If data is unclear or blurr then comment i will write it. please don't use AI i will unhelpfularrow_forwardYou are considering an option to purchase or rent a single residential property. You can rent it for $5,000 per month and the owner would be responsible for maintenance, property insurance, and property taxes. Alternatively, you can purchase this property for $204,500 and finance it with an 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepaid at any time with no penalty. You have done research in the market area and found that (1) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually; (2) maintenance and insurance are currently $1,545.00 each per year and they have been increasing at a rate of 3 percent per year; (3) you are in a 24 percent marginal tax rate and plan to occupy the property as your principal residence for at least four years; (4) the capital gains exclusion would apply when you sell the property; (5)…arrow_forwardIf data is unclear or blurr then comment i will write it.arrow_forward

- I need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forwardcorrect an If image is blurr or data is unclear then plz comment i will write values or upload a new image. i will give unhelpful if you will use incorrect data.arrow_forwardWhat are the five management assertions that serve as basis for financial statements audit programs?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Dividend disocunt model (DDM); Author: Edspira;https://www.youtube.com/watch?v=TlH3_iOHX3s;License: Standard YouTube License, CC-BY