a.

Find a 95% confidence interval for the difference between the bullish sentiment measures for the most recent two weeks.

a.

Answer to Problem 47SE

The 95% confidence interval for the difference between the bullish sentiment measures for the most recent two weeks is

Explanation of Solution

Calculation:

It is given that the bullish sentiment of individual investors for the week end was 27.6%, 48.7% for one week earlier and 39.7% for one month earlier. A sample of 240 is considered.

Confidence interval:

The

where

Here,

Software procedure:

Step-by-step software procedure to obtain the p-value using MINITAB software is as follows,

- Choose Stat > Basic Statistics > 2 Proportions.

- Choose Summarized data.

- In First sample, enter Trials (n) as 240 and Events as (x) 66.

- In Second sample, enter Trials (n) as 240 and Events as 117.

- Click Options.

- In Confidence level, Enter 95.

- In Alternative select not equal.

- Click OK in all dialogue boxes.

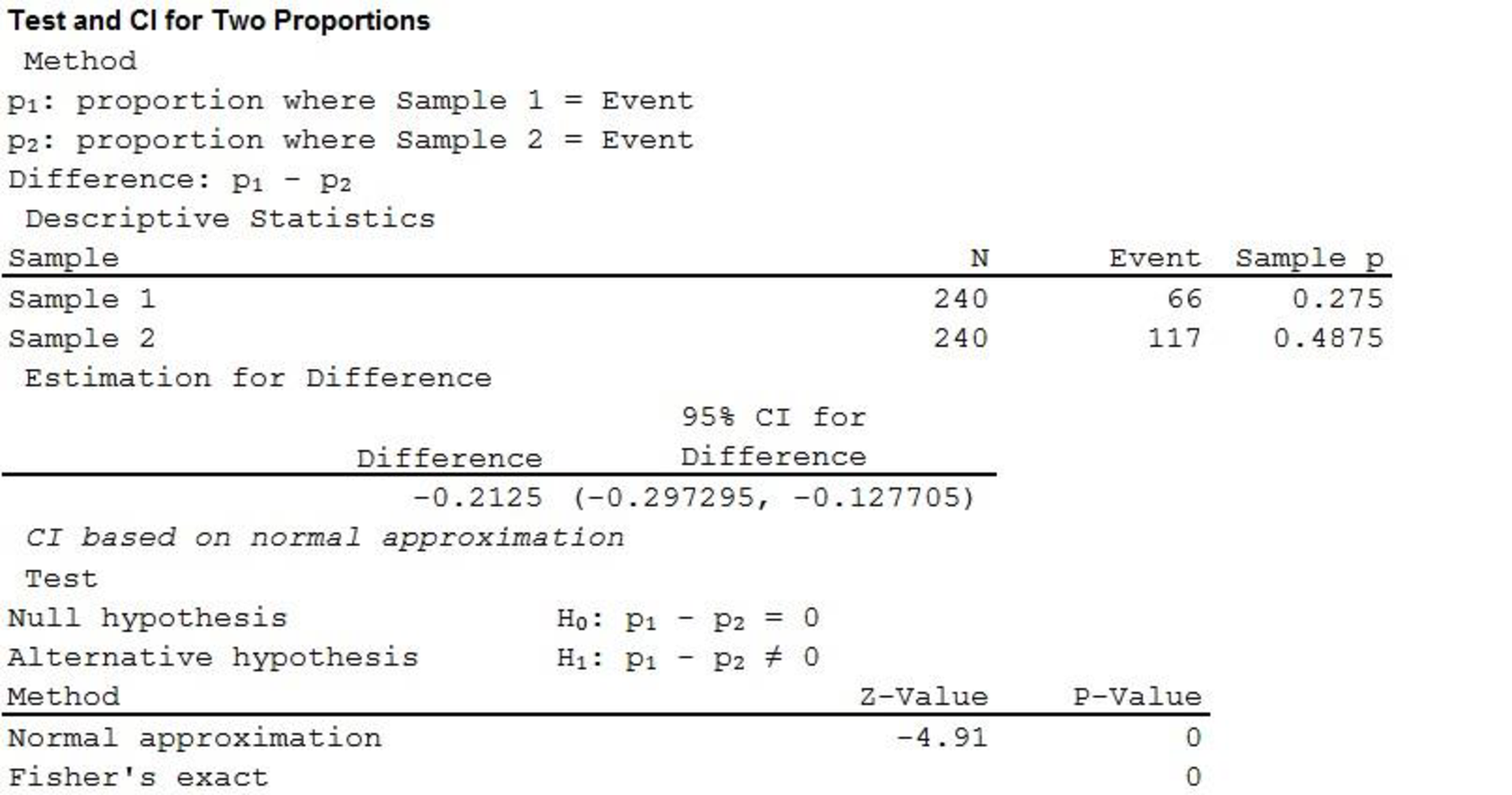

Output using MINITAB software is as follows,

Thus, the 95% confidence interval is

Interpretation:

There is 95% confidence that the difference between the bullish sentiment measures for the most recent two weeks lies between –0.297 and –0.127.

b.

State the null and alternative hypothesis so that rejection of the null hypothesis will allow to conclude that the most recent bullish sentiment is weaker than that of one month ago.

b.

Answer to Problem 47SE

The null and alternative hypotheses are given below:

Null hypothesis:

Alternative hypothesis:

Explanation of Solution

Calculation:

Here

State the hypothesis:

The test hypotheses are as follows,

Null hypothesis:

That is, the proportion of the bullish sentiment of individual investors for the most recent week is greater than the proportion of the bullish sentiment of individual investors for one month ago.

Alternative hypothesis:

That is, the proportion of the bullish sentiment of individual investors for the most recent week is less than the proportion of the bullish sentiment of individual investors for one month ago.

c.

Test the hypothesis in part (b) at

c.

Answer to Problem 47SE

There is sufficient evidence to conclude that, there is decrease in bullish sentiment over the past month.

Explanation of Solution

Calculation:

Test statistic:

The test statistic for hypothesis tests about

Where

Software procedure:

Step-by-step software procedure to obtain the p-value using MINITAB software is as follows,

- Choose Stat > Basic Statistics > 2 Proportions.

- Choose Summarized data.

- In First sample, enter Trials (n) as 240 and

Events as (x) 66. - In Second sample, enter Trials (n) as 240 and Events as 95.

- Click Options.

- In Confidence level, Enter 99.

- In Alternative select less than.

- Click OK in all dialogue boxes.

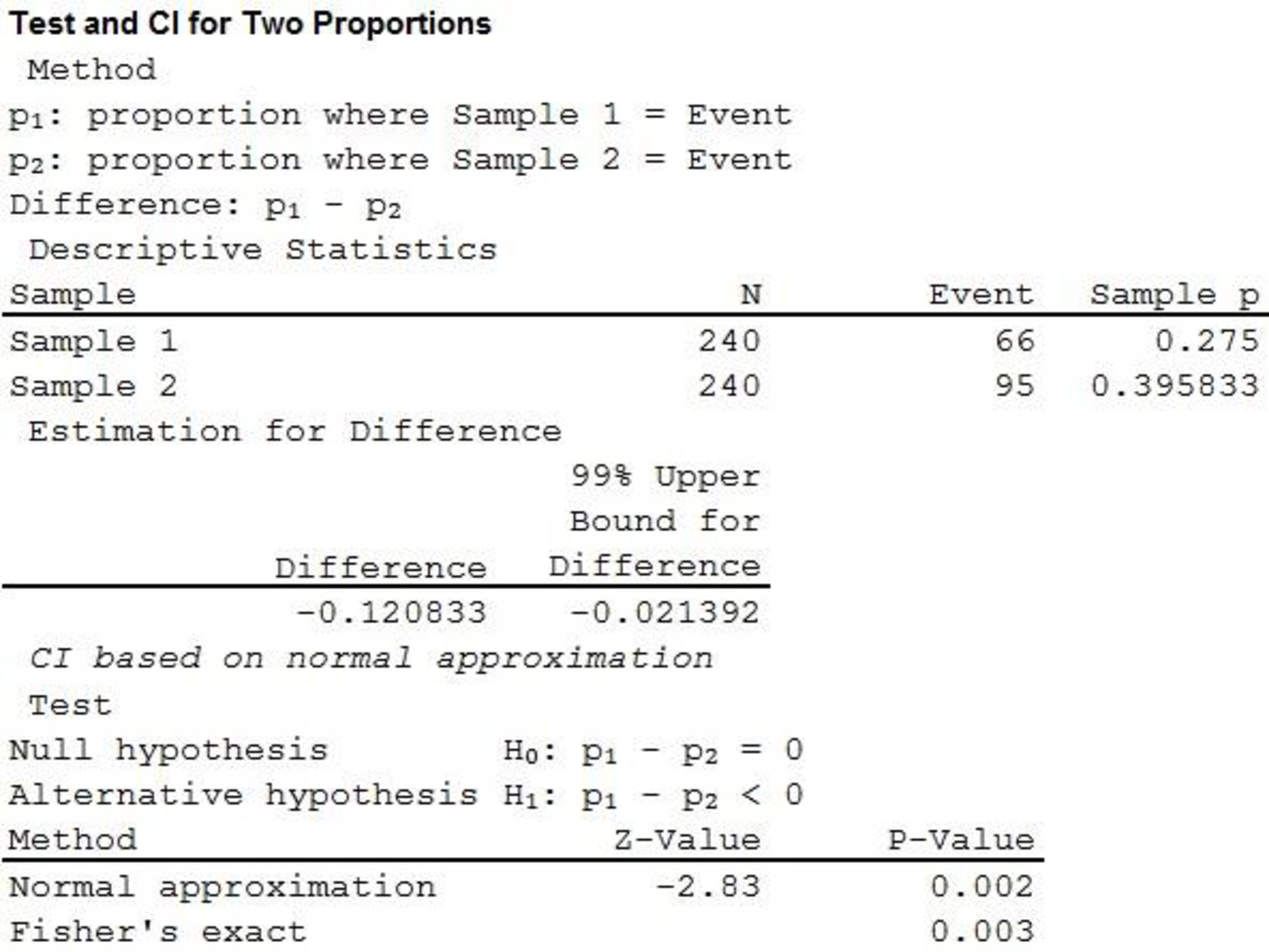

Output using MINITAB software is as follows,

Thus, the p-value is 0.002.

Rejection rule:

If the

If the

Conclusion:

Here the p-value 0.002 is less than the significance level 0.01.

That is,

Thus, the null hypothesis is rejected.

Therefore, there is sufficient evidence to conclude that, the proportion of the bullish sentiment of individual investors for the most recent week is less than the proportion of the bullish sentiment of individual investors for one month ago.

Interpretation:

Here the null hypothesis

Want to see more full solutions like this?

Chapter 10 Solutions

EBK STATISTICS FOR BUSINESS & ECONOMICS

- 2. [20] Let {X1,..., Xn} be a random sample from Ber(p), where p = (0, 1). Consider two estimators of the parameter p: 1 p=X_and_p= n+2 (x+1). For each of p and p, find the bias and MSE.arrow_forward1. [20] The joint PDF of RVs X and Y is given by xe-(z+y), r>0, y > 0, fx,y(x, y) = 0, otherwise. (a) Find P(0X≤1, 1arrow_forward4. [20] Let {X1,..., X} be a random sample from a continuous distribution with PDF f(x; 0) = { Axe 5 0, x > 0, otherwise. where > 0 is an unknown parameter. Let {x1,...,xn} be an observed sample. (a) Find the value of c in the PDF. (b) Find the likelihood function of 0. (c) Find the MLE, Ô, of 0. (d) Find the bias and MSE of 0.arrow_forward3. [20] Let {X1,..., Xn} be a random sample from a binomial distribution Bin(30, p), where p (0, 1) is unknown. Let {x1,...,xn} be an observed sample. (a) Find the likelihood function of p. (b) Find the MLE, p, of p. (c) Find the bias and MSE of p.arrow_forwardGiven the sample space: ΩΞ = {a,b,c,d,e,f} and events: {a,b,e,f} A = {a, b, c, d}, B = {c, d, e, f}, and C = {a, b, e, f} For parts a-c: determine the outcomes in each of the provided sets. Use proper set notation. a. (ACB) C (AN (BUC) C) U (AN (BUC)) AC UBC UCC b. C. d. If the outcomes in 2 are equally likely, calculate P(AN BNC).arrow_forwardSuppose a sample of O-rings was obtained and the wall thickness (in inches) of each was recorded. Use a normal probability plot to assess whether the sample data could have come from a population that is normally distributed. Click here to view the table of critical values for normal probability plots. Click here to view page 1 of the standard normal distribution table. Click here to view page 2 of the standard normal distribution table. 0.191 0.186 0.201 0.2005 0.203 0.210 0.234 0.248 0.260 0.273 0.281 0.290 0.305 0.310 0.308 0.311 Using the correlation coefficient of the normal probability plot, is it reasonable to conclude that the population is normally distributed? Select the correct choice below and fill in the answer boxes within your choice. (Round to three decimal places as needed.) ○ A. Yes. The correlation between the expected z-scores and the observed data, , exceeds the critical value, . Therefore, it is reasonable to conclude that the data come from a normal population. ○…arrow_forwardding question ypothesis at a=0.01 and at a = 37. Consider the following hypotheses: 20 Ho: μ=12 HA: μ12 Find the p-value for this hypothesis test based on the following sample information. a. x=11; s= 3.2; n = 36 b. x = 13; s=3.2; n = 36 C. c. d. x = 11; s= 2.8; n=36 x = 11; s= 2.8; n = 49arrow_forward13. A pharmaceutical company has developed a new drug for depression. There is a concern, however, that the drug also raises the blood pressure of its users. A researcher wants to conduct a test to validate this claim. Would the manager of the pharmaceutical company be more concerned about a Type I error or a Type II error? Explain.arrow_forwardFind the z score that corresponds to the given area 30% below z.arrow_forwardFind the following probability P(z<-.24)arrow_forward3. Explain why the following statements are not correct. a. "With my methodological approach, I can reduce the Type I error with the given sample information without changing the Type II error." b. "I have already decided how much of the Type I error I am going to allow. A bigger sample will not change either the Type I or Type II error." C. "I can reduce the Type II error by making it difficult to reject the null hypothesis." d. "By making it easy to reject the null hypothesis, I am reducing the Type I error."arrow_forwardGiven the following sample data values: 7, 12, 15, 9, 15, 13, 12, 10, 18,12 Find the following: a) Σ x= b) x² = c) x = n d) Median = e) Midrange x = (Enter a whole number) (Enter a whole number) (use one decimal place accuracy) (use one decimal place accuracy) (use one decimal place accuracy) f) the range= g) the variance, s² (Enter a whole number) f) Standard Deviation, s = (use one decimal place accuracy) Use the formula s² ·Σx² -(x)² n(n-1) nΣ x²-(x)² 2 Use the formula s = n(n-1) (use one decimal place accuracy)arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL