Concept explainers

PROBLEM 10-15 Comprehensive

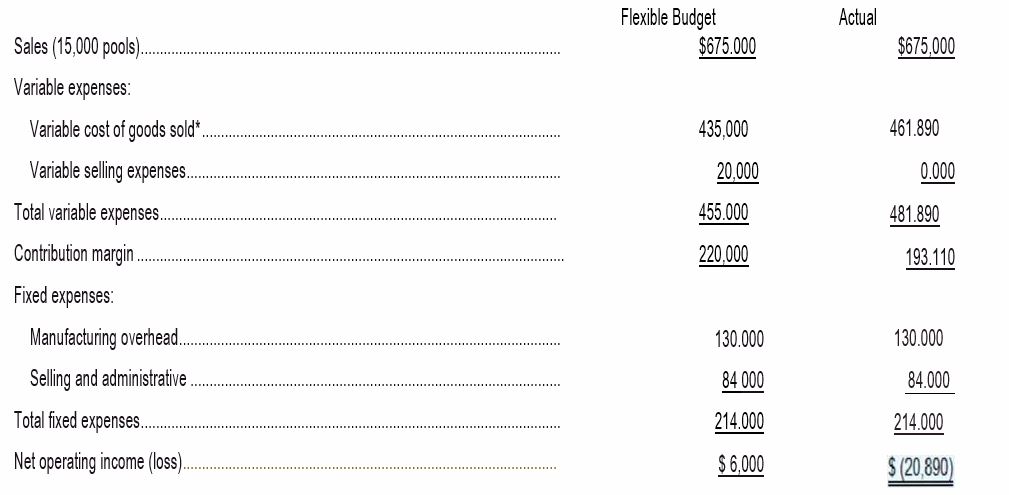

Miller Toy Company manufactures a plastic swimming pool at its Westwood Plant. The plant has been experiencing problems as shown by its June contribution format income statement below:

Flexible Budget

Actual

‘Contains direct materials, direct labor, and variable manufacturing

Janet Dunn, who has just been appointed general manager of the Westwood Plant, has been given instructions to “get things under control? Upon reviewing the plant’s income statement, Ms. Dunn has concluded that the major problem lies in the variable cost of goods sold. She has been provided with the following

| Standard Quantity or Hours | Standard Price or Rate | Standard Cost | |

| Direct materials | 3.0 pounds |

$5.00 per pound | $15.00 |

| Direct labor | 0.8 hours |

$16.00 per hour | 12.80 |

| Variable manufacturing overhead | 0.4 hours' |

$3.00 per hour | 1.20 |

| Total standard cost per unit | $29.00 |

'Based on machine-hours.

During June the plant produced 15:000 pools and incurred the following costs:

- Purchased 60:000 pounds of materials at a cost of $4.95 per pound.

- Used 49,200 pounds of materials in production. (Finished goods and work in process inventories are insignificant and can be ignored.)

- Worked 11,800 direct labor-hours at a cost of SI7.00 per hour.

- Incurred variable

manufacturing overhead cost totaling S18,290 for the month. A total of 5,900 machine-hours was recorded. It is the company’s policy to close all variances to cost of goods sold on a monthly basis.

Required:

- Compute the following variances for June: a Materials price and quantitv variances.

- Labor rate and efficiency variances.

- Variable overhead rate and efficiency variances.

- Summarize the variances that you computed in (1) above by showing the net overall fas orable or unfavorable variance for the month. What impact did this figure have on the company’s income statement9 Show computations.

- Pick out the two most significant variances that you computed in (1) above. Explain to Ms. Dunn possible causes of these variances.

Trending nowThis is a popular solution!

Chapter 10 Solutions

GEN COMBO LL MANAGERIAL ACCOUNTING; CONNECT ACCESS CARD

- No AI The principle that requires companies to record expenses in the same period as the revenues they help generate is the:A. Revenue Recognition PrincipleB. Consistency PrincipleC. Matching PrincipleD. Cost Principlearrow_forwardThe principle that requires companies to record expenses in the same period as the revenues they help generate is the:A. Revenue Recognition PrincipleB. Consistency PrincipleC. Matching PrincipleD. Cost Principlearrow_forwardNo ai 14. A company receives a bill for electricity to be paid next month. What is the journal entry today?A. Debit Utilities Expense; Credit Accounts PayableB. Debit Cash; Credit Utilities ExpenseC. Debit Accounts Payable; Credit Utilities ExpenseD. No entry until payment is madearrow_forward

- 14. A company receives a bill for electricity to be paid next month. What is the journal entry today?A. Debit Utilities Expense; Credit Accounts PayableB. Debit Cash; Credit Utilities ExpenseC. Debit Accounts Payable; Credit Utilities ExpenseD. No entry until payment is made i need helparrow_forward14. A company receives a bill for electricity to be paid next month. What is the journal entry today?A. Debit Utilities Expense; Credit Accounts PayableB. Debit Cash; Credit Utilities ExpenseC. Debit Accounts Payable; Credit Utilities ExpenseD. No entry until payment is made helparrow_forwardeBook Operating income for profit center Show Me How The centralized Data Analytics Department of Drewlink Company has expenses of $340,000. The department has provided a total of 8,000 hours of service for the period. The Retail Division has used 2,000 hours of data analytics service during the period, and the Commercial Division has used 6,000 hours of data analytics service. Additional data for the two divisions is following below: Retail Division Commercial Division Sales Cost of goods sold $2,550,000 1,450,000 Selling expenses 230,000 $1,700,000 750,000 170,000 Determine the divisional operating income for the Retail Division and the Commercial Division. Do not round interim calculations. Drewlink Company Divisional Operating income Line Item Description Sales Cost of goods sold Selling expenses Support department allocations Operating income Retail Division Commercial Division 2,550,000 1,450,000 $ 1,700,000 750,000 10000 785,000 525,000 Check My Work 1 more Check My Work uses…arrow_forward

- 14. A company receives a bill for electricity to be paid next month. What is the journal entry today?A. Debit Utilities Expense; Credit Accounts PayableB. Debit Cash; Credit Utilities ExpenseC. Debit Accounts Payable; Credit Utilities ExpenseD. No entry until payment is madearrow_forwardWhat type of account is accumulated depreciation?A. AssetB. Contra-assetC. ExpenseD. Liability help!!arrow_forwardWhat type of account is accumulated depreciation?A. AssetB. Contra-assetC. ExpenseD. Liabilityneed helparrow_forward

- What type of account is accumulated depreciation?A. AssetB. Contra-assetC. ExpenseD. Liabilityarrow_forwardWhat type of account is accumulated depreciation?A. AssetB. Contra-assetC. ExpenseD. Liabilityarrow_forwardWhich of the following accounts normally has a credit balance?A. Accounts ReceivableB. Sales RevenueC. EquipmentD. Rent Expense no aiarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning