Concept explainers

Calculate payroll

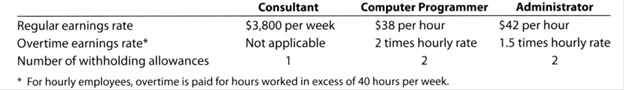

Diego Company has three employees—a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee:

For the current pay period, the computer programmer worked 55 hours and the administrator worked 52 hours. The federal income tax withheld for all three employees, who are single, can be determined from the wage bracket withholding table in Exhibit 3 in the chapter. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and one withholding allowance is $75.

Determine the gross pay and the net pay for each of the three employees for the current pay period.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Bundle: Accounting, Chapters 1-13, 26th + Working Papers, Chapters 1-17 For Warren/reeve/duchac's Accounting, 26th And Financial Accounting, 14th + ... For Warren/reeve/duchac's Accounting, 26th

- This Question Solution Provide With Relevant General Accounting Subjectarrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardApplying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table. Assets, beginning Assets, end Liabilities, Liabilities, Stockholders’ Equity, (in $ millions) of year of year beginning of year end of year end of year AMD Answer 1 $4,556 $2,956 Answer 2 Answer 3 Intel $123,249 Answer 4 Answer 5 $53,400 Answer 6 b. Calculate average assets for each company. (in $ millions) Average Assets AMD Answer 7 Intel Answer 8 c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9arrow_forward

- Applying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table. Assets, beginning Assets, end Liabilities, Liabilities, Stockholders’ Equity, (in $ millions) of year of year beginning of year end of year end of year AMD Answer 1 $4,556 $2,956 Answer 2 Answer 3 Intel $123,249 Answer 4 Answer 5 $53,400 Answer 6 b. Calculate average assets for each company. (in $ millions) Average Assets AMD Answer 7 Intel Answer 8 c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9arrow_forwardFormulating Financial Statements from Raw Data and Calculating RatiosFollowing is selected financial information from JM Smucker Co. for a recent fiscal year ($ millions). Current assets, end of year $2,010.1 Noncurrent liabilities, end of year $5,962.1 Cash, end of year 169.9 Stockholders' equity, end of year 8,140.1 Cash for investing activities (355.5) Cash from operating activities 1,136.3 Cost of product sold 5,298.2 Total assets, beginning of year 16,284.2 Total liabilities, end of year 7,914.9 Revenue 7,998.9 Cash for financing activities (945.2) Total expenses, other than cost of product sold 2,069.0 Stockholders' equity, beginning of year 8,124.8 Dividends paid (418.1) Requireda. Prepare the income statement for the year. J.M. Smucker Company, Inc. Income Statement ($ millions) Answer 1 Answer 2 Answer 3 Answer 4 Answer 5 Answer 6 Answer 7 Answer 8 Answer 9 Answer 10 b. Prepare the balance sheet at the end of the year. J.M.…arrow_forwardCalculate Total Fixed Cost With General Accounting Methodarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage