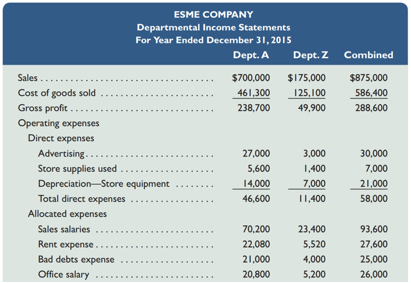

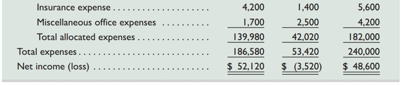

Esme Company’s management is trying to decide whether to eliminate Department Z, which has produced low

In analyzing whether to eliminate Department Z, management considers the following items:

a. The company has one office worker who earns $500 per week or $26,000 per year and four salesclerks who each earn $450 per week or $23,400 per year for each salesclerk.

b. The full salaries of three salesclerks are charged to Department A. The full salary of salesclerk is charged to Department Z.

C. Eliminating Department Z would avoid the sales salaries and the office salary currently allocated to it.

However, management prefers another plan. Two salesclerks have indicated that they will quitting soon. Management believes that their work can be done by two remaining clerks if the office worker works in sales half-time. Eliminating Department Z will this shift of duties. If this change is implemented, half the office worker’s salary would be reported as sales salaries and half would be reported as office salary.

d. The Store building is rented under a long-term lease that cannot be changed. Therefore, Department A will use the space and equipment currently used by Department Z.

e. Closing Department Z will eliminate its expenses for advertising,

Required

1. Prepare a three-column report that lists items and amounts for (a) the company’s total expenses (including cost of goods sold)--in column 1, (b) the expenses that would be eliminated by closing

Department Z—in column 2, and (c) the expenses that will continue—in column 3.

2. Prepare a

Department Z assuming that it will not affect Department A’s sales and gross profit. The statement should reflect the reassignment of the office worker to one-half time as a salesclerk.

Analysis Component

3. Reconcile the company’s combined net income with the forecasted net income assuming that

Department Z is eliminated (list both items and amounts). Analyze the reconciliation and explain why you think the department should or should not eliminated.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you demonstrate the accurate method for solving this General accounting question?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub