Concept explainers

• LO11–2

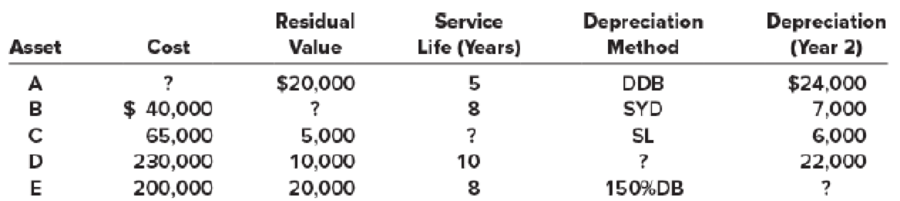

For each of the following depreciable assets, determine the missing amount (?). Abbreviations for depreciation methods are SL for straight line, SYD for sum-of-the-years’-digits, and DDB for double-declining balance.

Depreciation:

Depreciation refers to the reduction in the monetary value of a fixed asset due to its wear and tear or obsolescence. It is a method of distributing the cost of the fixed assets over its estimated useful life. The following is the formula to calculate the depreciation.

To determine: The missing amounts.

Explanation of Solution

Asset A:

In the given case cost of the asset is missing. Given information is residual value $20,000; service life 5 years, depreciation method: double declining balance method and depreciation in year 2 is $24,000.

Double declining balance (DDB) method:

In this method of depreciation, the depreciation is calculated by multiply beginning of year book value, not depreciable base, by an annual rate that is a multiple of the straight line rate.

Determine cost of the asset.

Beginning value of the asset A at year 1 is calculated as follows:

Hence, cost at year 1 is $100,000.

Asset B:

In given case residual value is missing. Given information is cost of the asset B is $40,000; service life is 8 years; depreciation method is sum of the year’s digit method; depreciation in year 2 is $7,000.

Sum-of- the-years’ digits (SYD) method:

Sum-of-the years’ digits method determines the depreciation expense by multiplying the depreciable base and declining fraction.

Determine the residual value of asset B

Working note:

Conclusion:

Hence, the residual value of the asset B is $4,000.

Asset C:

In the given case for asset C, estimated life is missing. Given information is as follows cost of the asset is $65,000; residual value of the asset is $5,000; depreciation method is straight line method and year 2 depreciation is $6,000.

Straight line method:

Under the straight-line method of depreciation, the same amount of depreciation is allocated every year over the estimated useful life of an asset.

Determine estimated life of the asset C

Hence, estimated life or service life of the asset C is 10 Years.

Asset D:

In the given case, method of depreciation is missing. Given information is as follows: cost of the asset D is $230,000; residual value of the asset D is $10,000; service life is 10 years; depreciation for year 2 is $22,000.

Determine the method of depreciation.

Hence, straight line method of depreciation is used to determine the depreciation of asset D.

Asset E:

In the given situation depreciation for year 2 is missing. Given information is as follows: cost of the asset E $200,000; residual value of the asset E is $20,000; service life is 8 years; depreciation method is 150% declining method.

One hundred fifty percent declining balance:

In this method of depreciation, the depreciation is calculated by multiply beginning of year book value, not depreciable base, by an annual rate that is a 150% or 1.5 of the straight line rate.

Determine the depreciation on asset E for year 2.

Depreciation on asset E for year 1 is $37,500

For year 2 depreciation expense is calculated as follows

Hence, depreciation expense for year 2 is $30,469.

Want to see more full solutions like this?

Chapter 11 Solutions

INTERMEDIATE ACCT.-CONNECT PLUS ACCESS