Concept explainers

a.

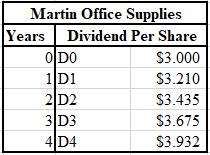

To calculate: The estimated value of dividend for Martin Office Supplies in the next four years.

Introduction:

Dividends:

It refers to the distribution of profits to the shareholders of a company and can be paid in terms of cash and stock.

a.

Answer to Problem 34P

The calculation of the next four anticipated values of dividend is shown below.

Explanation of Solution

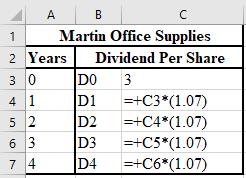

The formulae used for the calculation of the anticipated values of dividend are shown below.

b.

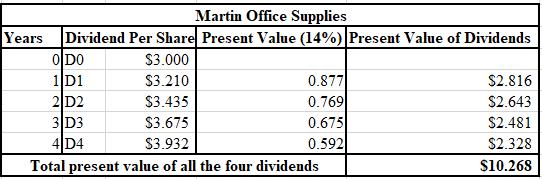

To calculate: The summation of the present values of the four anticipated values of dividend discounted at the rate of 14% of Martin Office Supplies.

Introduction:

The current value of an investment or an asset is termed as its PV. It is calculated by discounting the

b.

Answer to Problem 34P

The calculation of the PV of the next four values of dividend is shown below.

Hence, the sum of the PV of the next four anticipated values of dividend is $10.268.

Explanation of Solution

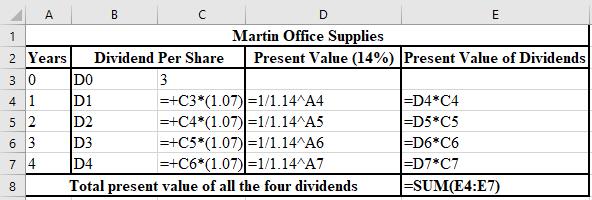

The formulae used for the calculation of the PV of the anticipated values of dividend are shown below.

c.

To calculate: The price of the stock at the end of fourth year (P4) of Martin Office Supplies.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

c.

Answer to Problem 34P

The price of the stock at the end of fourth year (P4) of Martin Office Supplies will be $60.10.

Explanation of Solution

Calculation of the stock price:

Working note:

Calculation of the expected dividend in the fifth year:

d.

To calculate: The PV of P4 at a discount rate of 14% for Martin Office Supplies.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its PV. It is calculated by discounting the future value of the investment or asset.

d.

Answer to Problem 34P

The PV of P4 discounted at 14% is $35.579.

Explanation of Solution

Calculation of the present value of the stock price calculated in part (c):

e.

To calculate: The current value of the stock of Martin Office Supplies.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

e.

Answer to Problem 34P

The current value of the stock is $45.845.

Explanation of Solution

Calculation of the current price of stock:

f.

To calculate: The current value of the stock of Martin Office Supplies.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

f.

Answer to Problem 34P

The price of the stock is the same as that computed in part (e), that is, $45.857.

Explanation of Solution

Calculation of the stock price by using formula 10-8:

g.

To calculate: The current value of the stock of Trump Office Supplies if EPS is $5.32 and the P/E ratio is 1.1, which is higher than the industry average.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

g.

Answer to Problem 34P

The current value of the stock of Trump Office Supplies is $46.816 if EPS is $5.32 and the P/E ratio is 1.1, which is higher than the industry average.

Explanation of Solution

Calculation of the price of the stock:

Working Note:

Calculation of the P/E ratio of the firm:

h.

To calculate: The difference between the stock prices calculated in parts (g) and (f) for Martin Office Supplies.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

h.

Answer to Problem 34P

The dollar difference between the stock prices in parts (g) and (f) is $0.959.

Explanation of Solution

Calculation of the difference between the stock prices in parts (g) and (f):

i.

To calculate: The effect of changing variables on the stock price if dividend increases, Ke increases, and g decreases of Martin Office Supplies.

Introduction:

Share Price:

The highest price of one share of a company that an investor is willing to pay is termed as share price. It is the current price used for the trading of such shares.

i.

Answer to Problem 34P

The price of the stock will increase in the 1st and 3rd parts, and decrease in the 2nd part.

Explanation of Solution

(1) If D1 increases, the stock price will go up. The stock price and amount of dividend are positively related to one another.

(2) If the required

(3) If the growth rate (g) increases, the price of the stock will also increase. They have a positive relationship.

Want to see more full solutions like this?

Chapter 10 Solutions

FOUND.OF FINANCIAL MANAGEMENT-ACCESS

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT