Concept explainers

Straight-line

• LO11–2, LO11–5

The property, plant, and equipment section of the Jasper Company’s December 31, 2017, balance sheet contained the following:

| Property, plant, and equipment: | ||

| Land | $120,000 | |

| Building | $ 840,000 | |

| Less: |

(200,000) | 640,000 |

| Equipment | 180,000 | |

| Less: Accumulated depreciation | ? | ? |

| Total property, plant, and equipment | ? |

The land and building were purchased at the beginning of 2013. Straight-line depreciation is used and a residual value of $40,000 for the building is anticipated.

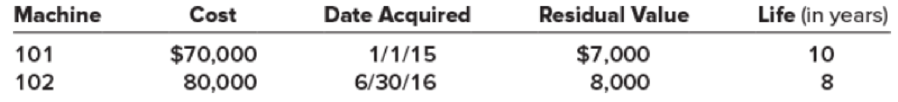

The equipment is comprised of the following three machines:

The straight-line method is used to determine depreciation on the equipment. On March 31, 2018, Machine 102 was sold for $52,500. Early in 2018, the useful life of machine 101 was revised to seven years in total, and the residual value was revised to zero.

Required:

1. Calculate the accumulated depreciation on the equipment at December 31, 2017.

2. Prepare the

3. Prepare a schedule to calculate the gain or loss on the sale of machine 102.

4. Prepare the journal entry for the sale of machine 102.

5. Prepare the 2018 year-end journal entries to record depreciation on the building and equipment.

(1)

Depreciation:

The decrease in the value of fixed tangible assets due to its use is known as depreciation. It is the allocation of the cost of tangible fixed assets over the useful life of the asset.

To calculate: The accumulated depreciation on the equipment at December 31, 2017.

Explanation of Solution

Company J using straight line method of depreciation:

Straight-line method: It is a method of providing depreciation. In this method, depreciation is calculated as the fixed percentage of the original cost of the fixed asset. The amount of depreciation in this method remains same for all the years of the useful life of the asset. Therefore, the following formula is used to calculate depreciation of asset.

To calculate: The accumulated depreciation on the equipment at December 31, 2017.

| Asset | Cost at 2016 ($) |

Estimated residual value | Estimated life of the asset | Number of years used |

Accumulated depreciation ($) |

| (1) | (2) | (2a) |

(3) | (4) | (5) =

|

| 101 | 70 | 7000 | 10years | 36 | 18,900 |

| 102 | 80 | 8000 | 8 years | 18 | 13,500 |

| 103 | 30 | 3000 | 9 years | 4 | 1,000 |

| Accumulated depreciation on 31, December 2017 | 33,400 | ||||

Table (1)

(2)

To prepare: The journal entry to record the depreciation machine 102 up to the date of sale.

Explanation of Solution

Prepare a journal entry to record the depreciation on equipment 102.

| Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| Depreciation expense (1) | 2,250 | ||

| Accumulated Depreciation | 2,250 | ||

| (To record the depreciation on equipment 102.) |

Table (2)

Working note:

(1) Calculate the depreciation on equipment 102 up to the date of sale.

Therefore depreciation up to the date of sale is $2,250.

(3)

To prepare: A schedule to calculate the gain or loss on the sale of machine 102.

Explanation of Solution

Prepare a schedule to calculate the gain or loss on sale of machine 102.

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Sales proceeds | 52,500 | ||

| Less: Book value on 31/03/18 | |||

| Cost | 80,000 | ||

| Accumulated depreciation | (15,750) | 64,250 | |

| Loss on sale of equipment 102 | 11,750 |

Table (2)

Calculate the accumulated depreciation

| Particulars | Amount $ |

| Depreciation through 31/12/17 | 13,500 |

| Depreciation from 1/1/18 to 31/3/18 | 2,250 |

| Accumulated depreciation | 15,750 |

Table (3)

(4)

To prepare: The journal entry for the sale of machine 102.

Explanation of Solution

Prepare the journal entry for the sale of machine 102.

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| 31/03/2018 | Cash | 52,500 | ||

| Accumulated depreciation | 15,750 | |||

| Loss on sale of the equipment 102 | 11,750 | |||

| Equipment 102 | 80,000 | |||

| (To record the sale of equipment 102.) |

Table (4)

- Cash is a current asset and increased due to sale of equipment 102. Thus, debit Cash account with $52,500.

- Accumulated depreciation is a contra asset. It increases the value of asset account. Thus, debit Accumulated Depreciation with $15,750.

- Loss on sale of equipment 102 decreases the value of shareholders equity. Thus, debit Loss on sale of equipment 102 with $11,750.

- Equipment 102 is an asset and decreases value of the assets due to sale. Thus, credit Equipment 102 with $80,000.

(5)

To prepare: The 2018 year-end journal entries to record depreciation on the building and equipment.

Explanation of Solution

Prepare a journal entry to record the depreciation on building.

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| 31/12/2018 | Depreciation expense (1) | 40,000 | ||

| Accumulated Depreciation – Building | 40,000 | |||

| (To record the depreciation.) |

Table (5)

- Depreciation is an expense which decreases shareholders equity. Thus, debit Depreciation expense account with $40,000.

- Accumulated depreciation is a contra asset. It decreases the value of asset. Thus, credit accumulated depreciation with $40,000.

Working notes:

Determine the depreciation per year.

The land and building were purchased at the beginning of 2013. Straight-line depreciation is used and a residual value of $40,000 for the building is anticipated.

Therefore annual depreciation on building is $40,000.

Prepare a journal entry to record the depreciation on equipment.

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| Depreciation expense (2) | 15,775 | |||

| Accumulated Depreciation | 15,775 | |||

| (To record the depreciation.) |

Table (6)

- Depreciation expense which decreases shareholders equity. Thus, debit Depreciation expense with $15,775.

- Accumulated depreciation is a contra asset. It decreases the value of asset. Thus, credit accumulated depreciation with $15,775.

Working note:

Compute the deprecation on equipments.

| Particulars | Amount ($) |

Amount ($) |

| Equipment 101 | ||

| Cost | 70,000 | |

| Less: Accumulated depreciation | 18,900 | |

| Book value, 12/31/17 | 51,100 | |

| Revised remaining life (7 years – 3 years) | 12,775 | |

| Equipment 103 (requirement 1) | 3,000 | |

| Depreciation | 15,7775 |

Table (7)

Therefore depreciation on equipment’s is $15,775.

Want to see more full solutions like this?

Chapter 11 Solutions

INTERMEDIATE ACTG+CONNECT <LOOSE>

- What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forward

- Need answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forward

- no ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning