Concept explainers

MACRS stands for modified accelerated cost recovery system. Life of the asset will be classified as per the internal revenue code.

Three years MACRS rates, Year 1: 33.33%, Year 2: 44.45%, Year 3: 14.81% and Year 4: 7.41%.

CWC bought machine that is expected to generate $25,000 in operating income before

Explanation of Solution

a.

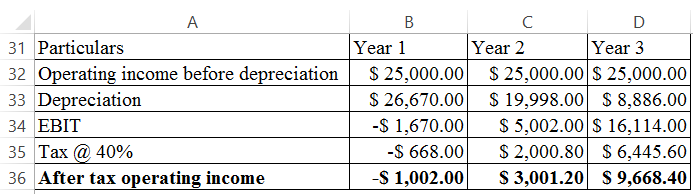

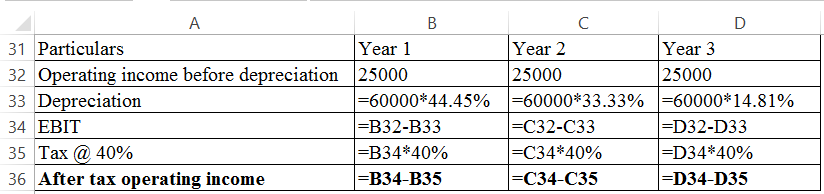

Calculate the after tax operating income as follows:

Formulas:

b.

Calculate the operating cash flows for year 1 as follows:

Therefore, the operating cash flows in year 1 is

Calculate the operating cash flows for year 2 as follows:

Therefore, the operating cash flows in year 2 is

Want to see more full solutions like this?

- What is corporate finance? how many types of corporate finance??arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2,350,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $3,310,000 in annual sales, with costs of $2,330,000. Assume the tax rate is 23 percent and the required return on the project is 11 percent. What is the project's NPV? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardGyygvvv iiiedfarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT