Concept explainers

Applying

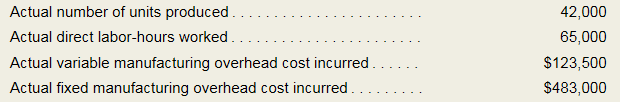

Lane Company manufactures a single product that requires a great deal of hand labor. Overhead cost is applied on the basis of standard direct labor-hours. The budgeted variable manufacturing overhead is $2 per direct labor-hour and the budgeted fixed manufacturing overhead is $480,000 per year.

The standard quantity of materials is 3 pounds per unit and the

Required:

- Compute the predetermined overhead rate for the year Break the rate down into variable and fixed elements.

- Prepare a standard cost card for the company’s product; show the details for all

manufacturing costs on your standard cost card. - Do the following:

- Compute the standard direct labor-hours allowed for the year’s production.

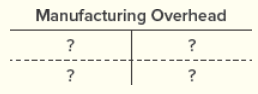

- Complete the following Manufacturing Overhead T-account for the year:

- Determine the reason for any underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances.

- Suppose the company had chosen 65,000 direct labor-hours as the denominator activity rather than 60,000 hours. State which, if any, of the variances computed in (4) above would have changed, and explain how the variance(s) would have changed. No computations are necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10A Solutions

Loose Leaf For Managerial Accounting for Managers

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you solve this financial accounting problem using appropriate financial principles?arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

- I am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardPlease provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Siemens Technology produces ergonomic keyboards for $75.00 per unit. The variable cost per unit is $27.00. Each keyboard requires 4 direct labor hours and 6 machine hours to produce. Which of the following is the correct contribution margin per machine hour? a) $8.00 b) $12.00 c) $19.00 d) $48.00 e) None of these.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning