Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 25E

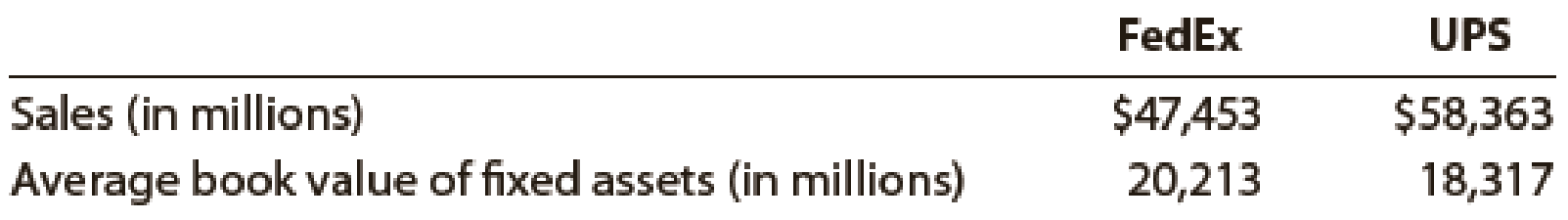

FedEx Corporation and United Parcel Service, Inc. compete in the package delivery business. The major fixed assets for each business include aircraft, sorting and handling facilities, delivery vehicles, and information technology. The sales and average book value of fixed assets reported on recent financial statements for each company were as follows:

- a. Compute the fixed asset turnover ratio for each company. Round to one decimal place.

- b. Which company appears more efficient in using fixed assets?

- c.

Interpret the meaning of the ratio for the more efficient company.

Interpret the meaning of the ratio for the more efficient company.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Joe transferred land worth $200,000, with a tax basis of $40,000, to JH Corporation, an existing entity, for 100 shares of its stock. JH Corporation has two other shareholders, Ethan and Young, each of whom holds 100 shares. With respect to the transfer:a. Joe has no recognized gain. b. JH Corporation has a basis of $160,000 in the land.c. Joe has a basis of $200,000 in his 100 shares in JH Corporation. d. Joe has a basis of $40,000 in his 100 shares in JH Corporation. e. None of the above.

I need help with this general accounting problem using proper accounting guidelines.

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Chapter 10 Solutions

Financial Accounting

Ch. 10 - ONeil Office Supplies has a fleet of automobiles...Ch. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Keyser Company purchased a machine that has a...Ch. 10 - Is it necessary for a business to use the same...Ch. 10 - a. Under what conditions is the use of the...Ch. 10 - Prob. 7DQCh. 10 - Immediately after a used truck is acquired, a new...Ch. 10 - Prob. 9DQCh. 10 - Prob. 10DQ

Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - Equipment acquired at the beginning of the year at...Ch. 10 - A truck acquired at a cost of 69,000 has an...Ch. 10 - A tractor acquired at a cost of 420,000 has an...Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - Equipment with a cost of 180,000 has an estimated...Ch. 10 - A truck with a cost of 82,000 has an estimated...Ch. 10 - On February 14, Garcia Associates Co. paid 2,300...Ch. 10 - On August 7, Green River Inflatables Co. paid...Ch. 10 - Equipment was acquired at the beginning of the...Ch. 10 - Equipment was acquired at the beginning of the...Ch. 10 - Prob. 7PEACh. 10 - Prob. 7PEBCh. 10 - On December 31, it was estimated that goodwill of...Ch. 10 - On December 31, it was estimated that goodwill of...Ch. 10 - Prob. 9PEACh. 10 - Prob. 9PEBCh. 10 - Prob. 1ECh. 10 - Prob. 2ECh. 10 - Prob. 3ECh. 10 - Tri-City Ironworks Co. reported 44,500,000 for...Ch. 10 - Convert each of the following estimates of useful...Ch. 10 - A refrigerator used by a wholesale warehouse has a...Ch. 10 - A diesel-powered tractor with a cost of 90,000 and...Ch. 10 - Prior to adjustment at the end of the year, the...Ch. 10 - A Kubota tractor acquired on January 8 at a cost...Ch. 10 - A storage tank acquired at the beginning of the...Ch. 10 - Equipment acquired at a cost of 105,000 has an...Ch. 10 - A building with a cost of 1,200,000 has an...Ch. 10 - US Freight Lines Co. incurred the following costs...Ch. 10 - Jackie Fox owns and operates Platinum Transport...Ch. 10 - Quality Move Company made the following...Ch. 10 - Willow Creek Company purchased and installed...Ch. 10 - Equipment acquired on January 8 at a cost of...Ch. 10 - Equipment acquired on January 6 at a cost of...Ch. 10 - Prob. 19ECh. 10 - Kleen Company acquired patent rights on January 10...Ch. 10 - Prob. 21ECh. 10 - List the errors you find in the following partial...Ch. 10 - Amazon.com, Inc. is the worlds leading Internet...Ch. 10 - Verizon Communications Inc. is a major...Ch. 10 - FedEx Corporation and United Parcel Service, Inc....Ch. 10 - The following table shows the sales and average...Ch. 10 - Prob. 27ECh. 10 - Prob. 28ECh. 10 - Prob. 29ECh. 10 - On October 1, Bentley Delivery Services acquired a...Ch. 10 - The following payments and receipts are related to...Ch. 10 - Dexter Industries purchased packaging equipment on...Ch. 10 - Perdue Company purchased equipment on April 1 for...Ch. 10 - New lithographic equipment, acquired at a cost of...Ch. 10 - The following transactions and adjusting entries...Ch. 10 - Prob. 6PACh. 10 - Prob. 1PBCh. 10 - Waylander Coatings Company purchased waterproofing...Ch. 10 - Layton Company purchased tool sharpening equipment...Ch. 10 - New tire retreading equipment, acquired at a cost...Ch. 10 - Prob. 5PBCh. 10 - Prob. 6PBCh. 10 - Prob. 1CPCh. 10 - Prob. 2CPCh. 10 - Godwin Co. owns three delivery trucks. Details for...Ch. 10 - The following is an excerpt from a conversation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- accounting question?arrow_forwardThree individuals form JEY Corporation with the following contributions: Joe, cash of $50,000 for 50 shares; Ethan, land worth $20,000 (basis of $11,000) for 20 shares; and Young, cattle worth $9,000 (basis of $6,000) for 9 shares and services worth $21,000 for 21 shares. a. These transfers are fully taxable and not subject to § 351. b. Young’s basis in her stock is $27,000. c. Young’s basis in her stock is $6,000. d. Ethan’s basis in his stock is $20,000. e. None of the above.arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License