Concept explainers

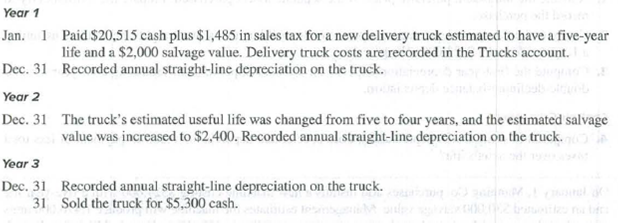

Yoshi Company completed the following transactions and events involving its delivery trucks.

Required

Prepare

Prepare journal entries to record the given transaction and events.

Explanation of Solution

Plant assets:

Plant assets refer to the fixed assets, having a useful life of more than a year that is acquired by a company to be used in its business activities, for generating revenue.

Prepare journal entries to record the given transaction and events as follows:

Year 1:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| January 1, Year 1 | Trucks (1) | 22,000 | ||

| Cash | 22,000 | |||

| (To record the purchase of truck) |

Table (1)

- Truck is an asset account and it increases the value of asset. Therefore, debit the trucks account by $22,000.

- Cash is an asset account and it decreases the value of asset. Therefore, credit Cash account by $22,000.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 1 | Depreciation Expense (2) | 4,000 | ||

| Accumulated Depreciation – Trucks | 4,000 | |||

| (To record the depreciation expense for truck) |

Table (2)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $4,000.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $4,000.

Working Notes:

Compute the acquisition cost of truck:

Compute depreciation expense:

Year 2:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 2 | Depreciation Expense (5) | 5,200 | ||

| Accumulated Depreciation – Trucks | 5,200 | |||

| (To record the depreciation expense for truck) |

Table (3)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $5,200.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $5,200.

Working Notes:

Compute the remaining depreciable amount:

| Computation of Depreciation | |

| Particulars | $ |

| Acquisition cost, January 1, Year 1 | $22,000 |

| Less: Accumulated depreciation for first year | (4,000) |

| Book value | 18,000 |

| Less: Revised salvage value | (2,400) |

| Remaining depreciable amount | $15,600 |

Table (4)

…… (4)

Compute the revised depreciation for year 2

Year 3:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 3 | Depreciation Expense (5) | 5,200 | ||

| Accumulated Depreciation – Trucks | 5,200 | |||

| (To record the annual depreciation expense for truck) |

Table (5)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $5,200.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $5,200.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 3 | Cash | 5,300 | ||

| Accumulated Depreciation – Trucks (6) | 14,400 | |||

| Loss on disposal of trucks (6) | 2,300 | |||

| Trucks | 22,000 | |||

| (To record the sale of truck) |

Table (6)

- Cash is an asset account and it increases the value of asset. Therefore, debit cash account by $5,300.

- Accumulated depreciation is a contra asset, and it increases the value of assets. Therefore, debit the accumulated depreciation by $14,400.

- Loss on sale of truck is an expense account and it decreases the value of stockholder’s equity. Therefore, debit the loss on sale of truck by $2,300.

- Truck is an asset account and it decreases the value of asset. Therefore, credit the trucks account by $22,000.

Working Notes:

Compute the gain or loss on the sale of truck:

| Computation of Gain or Loss on Sale of Truck | ||

| Details | Amount ($) | Amount ($) |

| Cost of the Asset | 22,000 | |

| Less: Accumulated depreciation | ||

| Year 1 (2) | 4,000 | |

| Year 2 (5) | 5,200 | |

| Year 3 (5) | 5,200 | (14,400) |

| Book value of asset | 7,600 | |

| Less: sold value of truck | 5,300 | |

| Loss on sale of Truck | (2,300) | |

Table (7)

...... (6)

Want to see more full solutions like this?

Chapter 10 Solutions

Principles of Financial Accounting.

- Hello tutor please provide correct answer general accounting question with correct solution do fastarrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning