a)

The industry outcome under unregulated

a)

Answer to Problem 11.10P

The

Explanation of Solution

The natural gas is a natural monopoly and the

According to the given condition,

The price per unit is $60 and the quantity is 40.

Substitute the values in

Total revenue earned is$2,400 and the total cost incurred is $1,800.

Profit earned can be calculated as

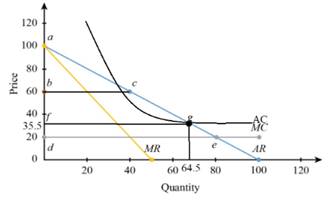

The graph of the given unregulated monopoly can be drawn as:

Consumer surplus can be given by the area below the demand curve and above the price line,i.e. the triangle abc.

Total surplus is termed as the social welfare. Thus the value of social surplus in the given condition is $1,400 ($600+$800).

Introduction: Monopoly is a market structure with a single firm selling a unique good. Monopoly is a price maker and has extensive market control. By analyzing the marginal revenue and marginal cost of producing an extra unit, a monopolist can determine its profit maximizing price and quantity.

b)

The regulatory price that maximizes social welfare and the industry outcome under this price is to be calculated.

b)

Answer to Problem 11.10P

The price maximizes social welfare is $20 and the quantity sold will be 80 units. The profit earned will be -$1,000.

Explanation of Solution

The price for maximization of social welfare can be calculated as follows:

By substitution,

Profit is calculated by

This indicates that the regulated monopoly has a negative

Consumer surplus can be given by the area below the demand curve and above the price line, i.e. the triangle ade.

The value of social surplus under regulated monopoly is $2,200 ($3,200-$1,000). The policy of regulation is not sustainable even though it maximizes the social welfare, but it makes the firm losses.

Introduction: Monopoly is a market structure with a single firm selling a unique good. Monopoly is a price maker and has extensive market control. By analyzing the marginal revenue and marginal cost of producing an extra unit, a monopolist can determine its profit maximizing price and quantity.

c)

The industry outcome with the laxer regulatory policy of constraining price and the sustainability of the policy in a long run is to be determined.

c)

Answer to Problem 11.10P

The optimal quantity produced in the given case is 64.5 units.

Explanation of Solution

According to the given condition, price and average cost of production will be charged equal.

The optimal quantity produced will be 64.5 units.

By substitution, we get the price per unit.

The profit in the given case should be zero as the price and the average production cost is charged equally.

Consumer surplus can be given by the area below the demand curve and above the price line, i.e. the triangle afg.

Therefore the consumer surplus is $2,079.80. The value of social welfare in this case is $2,079.80. The policy will be sustainable in long run as the firm is breaking even. This means that their profit is zero and has no incentive to exit.

Introduction: Monopoly is a market structure with a single firm selling a unique good. Monopoly is a price maker and has extensive market control. By analyzing the marginal revenue and marginal cost of producing an extra unit, a monopolist can determine its profit maximizing price and quantity.

Want to see more full solutions like this?

Chapter 11 Solutions

EBK INTERMEDIATE MICROECONOMICS AND ITS

- agrody calming Inted 001 and me 2. A homeowner is concerned about the various air pollutants (e.g., benzene and methane) released in her house when she cooks with natural gas. She is considering replacing her gas oven and stove with an electric stove comprising an induction cooktop and convection oven. The new appliance costs $900 to purchase and install. Capping the old gas line costs an additional $150 (a one-time fee). The old line must be inspected for leaks each year after capping, at a cost of $35 for each inspection. a. If the homeowner plans to remain in the house for four more years and the discount rate is 4%, what is the minimum present value of the benefits that the homeowner would need to experience for this purchase to be justified based on its private net sub present value? b. While trying to understand how she might express the value of reduced exposure to indoor air pollutants in dollar terms, the homeowner consulted the EPA website and found estimates provided by…arrow_forwardAfter the ban is imposed, Joe’s firm switches to the more expensive biodegradable disposable cups. This increases the cost associated with each cup of coffee it produces. Which cost curve(s) will be impacted by the use of the more expensive biodegradable disposable cups? Why? Which cost curve(s) will not shift, and why not? Please use the table below to answer this question. For the second column (“Impacted? If so, how?”), please use one of the following three choices: No shift; Shifts up (i.e., increases: at nearly any given quantity, the cost goes up); or Shifts down (i.e., decreases: at nearly any given quantity, the cost goes down). $ Cost Curve Impacted? If so, how? Explanation of the Shift: Why or Why Not AFC No shift. Fix costs stay the same, regardless of quantity. Fixed cost is calculated as Fixed Cost/Quantity. Since fixed costs remain unchanged, AFC stays the same for each quantity. MC Shifts up. Since the biodegradable cups are more expensive, the…arrow_forwardStyrofoam is non-biodegradable and is not easily recyclable. Many cities and at least one state have enacted laws that ban the use of polystyrene containers. These locales understand that banning these containers will force many businesses to turn to other more expensive forms of packaging and cups, but argue the ban is environmentally important. Shane owns a firm with a conventional production function resulting in U-shaped ATC, AVC, and MC curves. Shane's business sells takeout food and drinks that are currently packaged in styrofoam containers and cups. Graph the short-run AFC0, AVC0, ATC0, and MC0 curves for Shane's firm before the ban on using styrofoam containers.arrow_forward

- PART II: Multipart Problems wood or solem of triflussd aidi 1. Assume that a society has a polluting industry comprising two firms, where the industry-level marginal abatement cost curve is given by: MAC = 24 - ()E and the marginal damage function is given by: MDF = 2E. What is the efficient level of emissions? b. What constant per-unit emissions tax could achieve the efficient emissions level? points) c. What is the net benefit to society of moving from the unregulated emissions level to the efficient level? In response to industry complaints about the costs of the tax, a cap-and-trade program is proposed. The marginal abatement cost curves for the two firms are given by: MAC=24-E and MAC2 = 24-2E2. d. How could a cap-and-trade program that achieves the same level of emissions as the tax be designed to reduce the costs of regulation to the two firms?arrow_forwardOnly #4 please, Use a graph please if needed to help provearrow_forwarda-carrow_forward

- For these questions, you must state "true," "false," or "uncertain" and argue your case (roughly 3 to 5 sentences). When appropriate, the use of graphs will make for stronger answers. Credit will depend entirely on the quality of your explanation. 1. If the industry facing regulation for its pollutant emissions has a lot of political capital, direct regulatory intervention will be more viable than an emissions tax to address this market failure. 2. A stated-preference method will provide a measure of the value of Komodo dragons that is more accurate than the value estimated through application of the travel cost model to visitation data for Komodo National Park in Indonesia. 3. A correlation between community demographics and the present location of polluting facilities is sufficient to claim a violation of distributive justice. olsvrc Q 4. When the damages from pollution are uncertain, a price-based mechanism is best equipped to manage the costs of the regulator's imperfect…arrow_forwardFor environmental economics, question number 2 only please-- thank you!arrow_forwardFor these questions, you must state "true," "false," or "uncertain" and argue your case (roughly 3 to 5 sentences). When appropriate, the use of graphs will make for stronger answers. Credit will depend entirely on the quality of your explanation. 1. If the industry facing regulation for its pollutant emissions has a lot of political capital, direct regulatory intervention will be more viable than an emissions tax to address this market failure. cullog iba linevoz ve bubivorearrow_forward

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning