1.

Prepare a table to allocate the costs incurred by Company P.

1.

Explanation of Solution

Lump-Sum purchase:

If a company purchases a group of assets collectively and a lump sum amount is paid for such purchase, then it is referred to as basket purchase. The accounting term for this type of acquisition is the lump-sum purchase.

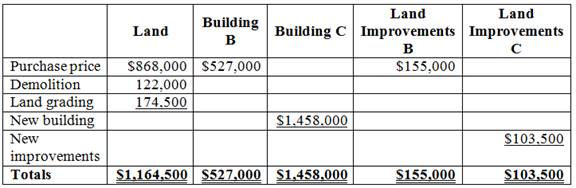

Compute the total cost of the assets as follows:

Table (1)

Prepare a table to allocate the costs incurred by Company P as follows:

| Assets | Fair Market Value (in $) | Percent of total= | Allocation of the purchase price based on the percentage of total |

| Land | 795,200 | 868,000 | |

| Building B | 482,800 | 527,000 | |

| Land Improvements B | 142,000 | 155,000 | |

| Total | $1,420,000 | $1,550,000 |

Table (2)

2.

Prepare a single

2.

Explanation of Solution

Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset on account of its wear and tear or obsolescence.

Prepare journal entry to record the purchase as follows:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| January 1, 2015 | Land | 1,164,500 | |

| Land improvements B | 527,000 | ||

| Land Improvements C | 1,458,000 | ||

| Building B | 155,000 | ||

| Building C | 103,500 | ||

| Cash | 3,408,000 | ||

| (To record the costs of lump-sum purchase) |

Table (3)

- Land is an asset account and it is increased. Therefore, debit land account.

- Land Improvements are the asset account and they are increased. Therefore, debit land improvements account.

- Building is an asset account and it is increased. Therefore debit building account.

- Cash is an asset account and it is decreased. Therefore credit cash account.

3.

Prepare the December 31

3.

Explanation of Solution

Prepare the December 31 adjusting entries to record depreciation of the assets for the year 2015 as follows:

Adjusting entry to record the depreciation of Building B for the year 2015:

| Date | Account title and Explanation | Post Ref. |

Debit (In $) |

Credit (In $) |

| December 31, 2015 | Depreciation expense | 28,500 | ||

| | 28,500 | |||

| (To record the depreciation expense) |

Table (4)

Working Note:

Calculate the depreciation expense.

- Depreciation expense is a component of

retained earnings . It decreases the retained earnings. Thus, depreciation expense is debited. - Accumulated depreciation is a contra asset which decreases the value of the asset. Increase in accumulated depreciation decreases the asset’s value. Thus, accumulated depreciation on equipment is credited.

Adjusting entry to record the depreciation of Building C for the year 2015:

| Date | Account title and Explanation | Post Ref. |

Debit (In $) |

Credit (In $) |

| December 31, 2015 | Depreciation expense | 60,000 | ||

| Accumulated depreciation | 60,000 | |||

| (To record the depreciation expense) |

Table (5)

Working Note:

Calculate the depreciation expense.

- Depreciation expense is a component of retained earnings. It decreases the retained earnings. Thus, depreciation expense is debited.

- Accumulated depreciation is a contra asset which decreases the value of the asset. Increase in accumulated depreciation decreases the asset’s value. Thus, accumulated depreciation on equipment is credited.

Adjusting entry to record the depreciation of Land Improvements B for the year 2015:

| Date | Account title and Explanation | Post Ref. |

Debit (In $) |

Credit (In $) |

| December 31, 2015 | Depreciation expense | 31,000 | ||

| Accumulated depreciation | 31,000 | |||

| (To record the depreciation expense) |

Table (6)

Working Note:

Calculate the depreciation expense.

- Depreciation expense is a component of retained earnings. It decreases the retained earnings. Thus, depreciation expense is debited.

- Accumulated depreciation is a contra asset which decreases the value of the asset. Increase in accumulated depreciation decreases the asset’s value. Thus, accumulated depreciation on equipment is credited.

Adjusting entry to record the depreciation of Land Improvements C for the year 2015:

| Date | Account title and Explanation | Post Ref. |

Debit (In $) |

Credit (In $) |

| December 31, 2015 | Depreciation expense | 10,350 | ||

| Accumulated depreciation | 10,350 | |||

| (To record the depreciation expense) |

Table (7)

Working Note:

Calculate the depreciation expense.

- Depreciation expense is a component of retained earnings. It decreases the retained earnings. Thus, depreciation expense is debited.

- Accumulated depreciation is a contra asset which decreases the value of the asset. Increase in accumulated depreciation decreases the asset’s value. Thus, accumulated depreciation on equipment is credited.

Want to see more full solutions like this?

Chapter 10 Solutions

Principles of Financial Accounting.

- Accounting problem with correctarrow_forwardMila Services collected $278,000 from customers in 2022. Of the amount collected, $134,000 was from services performed in 2021. In addition, Mila performed services worth $189,000 in 2022, which will not be collected until 2023. Mila Services also paid $217,000 for expenses in 2022. Of the amount paid, $156,000 was for expenses incurred on account in 2021. In addition, Mila incurred $172,000 of expenses in 2022, which will not be paid until 2023. Compute 2022 cash-basis net income.arrow_forwardRamos Corporation deposits all cash receipts on the day they are received and makes all cash payment by check.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education