Concept explainers

Basic Understanding of Foreign Exposure

The Hi-Stakes Company has a number of importing and exporting transactions. Importing activities result in payables and exporting activities result in receivables. (LCU represents the local currency unit of the foreign entity.)

Required

a. If the direct exchange rate increases, does the dollar weaken or strengthen relative to the other currency? If the indirect exchange rate increases does the dollar weaken or strengthen relative to the other currency?

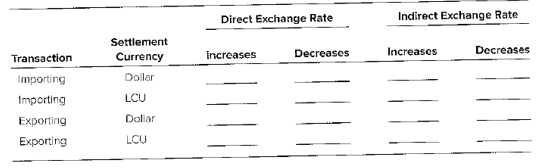

b. Indicate in the following table whether Hi−Stakes will have a foreign currency transaction gain (G), loss (L), or not be affected (NA) by changes in the direct or indirect exchange rates for each of the four situations presented.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

ADVANCED FINANCIAL ACCT.(LL) >CUSTOM<

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning