a)

Case summary:

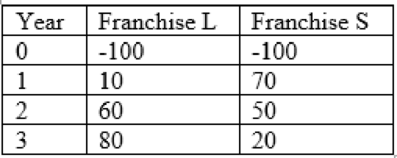

The cash flows of Franchise L's would start off slowly however will rise rather quickly as people become much health-conscious, while the cash flows of Franchise S would start off high however will trail off as other chicken competitors comes inside the marketplace and as people become more health-conscious and avoid fried foods. Franchise L serves breakfast and lunch, whereas Franchise S serves only dinner, so it is possible for person X to invest in both franchises.

Here are the net cash flows (in thousand $)

To determine: The definition of

b)

To determine: The relationship between IRR and YTM and IRR if equal

c)

To determine: The logic behind the IRR method and the franchises should be accepted if they are independent and mutually exclusive.

d)

To determine: Whether IRR changes with respect to change in cost of capital.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Bundle: Financial Management: Theory and Practice, Loose-leaf Version, 15th + Aplia, 1 term Printed Access Card

- Forest Enterprises, Incorporated, has been considering the purchase of a new manufacturing facility for $290,000. The facility is to be fully depreciated on a straight-line basis over seven years. It is expected to have no resale value after the seven years. Operating revenues from the facility are expected to be $125,000, in nominal terms, at the end of the first year. The revenues are expected to increase at the inflation rate of 2 percent. Production costs at the end of the first year will be $50,000, in nominal terms, and they are expected to increase at 3 percent per year. The real discount rate is 5 percent. The corporate tax rate is 25 percent. Calculate the NPV of the project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPVarrow_forwardHelp with questionsarrow_forwardPlease help with questionsarrow_forward

- Create financial forecasting years 2022, 2023, and 2024 using this balance sheet.arrow_forwardBeta Company Ltd issued 10% perpetual debt of Rs. 1,00,000. The company's tax rate is 50%. Determine the cost of capital (before tax as well as after tax) assuming the debt is issued at 10 percent premium. helparrow_forwardFinance subject qn solve.arrow_forward