Concept explainers

Basic Understanding of Foreign Exposure

The Hi-Stakes Company has a number of importing and exporting transactions. Importing activities result in payables and exporting activities result in receivables. (LCU represents the local currency unit of the foreign entity.)

Required

a. If the direct exchange rate increases, does the dollar weaken or strengthen relative to the other currency? If the indirect exchange rate increases does the dollar weaken or strengthen relative to the other currency?

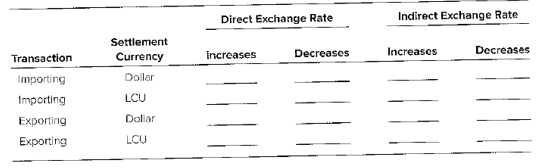

b. Indicate in the following table whether Hi−Stakes will have a foreign currency transaction gain (G), loss (L), or not be affected (NA) by changes in the direct or indirect exchange rates for each of the four situations presented.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

ADV.FIN.ACCT. CONNECT+PROCTORIO PLUS

- Don't use ai given answer accountingarrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardCaldwell Electronic Devices produces smartphone accessories. Estimated sales (in units) are 62,000 in July, 54,000 in August, and 49,500 in September. Each unit is priced at $35. Caldwell wants to have 45% of the following month's sales in ending inventory. That requirement was met on July 1. Each accessory requires 3 components and 8 feet of specialized cabling. Components cost $4 each, and cabling is $0.75 per foot. Caldwell wants to have 30% of the following month's production needs in ending raw materials inventory. On July 1, Caldwell had 45,000 components and 120,000 feet of cabling in inventory. What is Caldwell's expected sales revenue for August?arrow_forward

- Einstein 2023 balance sheet showed net fixed assets of $3.1 million, while its 2022 balance sheet showed net fixed assets of $2.9 million. Its 2023 income statement reported a depreciation expense of $280,000. How much did Jason spend to acquire new fixed assets during 2023?arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardJacobson Co. recently reported a net income of $7,840 and depreciation of $1,250. How much was its net cash flow, assuming it had no amortization expense and sold none of its fixed assets? provide answerarrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning