Concept explainers

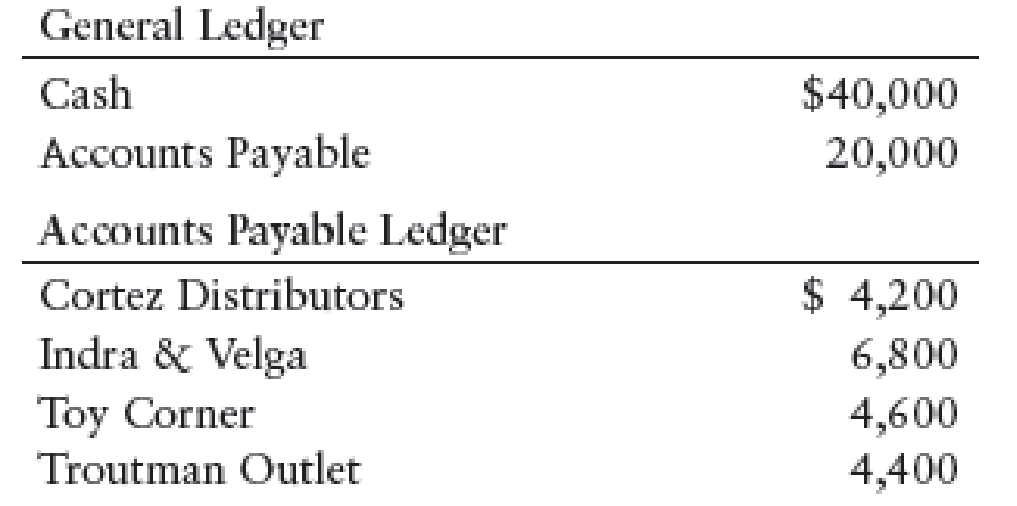

CASH PAYMENTS TRANSACTIONS Kay Zembrowski operates a retail variety store. The books include a general journal and an accounts payable ledger. Selected account balances on May 1 are as follows:

The following transactions are related to cash payments for the month of May:

May 1 Issued Check No. 326 in payment of May rent (Rent Expense), $2,600.

4 Issued Check No. 327 to Cortez Distributors in payment of merchandise purchased on account, $4,200, less a 3% discount. Check was written for $4,074.

7 Issued Check No. 328 to Indra & Velga in partial payment of merchandise purchased on account, $6,200. A cash discount was not allowed.

11 Issued Check No. 329 to Toy Corner for merchandise purchased on account, $4,600, less a 1% discount. Check was written for $4,554.

15 Issued Check No. 330 to County Power and Light (Utilities Expense), $1,500.

19 Issued Check No. 331 to Builders Warehouse for a cash purchase of merchandise, $3,500.

25 Issued Check No. 332 to Troutman Outlet for merchandise purchased on account, $4,400, less a 2% discount. Check was written for $4,312.

May 30 Issued Check No. 333 to Rapid Transit Company for freight charges on merchandise purchased (Freight-In), $800.

31 Issued Check No. 334 to City Merchants for a cash purchase of merchandise, $2,350.

Required

- 1. Enter the transactions starting with page 9 of a general journal.

- 2. Post from the general journal to the general ledger and the accounts payable ledger. Use general ledger account numbers as shown in the chapter.

1.

Journalize the cash payment transactions for the month of May.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the cash payment transactions for the month of May.

Transaction on May 1:

| Page: 9 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| May | 1 | Rent Expense | 521 | 2,600 | ||

| Cash | 101 | 2,600 | ||||

| (Record payment of rent expense) | ||||||

Table (1)

Description:

- Rent Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on May 4:

| Page: 9 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| May | 4 | Accounts Payable, C Distributors | 202/✓ | 4,200 | ||

| Cash | 101 | 4,074 | ||||

| Purchases Discounts | 501.2 | 126 | ||||

| (Record cash paid for purchases on account) | ||||||

Table (2)

Description:

- Accounts Payable, C Distributors is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

- Purchases Discounts is a contra-purchases or contra-costs account, and contra-purchases accounts increase the equity value, and an increase in equity is credited.

Working Note 1:

Compute purchases discount value.

Transaction on May 7:

| Page: 9 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| May | 7 | Accounts Payable, IV | 202/✓ | 6,200 | ||

| Cash | 101 | 6,200 | ||||

| (Record cash paid for purchases on account) | ||||||

Table (3)

Description:

- Accounts Payable, IV is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on May 11:

| Page: 9 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| May | 11 | Accounts Payable, T Corner | 202/✓ | 4,600 | ||

| Cash | 101 | 4,554 | ||||

| Purchases Discounts | 501.2 | 46 | ||||

| (Record cash paid for purchases on account) | ||||||

Table (4)

Description:

- Accounts Payable, T Corner is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

- Purchases Discounts is a contra-purchases or contra-costs account, and contra-purchases accounts increase the equity value, and an increase in equity is credited.

Working Note 2:

Compute purchases discount value.

Transaction on May 15:

| Page: 9 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| May | 15 | Utilities Expense | 533 | 1,500 | ||

| Cash | 101 | 1,500 | ||||

| (Record payment of utilities expense) | ||||||

Table (5)

Description:

- Utilities Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on May 19:

| Page: 9 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| May | 19 | Purchases | 501 | 3,500 | ||

| Cash | 101 | 3,500 | ||||

| (Record purchase of inventory) | ||||||

Table (6)

Description:

- Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on May 25:

| Page: 9 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| May | 25 | Accounts Payable, T Outlet | 202/✓ | 4,400 | ||

| Cash | 101 | 4,312 | ||||

| Purchases Discounts | 501.2 | 88 | ||||

| (Record cash paid for purchases on account) | ||||||

Table (7)

Description:

- Accounts Payable, T Outlet is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

- Purchases Discounts is a contra-purchases or contra-costs account, and contra-purchases accounts increase the equity value, and an increase in equity is credited.

Working Note 3:

Compute purchases discount value.

Transaction on May 30:

| Page: 9 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| May | 30 | Freight-In | 502 | 800 | ||

| Cash | 101 | 800 | ||||

| (Record payment of freight charges) | ||||||

Table (8)

Description:

- Freight-In is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on May 31:

| Page: 9 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| May | 31 | Purchases | 501 | 2,350 | ||

| Cash | 101 | 2,350 | ||||

| (Record purchase of inventory) | ||||||

Table (9)

Description:

- Purchases is an expense account which records the cost of inventory purchased. An increase in expense reduces the equity value, and a decrease in equity is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

2.

Post the given transactions into the accounts of the general ledger, and the suppliers account in accounts payable ledger.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the given transactions into the accounts of the general ledger.

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| May | 1 | Balance | ✓ | 40,000 | |||

| 1 | J9 | 2,600 | 37,400 | ||||

| 4 | J9 | 4,074 | 33,326 | ||||

| 7 | J9 | 6,200 | 27,126 | ||||

| 11 | J9 | 4,554 | 22,572 | ||||

| 15 | J9 | 1,500 | 21,072 | ||||

| 19 | J9 | 3,500 | 17,572 | ||||

| 25 | J9 | 4,312 | 13,260 | ||||

| 30 | J9 | 800 | 12,460 | ||||

| 31 | J9 | 2,350 | 10,110 | ||||

Table (10)

| ACCOUNT Accounts Payable ACCOUNT NO. 202 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| May | 1 | Balance | ✓ | 20,000 | |||

| 4 | J9 | 4,200 | 15,800 | ||||

| 7 | J9 | 6,200 | 9,600 | ||||

| 11 | J9 | 4,600 | 5,000 | ||||

| 25 | J9 | 4,400 | 600 | ||||

Table (11)

| ACCOUNT Purchases ACCOUNT NO. 501 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| May | 19 | J9 | 3,500 | 3,500 | |||

| 31 | J9 | 2,350 | 5,850 | ||||

Table (12)

| ACCOUNT Purchases Discounts ACCOUNT NO. 501.2 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| May | 4 | J9 | 126 | 126 | |||

| 11 | J9 | 46 | 172 | ||||

| 25 | J9 | 88 | 260 | ||||

Table (13)

| ACCOUNT Freight-In ACCOUNT NO. 502 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| May | 30 | J9 | 800 | 800 | |||

Table (14)

| ACCOUNT Rent Expense ACCOUNT NO. 521 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| May | 1 | J9 | 2,600 | 2,600 | |||

Table (15)

| ACCOUNT Utilities Expense ACCOUNT NO. 533 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| May | 15 | J9 | 1,500 | 1,500 | |||

Table (16)

Post the accounts payable balances of the suppliers to the supplier accounts in the accounts payable ledger.

| NAME T Corner | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| May | 1 | Balance | ✓ | 4,600 | ||

| 11 | J9 | 4,600 | 0 | |||

Table (17)

| NAME T Outlet | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| May | 1 | Balance | ✓ | 4,400 | ||

| 25 | J9 | 4,400 | 0 | |||

Table (18)

| NAME C Distributors | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| May | 1 | Balance | ✓ | 4,200 | ||

| 4 | J9 | 4,200 | ||||

Table (19)

| NAME IV | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| May | 1 | Balance | ✓ | 6,800 | ||

| 7 | J9 | 6,200 | 600 | |||

Table (20)

Want to see more full solutions like this?

Chapter 11 Solutions

College Accounting - Study Guide / Working Papers 1-15

- Please provide the answer to this general accounting question using the right approach.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardLockheed Corp. has assets of $342,750 and liabilities of $156,830. Then the firm receives $45,620 from an investor in exchange for new stock, which the firm issues to the investor. What is the value of stockholders' equity after the investment?arrow_forward

- I am looking for help with this financial accounting question using proper accounting standards.arrow_forwardOn August 1, Natalie Inc. has retained earnings of $63,780. Revenues for August were $12,450. Expenses for August were $5,620. In August, the company paid out a total of $2,230 in dividends to its shareholders. What is the value of retained earnings on August 31?arrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage