1.

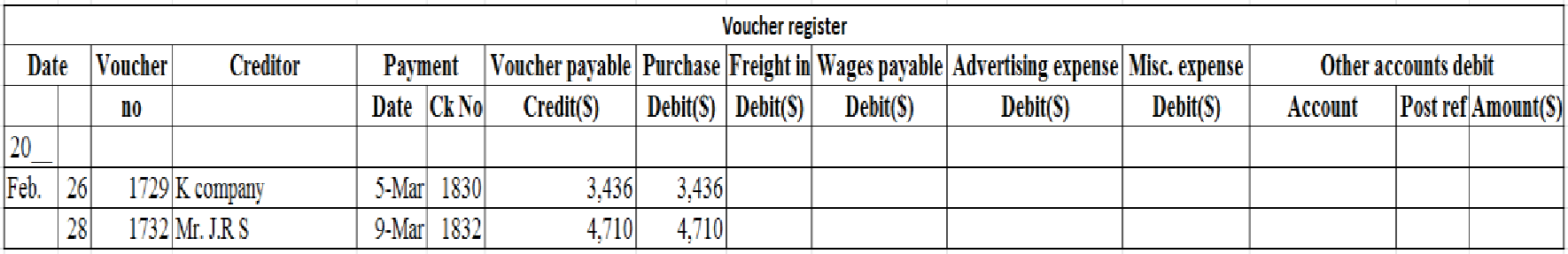

Prepare the voucher register for the February month.

1.

Explanation of Solution

Voucher: A voucher is a pre-numbered document which indicates the authorized approval of payment for a particular acquisition.

Voucher register is a journal that records the voucher once they are approved. Voucher register is also known as book of original entry.

Prepare the voucher register for the February month.

Table (1)

2.

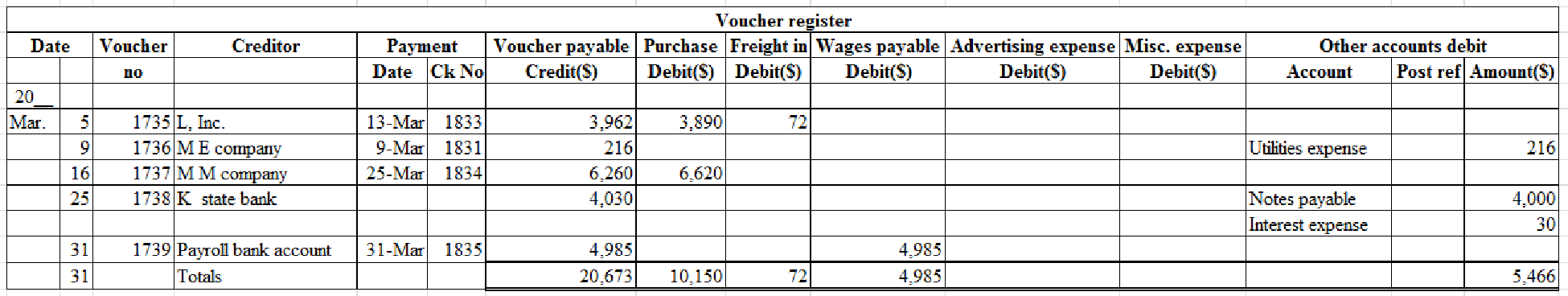

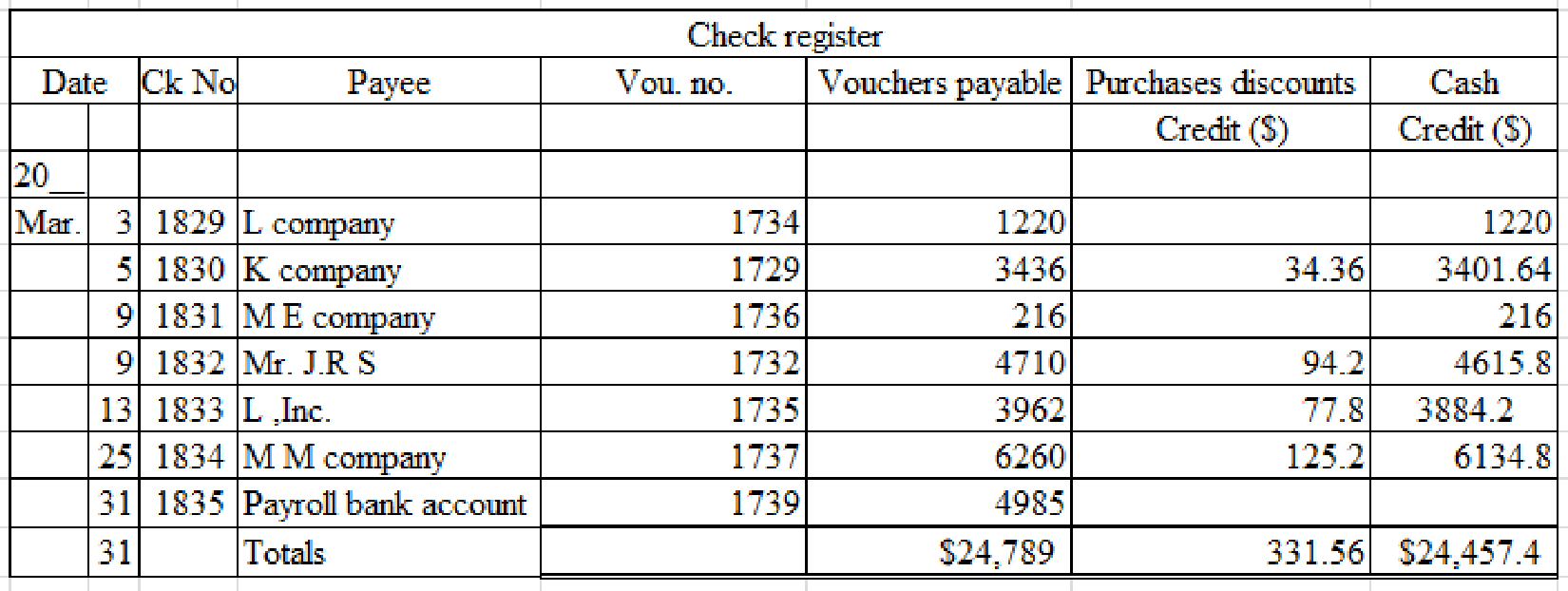

Prepare the voucher register and check register for the March month.

2.

Explanation of Solution

Check register is the journal used to record all the checks, cash payment and outlay of cash during an accounting period. Check register is also known as cash disbursements journal.

Prepare the voucher register for the March month.

Table (2)

Prepare the check register for the March month.

Table (3)

Working note: 1

Calculate the purchase discounts from K Company.

Working note: 2

Calculate the purchase discounts from Mr.J. R S.

Working note: 3

Calculate the purchase discounts from L, Inc.

Working note: 4

Calculate the purchase discounts from M M Company.

3.

Total of the voucher register and check register for the March month.

3.

Explanation of Solution

Total of the voucher register:

Total of the check register:

4.

Show the equality of credit and debit column of voucher register and check register.

4.

Explanation of Solution

Debit: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit.

Credit: It refers to selling goods and services to the customers on account.

Equality of debits and credits in voucher register:

| Equality of debits and credits | |||

| Particulars | Debits($) | Particulars | Credits($) |

| Purchases | 10,150 | Vouchers payable | 20,673 |

| Freight in | 72.00 | ||

| Wages payable | $4,985 | ||

| other | 5,466 | ||

| Total | $20,673 | $20,673 | |

Table (4)

Equality of debits and credits in check register:

| Equality of debits and credits | |||

| Particulars | Debits($) | Particulars | Credits($) |

| Vouchers payable | 24,789 | Purchase discounts | 331.56 |

| cash | 24,457.44 | ||

| Total | $20,673 | $20,673 | |

Table (5)

Want to see more full solutions like this?

Chapter 10A Solutions

College Accounting (Book Only): A Career Approach

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardIf the average age of inventory is 80 days, the average age of accounts payable is 55 days, and the average age of accounts receivable is 70 days, the number of days in the cash flow cycle is__.arrow_forwardAnswerarrow_forward

- Can you help me solve this financial accounting question using the correct financial procedures?arrow_forwardWhat is the direct labor time variance?arrow_forwardSunset Crafts Company sells handmade scarves for $28.50 per scarf. In FY 2023, total fixed costs are expected to be $185,000, and variable costs are estimated at $19.75 a unit. Sunset Crafts Company wants to have an FY 2023 operating income of $92,000. Use this information to determine the number of units of scarves that Sunset Crafts Company must sell in FY 2023 to meet this goal. (Don't round-up unit calculation)arrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardQuestion: 22 - Hader company has actual sales of $82,000 in April and $63,000 in May. It expects sales of $78,000 in June and $92,000 in July and in August. Assuming that sales are the only source of cash inflows and that half of them are for cash and the remainder are collected evenly over the following 2 months, what are the firm's expected cash receipts for June, July, and August?arrow_forwardCalculate the sales revenue to achieve a target profit of 375000arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage