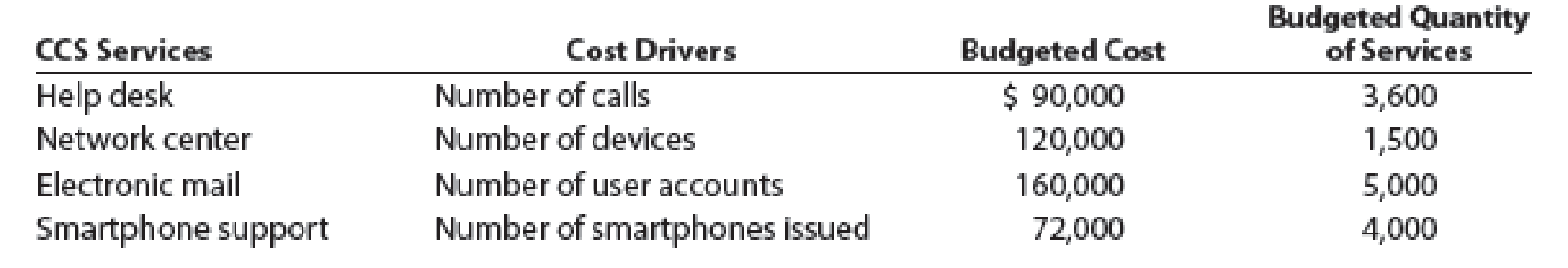

Varney Corporation, a manufacturer of electronics and communications systems, allocates Computing and Communications Services Department (CCS) costs to profit centers. The following table lists the types of services and cost drivers for each service. The table also includes the budgeted cost and quantity for each service for August.

One of the profit centers for Varney Corporation is the Communication Systems (COMM) division.

Assume the following information for COMM:

• COMM has 2,500 employees, of whom 20% are office employees.

• All of the office employees have been issued a smartphone, and 95% of them have a computer on the network.

• One hundred percent of the employees with a computer also have an email account.

• The average number of help desk calls for August was 0.6 call per individual with a computer.

• There are 400 additional printers, servers, and peripherals on the network beyond the personal computers.

a. Compute the service allocation rate for each of CCS’s services for August.

b. Compute the allocation of CCS’s services to COMM for August.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Bundle: Managerial Accounting, 15th + Cengagenowv2, 1 Term Printed Access Card

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning