TAXATION INDIVIDUALS & BUSINESS ENTITIE

10th Edition

ISBN: 9781260799705

Author: SPILKER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 42P

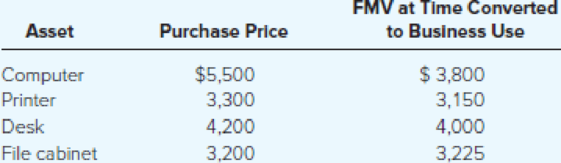

Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school (several years ago) that she is planning to use in her business. What is the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Harrison Manufacturing had a beginning work in process inventory

balance of $40,500. During the year, $89,000 of direct materials

were placed into production. Direct labor costs totaled $72,600,

and indirect labor was $24,500.

Manufacturing overhead is allocated at 125% of direct labor costs.

Actual manufacturing overhead was $95,000, and jobs costing

$275,000 were completed during the year.

Compute the ending work in process inventory balance.

RIO is a retailer of smart televisions. Typically, the company purchases atelevision for $1,200 and sells it for $1,500. What is the gross profit margin on this television?

Can you help me with this financial accounting question?

Chapter 10 Solutions

TAXATION INDIVIDUALS & BUSINESS ENTITIE

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the total period cost for the month under variable costingarrow_forwardI don't need ai answer general accounting questionarrow_forwardRDX Corporation's production budget for September is 22,000 units and includes the following component unit costs: direct materials, $7.50; direct labor, $12.00; variable overhead, $6.20. Budgeted fixed overhead is $55,000. Actual production in September was 23,400 units, actual unit component costs incurred during September include direct materials, $8.10; direct labor, $11.80; variable overhead, $6.50. Actual fixed overhead was $57,000, the standard fixed overhead application rate per unit consists of $2.50 per machine hour and each unit is allowed a standard of 1.2 hours of machine time. Calculate the fixed overhead budget variance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License