Concept explainers

Comprehensive

“Wonderful! Not only did our salespeople do a good job in meeting the sales budget this year, but our production people did a good job in controlling costs as well,” said Kim Clark, president of Martell Company. “Our $18,300 overall

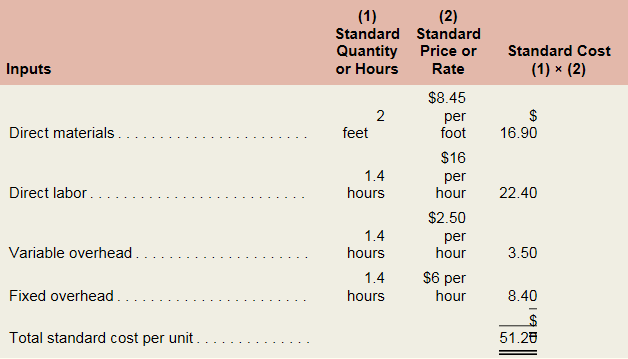

The company produces and sells a single product. The standard cost card for the product follows:

The following additional information is available for the year just completed:

- The company manufactured 30,000 units of product during the year.

- A total of 64,000 feet of material was purchased during the year at a cost of $8.55 per foot. All of this material was used to manufacture the 30,000 units produced. There were no beginning or ending inventories for the year.

- The company worked 43,500 direct labor-hours during the year at a direct labor cost of $15.80 per hour.

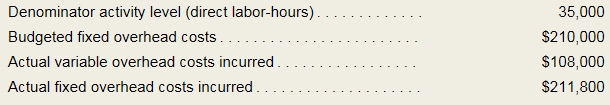

Overhead is applied to products on the basis of standard direct labor-hours. Data relating to manufacturing overhead costs follow:

Required:

- Compute the materials price and quantity variances for the year.

- Compute the labor rate and efficiency variances for the year.

- For manufacturing overhead compute:

- The variable overhead rate and efficiency variances for the year.

- The fixed overhead budget and volume variances for the year.

- Total the variances you have computed, and compare the net amount with the $18,300 mentioned by the president. Do you agree that bonuses should be given to everyone for good cost control during the year? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10A Solutions

MANAGERIAL ACCOUNTING F/..(LL)-W/ACCESS

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning