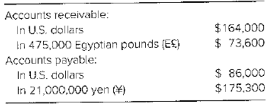

Chocolate De−lites imports and exports chocolate delicacies. Some transactions are denominated in U.S. dollars and others in foreign currencies. A summary of

The spot rates on December 31, 20X6, were

E€1 = $0.176

¥1 = $0.0081

The average exchange rates during the collection and payment period in 20X7 are

E€1 = $0.18

¥1 = $0.0078

Required

a. Prepare the adjusting entries on December 31, 20X6.

b. Record the collection of the accounts receivable in 20X7.

c. Record the payment of the accounts payable in 20X7.

d. What was the foreign currency gain or loss on the accounts receivable transaction denominated in E€ for the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

e. What was the foreign currency gain or loss on the accounts receivable transaction denominated in ¥? For the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

f. What was the combined foreign currency gain or loss for both transactions? What could Chocolate De-lites have done to reduce the risk associated with the transactions denominated in foreign currencies?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

- Calculate the times-interest-earned ratios for PEPSI CO, Given the following informationarrow_forwardCalculate the times-interest-earned ratios for Coca Cola in 2020. Explain if the times-interest-earned ratios is adequate? Is the times-interest-earned ratio greater than or less than 2.5? What does that mean for the companies' income? Can the company afford the interest expense on a new loan?arrow_forwardWhich of the following is a temporary account?A. EquipmentB. Accounts PayableC. Utilities ExpenseD. Common Stockarrow_forward

- Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recordedarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- Which of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning