Concept explainers

1)

Record the given transactions.

1)

Explanation of Solution

Record the given transactions:

| Date | Account title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 2, 2021 | Cash | 40,000 | ||

| Common stock | 2,000 | |||

| Additional paid-in-capital (balance) | 38,000 | |||

| (To record the issue of common stock) | ||||

| January 9, 2021 | 14,300 | |||

| Service revenue | 14,300 | |||

| (To record service revenue on account ) | ||||

| January 10, 2021 | Supplies | 4,900 | ||

| Accounts payable | 4,900 | |||

| (To record supplies on account) | ||||

| January 12, 2021 | 18,000 | |||

| Cash | 18,000 | |||

| (To record purchase of treasury stock ) | ||||

| January 15, 2021 | Accounts payable | 16,500 | ||

| Cash | 16,500 | |||

| (To record payment of cash on account ) | ||||

| January 21, 2021 | Cash | 49,100 | ||

| Service revenue | 49,100 | |||

| (To record service for cash) | ||||

| January 22, 2021 | Cash | 16,600 | ||

| Accounts receivable | 16,600 | |||

| (To record receipt of cash on account) | ||||

| January 29, 2021 | Dividends | 3,300 | ||

| Dividends payable | 3,300 | |||

| (To record declaration of dividend) | ||||

| January 30, 2021 | Cash | 12,000 | ||

| Treasury stock | 10,800 | |||

| Additional paid-in capital | 1,200 | |||

| (To record resale of treasury stock) | ||||

| January 31, 2021 | Salaries expense | 42,000 | ||

| Cash | 42,000 | |||

| (To record the payment of monthly salaries) |

Table (1)

2)

Record the given

2)

Explanation of Solution

Record the given adjustment entries:

| Date | Account title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2021 | Utilities expenses | 6,200 | ||

| Utilities payable | 6,200 | |||

| (To record utilities adjustments) | ||||

| January 31, 2021 | Supplies expenses | 7,300 | ||

| Supplies | 7,300 | |||

| (To record supplies adjustments) | ||||

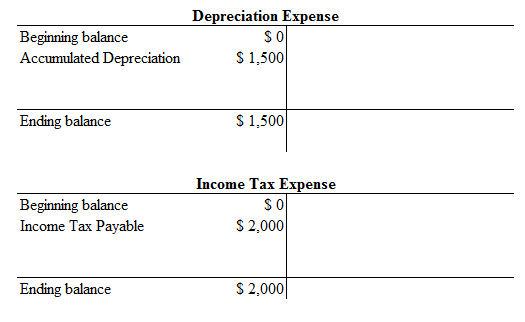

| January 31, 2021 | 1,500 | |||

| 1,500 | ||||

| (To record depreciation for January) | ||||

| January 31, 2021 | Income tax expense | 2,000 | ||

| Income tax payable | 2,000 | |||

| (To record the adjustment for income taxes) |

Table (2)

3)

Prepare the adjusted

3)

Explanation of Solution

Adjusted trial balance: Adjusted trial balance is that statement which contains complete list of accounts with their adjusted balances, after all relevant adjustments have been made. This statement is prepared at the end of every financial period.

Prepare the adjusted trial balance as of January 31, 2021:

| GF Fireworks | ||

| Adjusted Trial balance | ||

| January 31, 2021 | ||

| Accounts |

Debit ($) | Credit ($) |

| Cash | $83,900 | |

| Accounts Receivable | 42,200 | |

| Supplies | 5,100 | |

| Equipment | 64,000 | |

| Accumulated Depreciation | $10,500 | |

| Accounts Payable | 3,000 | |

| Utilities Payable | 6,200 | |

| Dividends Payable | 3,300 | |

| Income Tax Payable | 2,000 | |

| Common Stock | 12,000 | |

| Additional Paid-in Capital | 119,200 | |

| 45,100 | ||

| Dividends | 3,300 | |

| Treasury Stock | 7,200 | |

| Service Revenue | 63,400 | |

| Salaries Expense | 42,000 | |

| Utilities Expense | 6,200 | |

| Supplies Expense | 7,300 | |

| Depreciation Expense | 1,500 | |

| Income Tax Expense | 2,000 | |

| Totals | $264,700 | $264,700 |

Table (3)

Working note:

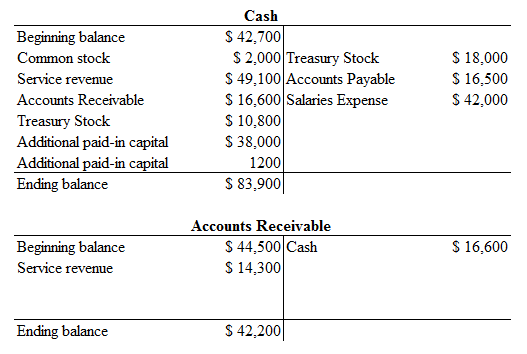

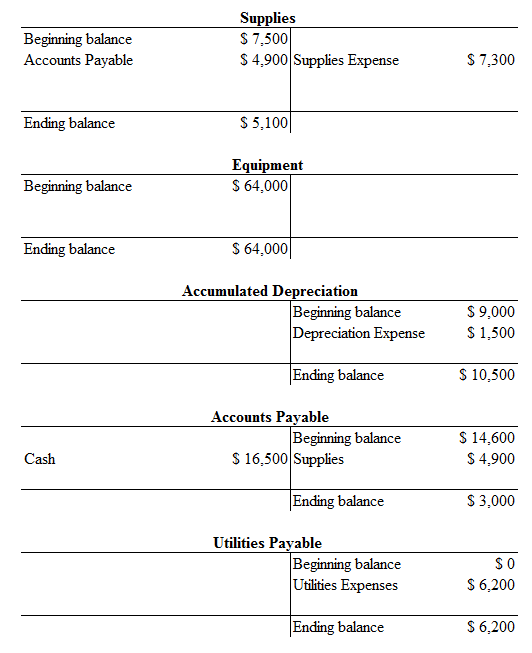

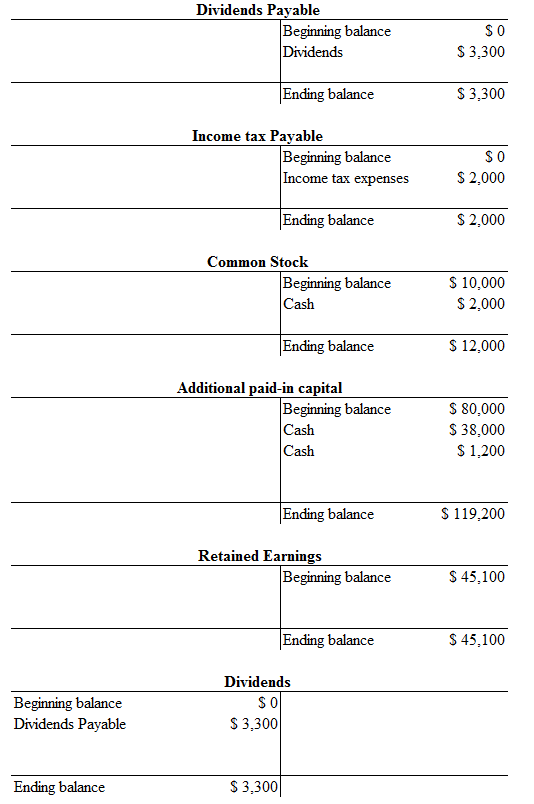

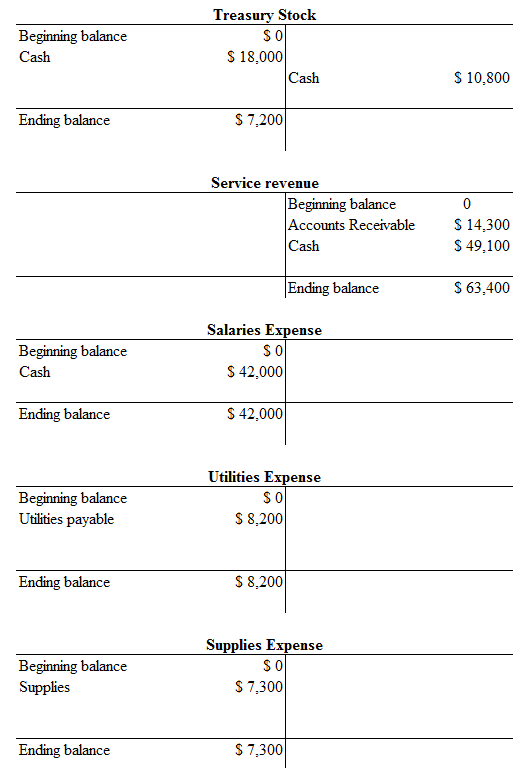

Prepare the T-accounts for ending balances:

4)

Prepare an income statement for the period ended January 31, 2021.

4)

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the period ended January 31, 2021:

| GF Fireworks | ||

| Income statement | ||

| For the month ended January 31, 2021 | ||

| Particulars | Amount ($) | Amount ($) |

| Service revenue | $63,400 | |

| Salaries expense | (42,000) | |

| Utilities expense | (6,200) | |

| Supplies expense | (7,300) | |

| Depreciation expense | (1,500) | 57,000 |

| Income before taxes | 6,400 | |

| Income tax expense | 2,000 | |

| Net income | $ 4,400 | |

Table (5)

Therefore, net income for the month of January is $4,400.

5)

Prepare a classified

5)

Explanation of Solution

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare a classified balance sheet as of January 31, 2021:

| GF Fireworks | |||

| Classified balance sheet | |||

| As on January 31, 2021 | |||

| Assets | Liabilities and stockholders’ equity | ||

| Particulars |

Amount ($) | Particulars | Amount ($) |

| Current assets: | Liabilities | ||

| Cash | $ 83,900 | Accounts payable | $3,000 |

| Accounts receivable | 42,200 | Utilities payable | 6,200 |

| Supplies | 5,100 | Dividends payable | 3,300 |

| Total current assets | 131,200 | Income tax payable | 2,000 |

| Total current liabilities | 14,500 | ||

| Long term assets: | Stockholders’ Equity | ||

| Equipment | 64,000 | Common stock | 12,000 |

| Less: Accumulated Depreciation | (10,500) | Additional paid-in capital | 119,200 |

| Equipment , net | $54,500 | Retained earnings (1) | 46,200 |

| Treasury stock | (7,200) | ||

| Total stockholders’ equity | 170,200 | ||

| Total assets | $184,700 | Total liabilities and stockholders’ equity | $184,700 |

Table (6)

Working note:

Compute the ending balance of retained earnings:

6)

Prepare the closing entries.

6)

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the closing entries:

| Date | Account title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2021 | Service revenue | 63,400 | ||

| Retained earnings | 63,400 | |||

| (To record closing entries) | ||||

| January 31, 2021 | Retained earnings | 59,000 | ||

| Salaries expense | 42,000 | |||

| Utilities expense | 6,200 | |||

| Supplies expense | 7,300 | |||

| Depreciation expense | 1,500 | |||

| Income tax expense | 2,000 | |||

| (To record the closing entries) | ||||

| January 31, 2021 | Retained earnings | 3,300 | ||

| Dividends | 3,300 | |||

| (To record the closing entries) |

Table (7)

7a)

Calculate the return on equity for the month of January. Compare it with the industry average of 2.5% and state whether the company more or less profitable than other companies in the same industry.

7a)

Explanation of Solution

Return on equity ratio: Rate of return on equity ratio is used to determine the relationship between the net income available for the common stockholders’ and the average common equity that is invested in the company.

Calculate the return on equity in 2021:

Given, the net income is $4,400 and beginning and ending stockholder’ equity are 135,100 and 170,200 respectively.

Therefore, return on equity in January 2021 is 2.9%.

The industry average is 2.5%.

Therefore the company’s return on equity (2.9%) is more profitable than other companies in the same industry.

7b)

Identify the common stock outstanding as on January 31, 2021.

7b)

Explanation of Solution

Outstanding stock: The total number of shares that are authorized and issued by a public company, and are held by the stockholders or investors are referred to as outstanding stock.

Identify the common stock outstanding as on January 31, 2021:

| Particulars | Shares |

| Common shares outstanding at beginning of January | 10,000 |

| Add: Shares issued during January | 2,000 |

| Less: Treasury stock | (1,000) |

| Add: Resell of treasury stock | 600 |

| Common stock outstanding as on January 31, 2021 | 11,600 |

Table (8)

The common stock outstanding as on January 31, 2021 is 11,600.

7c)

Calculate earnings per share for the month of January.

7c)

Explanation of Solution

Earnings per share: Earnings per share help to measure the profitability of a company. Earnings per share are the amount of profit that is allocated to each share of outstanding stock.

Calculate the projected earnings per share for 2021 before purchase of stock.

Given, net income is $4,400 and shares outstanding at the beginning and ending 10,000 and 11,600 respectively.

Therefore, earnings’ per share January in 2021 is $0.41.

Want to see more full solutions like this?

Chapter 10 Solutions

Financial Accounting

- The stockholders' equity at the beginning of the period was $212,000; at the end of the period, assets were $305,000 and liabilities were $70,000. If the owner made no additional investments or paid no dividends during the period, did the business incur a net income or a net loss for the period, and how much?arrow_forwardWhat is the total market value of the firm's equity?arrow_forwardHello tutor please provide correct answer general accounting question with correct solution do fastarrow_forward

- Pension plan assets were $2,300 million at the beginning of the year and $2,560 million at the end of the year. At the end of the year, retiree benefits paid by the trustee were $60 million and cash invested in the pension fund was $65 million. What was the percentage rate of return on plan assets?arrow_forwardSanchez Manufacturing produces lawn mowers that sell for $175. Each lawn mower uses $32 in direct materials and $18 in direct labor per unit. Sanchez has two activities: Assembly, which is applied at the rate of $8 per assembly hour, and Testing, which is applied at the rate of $34 per batch. This month, Sanchez made 245 lawn mowers, using 980 assembly hours in 49 batches. What is the total manufacturing cost for one lawn mower?arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- The per-unit manufacturing cost under absorption costing is _________.arrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forwardTabitha is the stockholder and operator of Optimum Minds LLC, a business coaching firm. At the end of its accounting period, December 31, 2017, Optimum Minds has assets of $810,000 and liabilities of $195,000. Using the accounting equation, determine the following amounts: a. Stockholders' equity as of December 31, 2017. b. Stockholders' equity as of December 31, 2018, assuming that assets increased by $98,000 and liabilities decreased by $42,000 during 2018.arrow_forward

- In a certain standard costing system, the following results occurred last period: total labor variance, 3200 F; labor efficiency variance, 4,300 F; and the actual labor rate was $0.35 more per hour than the standard labor rate. The number of direct labor hours used last period was __.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardSolve this financial accounting problemarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education