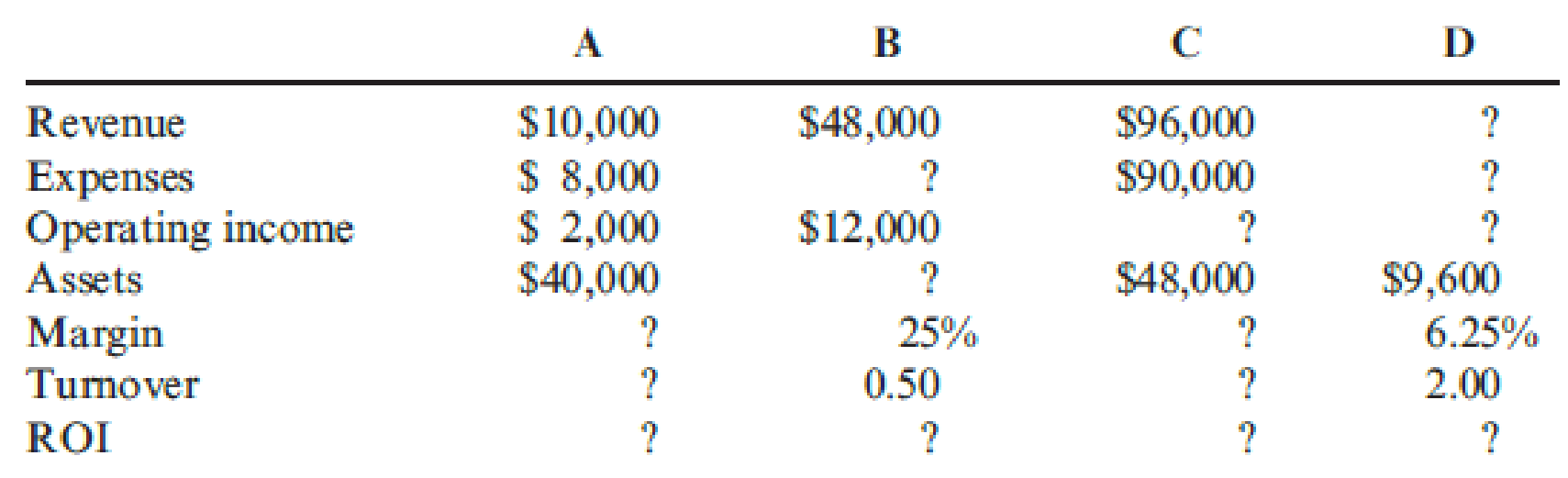

Consider the data for each of the following four independent companies:

Required:

- 1. Calculate the missing values in the above table. (Round rates to four significant digits.)

- 2. Assume that the cost of capital is 9 percent for each of the four firms. Compute the residual income for each of the four firms.

1.

Calculate the missing amounts in the given table.

Explanation of Solution

Margin: It is an amount income generated by a dollar of sales. It is calculated as follows:

Turnover: It is an amount of sales generate by average operating assets. It is calculated by dividing the sales by the average operating assets in the assets, required to generate those sales.

Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions or a companies.

Calculate the missing amounts in the given table:

| Particulars | A | B | C | D | ||||

| Revenue | $10,000 | $48,000 | $96,000 | $19,200 | k | |||

| Expenses | $8,000 | $36,000 | d | $90,000 | $18,000 | l | ||

| Operating income | $2,000 | $12,000 | $6,000 | g | $1,200 | m | ||

| Assets | $40,000 | $96,000 | e | $48,000 | $9,600 | |||

| Margin | 20% | a | 25% | 6.25% | h | 6.25% | ||

| Turnover | 0.25 | b | 0.50 | 2.00 | i | 2.00 | ||

| ROI | 5.00% | c | 12.5% | f | 12.50% | j | 12.50% | n |

Table (1)

Notes to the above table:

a) Calculate margin for A:

b) Calculate the turnover for A:

c) Calculate the ROI for A:

d) Calculate the expenses for B:

e) Calculate the assets for B:

f) Calculate the ROI for B:

g) Calculate the operating income for C:

h) Calculate margin for C:

i) Calculate the turnover for C:

j) Calculate the ROI for C:

k) Calculate the Revenue for D:

m) Compute the Operating income for D:

l) Compute the expenses for D:

n) Compute the ROI for D:

2.

Calculate the residual income for each of the four firms.

Explanation of Solution

Residual income: It is an amount by which an operating income (earnings) exceeds a minimum acceptable return on the average capital invested.

Residual income for Firm A:

Therefore, residual income of Firm A is ($1,600).

Residual income for Firm B:

Therefore, residual income of Firm B is $3,360.

Residual income for Firm C:

Therefore, residual income of Firm C is $1,680.

Residual income for Firm D:

Therefore, residual income of Firm D is $336.

Want to see more full solutions like this?

Chapter 10 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- ???!!arrow_forwardA logistics company processes and ships online orders for its clients. The company uses a predetermined variable overhead rate based on direct labor hours. • Each order requires 0.05 direct labor hours • Variable overhead rate: $6.50 per direct labor hour • Total orders shipped in August: 200,000 . Total actual direct labor hours used: 10,200 • Total variable overhead costs incurred: $65,200 What is the variable overhead efficiency variance for August?arrow_forwardWhat is the correct option? General accounting questionarrow_forward

- Solve this Accounting Problemarrow_forwardAnderson Corp. pays its employees every Friday for work performed through that Friday. Anderson employees work Monday through Friday and do not work on weekends. The gross payroll for Anderson is $12,500 each week. Anderson will pay its employees $12,500 on Friday, May 8th. This payroll is for wages earned Monday, May 4th through Friday, May 8th. How much of the $12,500 paid on May 8th should be expensed in May?arrow_forwardRichardson Industries has budgeted total factory overhead for the year at $710,000, divided into two departments: Cutting ($500,000) and Finishing ($210,000). Richardson manufactures two products: dining tables and chairs. Each dining table requires 4 direct labor hours in Cutting and 2 direct labor hours in Finishing. Each chair requires 3 direct labor hours in Cutting and 4 direct labor hours in Finishing. Each product is budgeted for 3,500 units of production for the year. Determine the total number of budgeted direct labor hours for the year in the Finishing Department.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub