Bundle: Accounting, Loose-Leaf Version, 26th + CengageNOWv2, 2 term Printed Access Card

26th Edition

ISBN: 9781305617063

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 11.5BPR

Payroll accounts and year-end entries

The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year:

| 101 Salaries Payable | — |

| 102 Social Security Tax Payable | 52,913 |

| 103 Medicare Tax Payable | 728 |

| 104 Employees Federa1 Income Tax Payable | 4,490 |

| 1 OS Employees State Income Tax Payable | 4,073 |

| T C-5 State |

1,260 |

| 107 Federal Unemployment Tax Payable | 360 |

| 108 Retirement Savings | |

| Deductions Payable | $ 2,300 |

| 109 Medical Insurance Payable | 2,520 |

| 201 Sales Salaries Expense | 700,000 |

| 301 Officers Salaries Expense | 340,00O |

| 401 Office Salaries Expense | 125,000 |

| 408 Payroll Tax Expense | 59,491 |

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

| Dec. 1. | Issued Check No. 815 to Aberderas Insurance Company for $2,520, in payment of the semiannual premium on the group medical insurance policy. |

| 1, | Issued Check No. 816 to Alvarez. Bank for $8,131, in payment for $2,913 of social security tax, $728 of Medicare tax, and $4,490 of employees’ federal income tax due. |

| 2. | Issued Check No. 817 for $2,300 to Alvarez Bank to invest in a retirement savings account for employees. |

| 12 | |

|

|

| 12. | Issued Check No. 822 in payment of the net amount of the biweekly payroll to fund tile payroll bank account. |

| 12. | Journalized the entry to record payroll taxes on employees' earnings of December 12: social security tax, SI,452; Medicare tax, $363: state unemployment tax, $315: federal unemployment tax. $90. |

| 15. | Issued Check No. 830 to Alvarez Bank for $7,938, in payment of $2,904 of social security tax, $726 of Medicare tax, and $4,308 of employees' federal income tax due. |

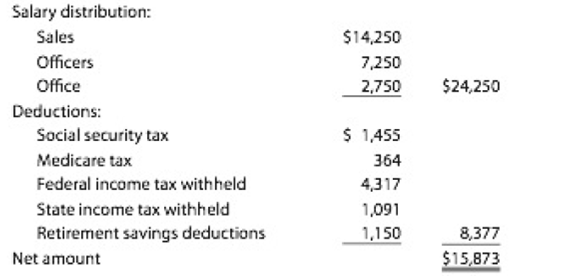

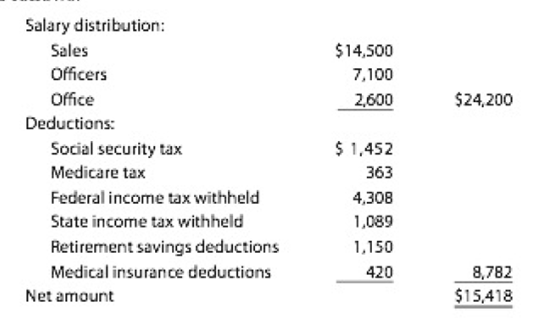

| 26. | Journalized the entry to record the biweekly payroll. A summary of the payroll record follows:

|

| Dec. 26. | Journalized the entry to record payroll taxes on employees' earnings of December 26: social security tax, SI,455; Medicare tax, $364; state unemployment tax, SI50; federal unemployment tax, S40. |

| 30. | Issued Check No. 851 for $6,258 to State Department of Revenue, in payment of employees' state income tax due on December 31. |

| 30. | Issued Check No. 852 to Alvarez Bank for $2,300 to invest in a retirement savings account for employees. |

| 31 | Paid $55,400 to the employee pension plan. The annual pension cost is $65,500. (Record both the payment and the unfunded pension liability.) |

Instructions

- 1. Journalize the transactions.

- 2. Journalize the following

adjusting entries on December 31:- a. Salaries accrued: sales salaries, $4,275; officers salaries, $2,175; office salaries, $825. The payroll taxes are immaterial and are not accrued.

- b. Vacation pay, $13,350.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Calculate Total Fixed Cost With General Accounting Method

Im Waiting for Solution of this General Accounting Question

Provide Solutions Please

Chapter 11 Solutions

Bundle: Accounting, Loose-Leaf Version, 26th + CengageNOWv2, 2 term Printed Access Card

Ch. 11 - Does a discounted note payable provide credit...Ch. 11 - Employees are subject to taxes withheld from their...Ch. 11 - Prob. 3DQCh. 11 - Prob. 4DQCh. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - To match revenues and expenses properly, should...Ch. 11 - Prob. 8DQCh. 11 - When should the liability associated with a...Ch. 11 - Prob. 10DQ

Ch. 11 - Prob. 11.1APECh. 11 - Proceeds from notes payable On January 26, Nyree...Ch. 11 - Prob. 11.2APECh. 11 - Prob. 11.2BPECh. 11 - Prob. 11.3APECh. 11 - Prob. 11.3BPECh. 11 - Prob. 11.4APECh. 11 - Prob. 11.4BPECh. 11 - Prob. 11.5APECh. 11 - Prob. 11.5BPECh. 11 - Prob. 11.6APECh. 11 - Prob. 11.6BPECh. 11 - Prob. 11.7APECh. 11 - Estimated warranty liability Quantas Industries...Ch. 11 - Quick ratio Nabors Company reported the following...Ch. 11 - Quick ratio Adieu Company reported the following...Ch. 11 - Current liabilities Bon Nebo Co. sold 25,000...Ch. 11 - Entries for discounting notes payable Griffin...Ch. 11 - Evaluating alternative notes A borrower has two...Ch. 11 - Entries for notes payable A business issued a...Ch. 11 - Prob. 11.5EXCh. 11 - Prob. 11.6EXCh. 11 - Prob. 11.7EXCh. 11 - Calculate payroll An employee earns 32 per hour...Ch. 11 - Calculate payroll Diego Company has three...Ch. 11 - Summary payroll data In the following summary of...Ch. 11 - Prob. 11.11EXCh. 11 - Payroll entries The payroll register for Proctor...Ch. 11 - Payroll entries Widmer Company had gross wages of...Ch. 11 - Prob. 11.14EXCh. 11 - Prob. 11.15EXCh. 11 - Prob. 11.16EXCh. 11 - Prob. 11.17EXCh. 11 - Prob. 11.18EXCh. 11 - Prob. 11.19EXCh. 11 - Accrued product warranty General Motors...Ch. 11 - Prob. 11.21EXCh. 11 - Quick ratio Gmeiner Co. had the following current...Ch. 11 - Quick ratio The current assets and current...Ch. 11 - Liability transactions The following items were...Ch. 11 - Entries for payroll and payroll taxes The...Ch. 11 - Wage and tax statement data on employer FICA tax...Ch. 11 - Prob. 11.4APRCh. 11 - Payroll accounts and year-end entries The...Ch. 11 - Prob. 11.1BPRCh. 11 - Entries for payroll and payroll taxes The...Ch. 11 - Prob. 11.3BPRCh. 11 - Prob. 11.4BPRCh. 11 - Payroll accounts and year-end entries The...Ch. 11 - Prob. 11.3CPPCh. 11 - Ethics and professional conduct in business Tonya...Ch. 11 - Prob. 11.2CPCh. 11 - Prob. 11.3CPCh. 11 - Contingent liabilities Altria Group, Inc., has...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting Question Solution with Correct Methodarrow_forwardComputing Return on Assets and Applying the Accounting Equation Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%). ROA Answer 1arrow_forwardGive Answer of this Questionarrow_forward

- Val Sims is a self-employed CPA and is the sole practitioner in her tax practice. She has had several situations arise this year involving client representation, client records, and client fee arrangements. Val is concerned that her actions may be in violation of the Circular 230 regulations governing practice before the Internal Revenue Service (IRS). Indicate whether Val is in violation of the regulations for each of the actions described. 1. Howard Corporation's prior-year income tax return was prepared and filed by the company's controller. The return was audited and Howard Corporation paid the additional income taxes assessed by the IRS, including penalties and interest. Although Howard Corporation agreed with income tax assessment, it did not agree with the penalties and interest determined by the IRS. Howard Corporation engaged Val to file a refund claim in connection with the penalties and interest assessed. Val charged the client a fee based on 30 percent of the amount by…arrow_forwardHello I'm Waiting For This General Accounting Question Solutionarrow_forwardPlease I want Answer of this Financial Accounting Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY