Concept explainers

Foreign Sales

Tex Hardware sells many of its producers overseas. The following are some selected transactions.

- Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was made on July 3 when the rate was Dkr 1 = $0.1753.

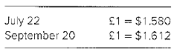

- On July 22, Tex sold copper fillings to a company in London for £30,000 with payment due on September 20. Also, on July 22, Tex entered into a 60-day forward contract to sell £30,000 at a forward rate of £ 1 = $1.630. The forward contract is not designated as a hedge. The spot rates follow:

Required

Prepare

Introduction: Foreign exchange rate is the rate at which currency of one country is changed to currency of another country is called foreign exchange rate. Mainly there are two rate, i.e. direct exchange rate and indirect exchange rate.

Foreign exchange gain or loss: Foreign exchange gain or loss arises when there is selling or buying of any goods and services in foreign currency.

The recording of the journal entries related to the sale made by T company, use of forward contract and entries regarding the settlement.

Explanation of Solution

- Journal entries to record sale of electronic subassemblies to a firm in Denmark is as follows:

- Journal entries to record sale of copper fittings to a firm in London is as follows:

- Journal entries to record sale of storage devices to a firm in Canada is as follows:

| Date | Particulars | Debit ($) | Credit ($) |

| Jun-06 | Accounts receivables | 21,000 | |

| To Sales account (Dkr120,000*0.1750$) | 21,000 | ||

| (Recording entry for the sale of electronic subassemblies by T company at exchange rate of Dkr1=$0.1750) | |||

| Jul-03 | Accounts receivable | 36 | |

| To Foreign currency transaction gain [($0.1753-$0.1750) *120,000] | 36 | ||

| (Recording entry for revaluing foreign currency receivable to U.S dollar) | |||

| Jul-03 | Foreign currency units (Dkr) | 21,036 | |

| To Accounts receivables ($0.1753*Dkr120,000) | 21,036 | ||

| (Recording entry for collection of accounts receivable in Dkr i.e. Danish kroner) |

| Date | Particulars | Debit ($) | Credit ($) |

| Jul-22 | Accounts receivable | 47,400 | |

| To sales account (£30,000*1.580) | 47,400 | ||

| (Recording entry for sale of copper fittings to a company in London) | |||

| Jul-22 | Dollars receivable from broker | 48,900 | |

| To Foreign currency payable to broker (£30,000*1.630) | |||

| (Recoding entry for entering into the 60-day forward contract @1.630) | 48,900 | ||

| Sep-20 | Accounts receivable | 960 | |

| To foreign currency transaction gain [(1.612-1.580) *£30,000] | 960 | ||

| (recording entry for revaluing the accounts receivable at settlement date) | |||

| Sep-20 | Foreign currency payable to broker | 540 | |

| To foreign currency transaction gain [(1.612-1.630) *£30,000] | 540 | ||

| (Recording entry for revaluing the forward contract value at settlement date) | |||

| Sep-20 | Foreign currency units | 48,360 | |

| To Accounts receivable (£30,000*1.612) | 48,360 | ||

| (Recording entry for receipt of British pounds from accounts receivable) | |||

| Sep-20 | Foreign currency payable to broker | 48,360 | |

| To foreign currency units (£30,000*1.612) | 48,360 | ||

| (Recording entry for payment of pounds to broker) | |||

| Sep-20 | Cash | 48900 | |

| To Dollars receivable from broker (£30000*1.630) | 48900 | ||

| (Recording entry for receipt of U.S dollar from broker as per forward contract) |

| Date | Particulars | Debit ($) | Credit ($) |

| Oct-11 | Accounts receivable | 51,450 | |

| To sales account (C$70,000*0.7350) | 51,450 | ||

| (Recording entry for sale of storage device to a company in Canada) | |||

| Oct-11 | Dollars receivable from broker | 51,100 | |

| To Foreign currency payable to broker (C$70,000*0.730) | 51,100 | ||

| (Recoding entry for entering into the 30-day forward contract @) | |||

| Nov-10 | Foreign currency transaction loss | 210 | |

| To Accounts receivable [(0.7350-0.7320) *C$70,000] | 210 | ||

| (recording entry for revaluing the accounts receivable at settlement date) | |||

| Nov-10 | Foreign currency transaction loss | 140 | |

| To Foreign currency payable to broker [(0.7300-0.7320) *C$70,000] | 140 | ||

| (Recording entry for revaluing the forward contract value at settlement date) | |||

| Nov-10 | Foreign currency units | 51,240 | |

| To Accounts receivable (C$70,000*0.7320) | 51,240 | ||

| (Recording entry for receipt of Canadian dollar from accounts receivable) | |||

| Sep-20 | Foreign currency payable to broker | 51,240 | |

| To foreign currency units (C$70,000*0.7320) | 51,240 | ||

| (Recording entry for payment of Canadian dollar to broker) | |||

| Sep-20 | Cash | 51,100 | |

| To Dollars receivable from broker (C$70,000*0.730) | 51,100 | ||

| (Recording entry for receipt of U.S dollar from broker as per forward contract) |

Want to see more full solutions like this?

Chapter 11 Solutions

Advanced Financial Accounting

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward