Pearson Etext For Foundations Of Finance -- Combo Access Card (10th Edition)

10th Edition

ISBN: 9780135639344

Author: Arthur J. Keown, John D Martin, J. William Petty

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 23SP

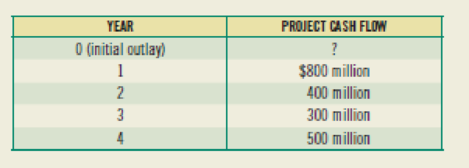

(IRR, payback, and calculating a missing cash flow) Mode Publishing is considering building a new printing facility that will involve a large initial outlay and then result in a series of positive

If you know that the project has a regular payback of 2.5 years, what is the project’s

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between a bond's coupon rate and its yield to maturity (YTM)?no AI

What is the difference between a bond's coupon rate and its yield to maturity (YTM)?

What is the difference between a bond's coupon rate and its yield to maturity (YTM)? Need help

Chapter 10 Solutions

Pearson Etext For Foundations Of Finance -- Combo Access Card (10th Edition)

Ch. 10 - Why is capital budgeting such an important...Ch. 10 - What are the disadvantages of using the payback...Ch. 10 - Prob. 4RQCh. 10 - What are mutually exclusive projects? Why might...Ch. 10 - Prob. 6RQCh. 10 - When might two mutually exclusive projects having...Ch. 10 - Prob. 1SPCh. 10 - Prob. 2SPCh. 10 - Prob. 3SPCh. 10 - Prob. 4SP

Ch. 10 - (NPV, PI, and IRR calculations) Fijisawa Inc. is...Ch. 10 - (Payback period, NPV, PI, and IRR calculations)...Ch. 10 - (NPV, PI, and IRR calculations) You are...Ch. 10 - (Payback period calculations) You are considering...Ch. 10 - (NPV with varying required rates of return)...Ch. 10 - Prob. 10SPCh. 10 - (NPV with varying required rates of return) Big...Ch. 10 - (NPV with different required rates of return)...Ch. 10 - (IRR with uneven cash flows) The Tiffin Barker...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (MIRR calculation) Calculate the MIRR given the...Ch. 10 - (PI calculation) Calculate the PI given the...Ch. 10 - (Discounted payback period) Gios Restaurants is...Ch. 10 - (Discounted payback period) You are considering a...Ch. 10 - (Discounted payback period) Assuming an...Ch. 10 - (IRR) Jella Cosmetics is considering a project...Ch. 10 - (IRR) Your investment advisor has offered you an...Ch. 10 - (IRR, payback, and calculating a missing cash...Ch. 10 - (Discounted payback period) Sheinhardt Wig Company...Ch. 10 - (IRR of uneven cash-flow stream) Microwave Oven...Ch. 10 - (MIRR) Dunder Mifflin Paper Company is considering...Ch. 10 - (MIRR calculation) Arties Wrestling Stuff is...Ch. 10 - (Capital rationing) The Cowboy Hat Company of...Ch. 10 - Prob. 29SPCh. 10 - (Size-disparity problem) The D. Dorner Farms...Ch. 10 - (Replacement chains) Destination Hotels currently...Ch. 10 - Prob. 32SPCh. 10 - Prob. 33SPCh. 10 - Why is the capital-budgeting process so important?Ch. 10 - Prob. 2MCCh. 10 - What is the payback period on each project? If...Ch. 10 - What are the criticisms of the payback period?Ch. 10 - Prob. 5MCCh. 10 - Prob. 6MCCh. 10 - Prob. 7MCCh. 10 - Prob. 8MCCh. 10 - Prob. 9MCCh. 10 - Determine the IRR for each project. Should either...Ch. 10 - How does a change in the required rate of return...Ch. 10 - Caledonia is considering two investments with...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How do you calculate the net present value (NPV) of a project, and what does it indicate? Need helparrow_forwardHow do you calculate the net present value (NPV) of a project, and what does it indicate?arrow_forwardHow do you calculate the internal rate of return (IRR) for an investment, and what does it represent?helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License