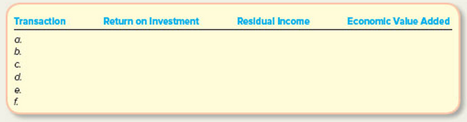

Determining the Impact of Various Transactions on Investment Turnover, ROI, Residual Income, and Profit Margin

Poseidon Corporation manufactures a variety of gear for water sports. Poseidon has three divisions: Lake, River, and Ocean. Each division is managed as an investment center. During the current year, the Ocean division experienced the following transactions:

a. A special order was accepted at a selling price significantly less than the ordinary selling price. The sale will not impact other sales because this was a one-time order and Ocean has excess capacity. The selling price was in excess of total variable costs.

b. One of three production managers in the Ocean Division submitted his resignation. The position will not be filled due to current efficiencies experienced in the production department.

c. Due to the popularity of open-ocean swimming during the Olympics, the company experienced a surge in sales during the summer months. Sales returned to their normal level for the remainder of the year.

d. Equipment costing $500,000 was purchased to replace fully depreciated, obsolete equipment.

e. The company’s after-tax cost of capital increased from 8 percent to 10 percent, with no effect on the minimum required

f. The company’s effective tax rate decreased from 35 percent to 30 percent.

Required:

For each transaction listed in this exercise, determine the impact on investment turnover,

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting

- If Carter Enterprises has $218,600 of total liabilities and $293,400 of stockholders' equity, what is the value of its total assets? Need helparrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forwardWhat was michael johnson's beginning capital balance?arrow_forward

- Abbott Manufacturing produces a single product. Variable production costs are $18.2 per unit, and variable selling and administrative expenses are $4.5 per unit. Fixed manufacturing overhead totals $72,000, and fixed selling and administration expenses total $48,000. Assuming a beginning inventory of zero, production of 7,500 units, and sales of 5,800 units, the dollar value of the ending inventory under variable costing would be_.arrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forwardAltair Industries has variable costs equal to 40% of sales. The company is considering a proposal that will increase sales by $45,000 and total fixed costs by $22,500. By what amount will net income increase?arrow_forward

- Can you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardMichael Johnson's capital statement shows that his drawings during the year were $35,000. He made an additional capital investment of $25,000, and his share of the net income for the year was $18,000. His ending capital balance was $240,000. What was Michael Johnson's beginning capital balance? a. $232,000 b. $278,000 c. $258,000 d. $268,000arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,