Concept explainers

Fixed

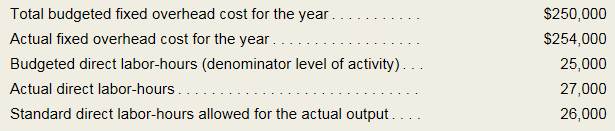

Primara Corporation has a

Required:

- Compute the fixed portion of the predetermined overhead rate for the year.

- Compute the fixed overhead

budget variance and volume variance.

1

Fixed portion of the predetermined overhead rate of the year.

Introduction: Fixed overhead volume variances mean a measure that defines the difference between budgeted fixed overhead costs and actual cost of fixed overhead costs. This explains the units produced based on the standard hours allowed and standard fixed rate.

Answer to Problem 10A.1E

Explanation of Solution

2

Fixed overhead budget variance and volume variance.

Introduction: Fixed overhead volume variances mean a measure that defines the difference between budgeted fixed overhead costs and actual cost of fixed overhead costs. This explains the units produced based on the standard hours allowed and standard fixed rate.

Answer to Problem 10A.1E

Budgeted variances is $4,000U and volume variances is $10,000F

Explanation of Solution

Want to see more full solutions like this?

Chapter 10A Solutions

MANAGERIAL ACCOUNTING F/MGRS.

- What was the gain or loss on the disposal ?arrow_forwardThe entity reports the following transactions for the 2023 tax year. The trustee accumulates all accounting income for the year. Operating income from a business $565,000 33,900 Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds 4,520,000 Trustee fees, deductible portion (16,950) (113,000) Net rental losses, passive activity Click here to access tax table for this problem. Carryout the tax computations to two decimal places and round the final tax liability to the nearest dollar. Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the trustee's gross income taxed at 20% for the Valerio Trust is $ The Federal income tax liability for the Valerio Trust is $ The Trustee taxable income taxed at ordinary rates for the Valerio Trust is $ 1,790,299 X. 33,900 ✓ 547,950 ✔.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning