Concept Introduction:

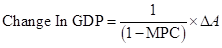

The formula to calculate change in GDP is,

Here,

is autonomous spending.

is autonomous spending. - MPC is marginal propensity to consume.

Marginal Propensity to Consume ( MPC ): It is defined as the change which occurs in total consumption level due to change in disposable income.

The formula to calculate MPC is,

Here,

is change in disposable income.

is change in disposable income.  is change in consumption level.

is change in consumption level. - MPC is marginal propensity to consume.

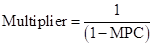

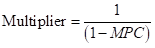

Multiplier: It is defined as the ratio of total change in gross domestic product due to change in the autonomous spending.

The formula to calculate multiplier is,

Here,

- MPC is marginal propensity to consume.

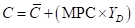

Consumption Level ( C ): It is one of the largest components of GDP .The individual consumption Depends on the disposable income.

Consumption Function: It shows how the change in disposable income of an individual changes the consumption level.

The formula to calculate consumption function is,

Here,

- C is consumption level.

is autonomous consumption.

is autonomous consumption. is disposable income

is disposable income- MPC is marginal propensity to consume.

Autonomous Consumption: This is defined as the consumption level when the income of an individual is zero.

Planned Aggregate Spending: It is the summation of consumption level in an economy and the planned investment.

The formula to calculate planned aggregate spending is,

Here,

- C is consumption level.

is the planned investment spending.

is the planned investment spending.  is the planned aggregate spending.

is the planned aggregate spending.

Unplanned Investment: All those investments that businesses do not intend to take in given time. It is certain due to some external factors like fall in interest rate and increase in future profitability.

The formula to calculate unplanned investment is,

Here,

- YDis disposable income.

is unplanned investment spending.

is unplanned investment spending. - AE is the planned aggregate spending.

Answer to Problem 13P

a. Planned aggregate expenditure and unplanned investment.

| GDP | YD (A) | C (B) | Iplanned (C ) | AEplanned  | Iunplanned  |

| (billions of dollars) | |||||

| 0 | 0 | 100 | 300 | 400 |  |

| 400 | 400 | 400 | 300 | 700 |  |

| 800 | 800 | 700 | 300 | 1,000 |  |

| 1,200 | 1,200 | 1,000 | 300 | 1,300 |  |

| 1,600 | 1,600 | 1,300 | 300 | 1,600 | 0 |

| 2,000 | 2,000 | 1,600 | 300 | 1,900 | 100 |

| 2,400 | 2,400 | 1,900 | 300 | 2,200 | 200 |

| 2,800 | 2,800 | 2,200 | 300 | 2,500 | 300 |

| 3,200 | 3,200 | 2,500 | 300 | 2,800 | 400 |

b. Aggregate consumption function.

Given,

Autonomous consumption is $100 billion.

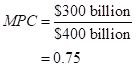

Change in disposable income is $400 billion.

Change in aggregate consumer spending is $300 billion.

The formula to calculate MPC is,

Substitute $300 billion for  and $400 billion for

and $400 billion for

Hence MPC is 0.75.

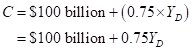

The formula to calculate consumption function is,

Substitute $100 billion for  and 0.75 for MPC.

and 0.75 for MPC.

c. Income- expenditure equilibrium GDP.

The equilibrium GDP (Y*) is $1,600 billion.

Explanation of Solution

Income expenditure equilibrium GDP is the point where planned aggregate spending is equal to the GDP. The table drawn in part a highlights the condition is satisfied at the level where GDP is equal to $1,600 billion.

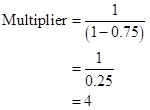

d. Value of the multiplier.

Given,

MPC is 0.75.

The formula to calculate multiplier is,

Substitute 0.75 for MPC.

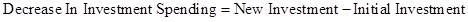

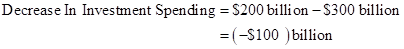

e. The new Y * when planned investment changes.

Given,

New investment is $200 billion.

Initial investment is $300 billion.

The formula to calculate change in planned investment is,

Substitute $200 billion for new investment and $200 billion for initial investment.

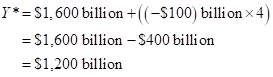

Given,

Change in investment is  billion.

billion.

Real GDP is $1,600 billion.

Multiplier is 4.

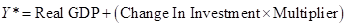

The formula to calculate new Y* is,

Substitute $1,600 billion for real GDP, 4 for multiplier and  billion for change in investment.

billion for change in investment.

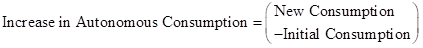

f. The new Y * when autonomous consumption changes.

Given,

New autonomous consumption is $200 billion.

Initial autonomous consumption is $100 billion.

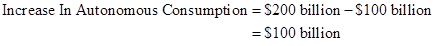

The formula to calculate change in autonomous consumption is,

Substitute $200 billion for new consumption and $100 billion for initial consumption.

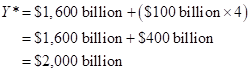

Given,

Change in consumption is $100 billion.

Real GDP is $1,600 billion.

Multiplier is 4.

The formula to calculate new Y* is,

Substitute $1,600 billion for real GDP, 4 for multiplier and $100 billion for change in consumption.

Want to see more full solutions like this?

Chapter 11 Solutions

LaunchPad for Krugman's Macroeconomics (Six Month Access)

- If food is produced in the U.S., sold in the U.S. and consumed in the U.S., a reduction in its price will have which of the following effects ______? Two of the answers are correct. The consumer price index will decrease. None of the answers are correct. The GDP deflator will decrease.arrow_forwardhow to caculate verible cost?arrow_forwardWhat is the deficit?arrow_forward

- Identify the two curves shown on the graph, and explain their upward and downward slopes. Why does curve Aintersect the horizontal axis? What is the significance of quantity d? What does erepresent? How would the optimal quantity of information change if the marginal benefit of information increased—that is, if the marginal benefit curve shifted upward?arrow_forward6. Rent seeking The following graph shows the demand, marginal revenue, and marginal cost curves for a single-price monopolist that produces a drug that helps relieve arthritis pain. Place the grey point (star symbol) in the appropriate location on the graph to indicate the monopoly outcome such that the dashed lines reveal the profit-maximizing price and quantity of a single-price monopolist. Then, use the green rectangle (triangle symbols) to show the profits earned by the monopolist. 18 200 20 16 16 14 PRICE (Dollars per dose) 12 10 10 8 4 2 MC = ATC MR Demand 0 0 5 10 15 20 25 30 35 40 45 50 QUANTITY (Millions of doses per year) Monopoly Outcome Monopoly Profits Suppose that should the patent on this particular drug expire, the market would become perfectly competitive, with new firms immediately entering the market with essentially identical products. Further suppose that in this case the original firm will hire lobbyists and make donations to several key politicians to extend its…arrow_forwardConsider a call option on a stock that does not pay dividends. The stock price is $100 per share, and the risk-free interest rate is 10%. The call strike is $100 (at the money). The stock moves randomly with u=2 and d=0.5. 1. Write the system of equations to replicate the option using A shares and B bonds. 2. Solve the system of equations and determine the number of shares and the number of bonds needed to replicate the option. Show your answer with 4 decimal places (x.xxxx); do not round intermediate calculations. This is easy to do in Excel. A = B = 3. Use A shares and B bonds from the prior question to calculate the premium on the option. Again, do not round intermediate calculations and show your answer with 4 decimal places. Call premium =arrow_forward

- Answer these questions using replication or the risk neutral probability. Both methods will produce the same answer. Show your work to receive credit. 6. What is the premium of a call with a higher strike. Show your work to receive credit; do not round intermediate calculations. S0 = $100, u=2, d=0.5, r=10%, strike=$150arrow_forwardAnswer these questions using replication or the risk neutral probability. Both methods will produce the same answer.arrow_forwardProblem 2: At a raffle, 2000 tickets are sold at $5 each for five prizes of $2000, $1000, $500, $250, and $100. You buy one ticket. What is the expected value of your gain? 1. Find the gain for each prize. 2. Write a probability distribution for the possible gains. 3. Find the expected value. 4. Interpret the results.arrow_forward

- This activity focuses on developing direct and supported opinions using various sources of information on the importance of the following topics: non-renewable and renewable energies, economic factors and obstacles that can affect the relationship between international trade and economic growth, devaluation of the currency in countries, and the imbalance of economic equity. In this context, it is essential that, when studying and developing these topics, students understand the concepts of the value of currencies and that leads to devaluation, non-renewable and renewable energy resources, economic development and obstacles, distribution of wealth, economic growth and external and internal constraints, and about international trade as a growth factor. Thus, the objectives that are intended to be achieved are the following: Acquire knowledge about the concepts mentioned above. Determine relationships between economic growth and international trade. Understand what some limitations that…arrow_forwardConsider a firm facing conventional production technology. The short run Production Function has a small range of increasing marginal product (increasing marginal returns) and then is subject to the Law of Diminishing Marginal Product (diminishing marginal returns). A. Putting quantity on the horizontal axis and dollars on the vertical axis, depict three important curves: Fixed Cost (FC), Variable Cost (VC), and Total Cost (TC). (Note that we are not asking you to depict average cost functions!) B. Please clearly indicate on this graph the range of quantities where the firm is experiencing (1) increasing marginal product and (2) diminishing marginal product. C. In a few sentences, please justify why you've made this specific classification of increasing/diminishing marginal product in part (b).arrow_forwardplease answer the following questions: What is money, and why does anyone want it? Explain the concept of the opportunity cost of holding money . Explain why an increase in U.S. interest rates relative to UK interest rates would affect the U.S.-UK exchange rate. Suppose that a person’s wealth is $50,000 and that her yearlyincome is $60,000. Also suppose that her money demand functionis given by Md = $Y10.35 - i2Derive the demand for bonds. Suppose the interest rate increases by 10 percentage points. What is the effect on her demand for bonds?b. What are the effects of an increase in income on her demand for money and her demand for bonds? Explain in wordsarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education