INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

9th Edition

ISBN: 9781260216141

Author: SPICELAND

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 10.9BE

Fixed-asset turnover ratio

• LO10–5

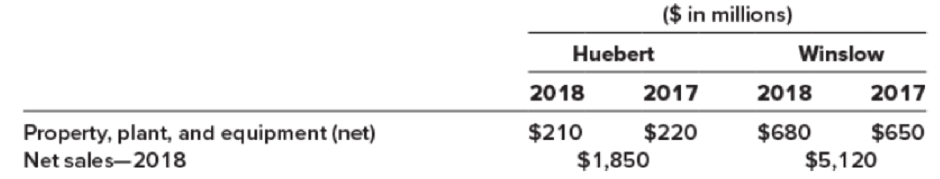

Huebert Corporation and Winslow Corporation reported the following information:

Calculate each companies fixes-asset turnover ratio and determine which company utilizes its fixed assets most efficiently to generate sales.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

No AI

Which of the following is not a current asset?A. Accounts ReceivableB. Prepaid RentC. BuildingD. Inventory

What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividend

Which account is not closed at the end of the accounting period?A. RevenueB. ExpenseC. DividendsD. Supplies

Chapter 10 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

Ch. 10 - Prob. 10.1QCh. 10 - Prob. 10.2QCh. 10 - Prob. 10.3QCh. 10 - Prob. 10.4QCh. 10 - Prob. 10.5QCh. 10 - Prob. 10.6QCh. 10 - When an asset is acquired and a note payable is...Ch. 10 - Explain how assets acquired in exchange for equity...Ch. 10 - Prob. 10.9QCh. 10 - What account is credited when a company receives...

Ch. 10 - Prob. 10.11QCh. 10 - Identify the two exceptions to valuing property,...Ch. 10 - In what situations is interest capitalized?Ch. 10 - Define average accumulated expenditures and...Ch. 10 - Explain the difference between the specific...Ch. 10 - Prob. 10.16QCh. 10 - Prob. 10.17QCh. 10 - Explain the accounting treatment of costs incurred...Ch. 10 - Explain the difference in the accounting treatment...Ch. 10 - Prob. 10.20QCh. 10 - Prob. 10.21QCh. 10 - Prob. 10.22QCh. 10 - Prob. 10.23QCh. 10 - Acquisition cost; machine LO101 Beavert on Lumber...Ch. 10 - Prob. 10.2BECh. 10 - Prob. 10.3BECh. 10 - Cost of a natural resource; asset retirement...Ch. 10 - Asset retirement obligation LO101 Refer to the...Ch. 10 - Prob. 10.6BECh. 10 - Acquisition cost; noninterest-bearing note LO103...Ch. 10 - Prob. 10.8BECh. 10 - Fixed-asset turnover ratio LO105 Huebert...Ch. 10 - Fixed-asset turnover ratio; solve for unknown ...Ch. 10 - Prob. 10.11BECh. 10 - Nonmonetary exchange LO106 Refer to the situation...Ch. 10 - Nonmonetary exchange LO106 Refer to the situation...Ch. 10 - Prob. 10.14BECh. 10 - Prob. 10.15BECh. 10 - Research and development LO108 Maxtor Technology...Ch. 10 - Prob. 10.17BECh. 10 - Research and development; various types LO108...Ch. 10 - Prob. 10.19BECh. 10 - Acquisition costs; land and building LO101 On...Ch. 10 - Acquisition cost; equipment LO101 Oaktree Company...Ch. 10 - Prob. 10.3ECh. 10 - Cost of a natural resource; asset retirement...Ch. 10 - Intangibles LO101 In 2018, Bratten Fitness...Ch. 10 - Goodwill LO101 On March 31, 2018, Wolfson...Ch. 10 - Prob. 10.7ECh. 10 - Prob. 10.8ECh. 10 - Prob. 10.9ECh. 10 - Acquisition costs; noninterest-bearing note ...Ch. 10 - Prob. 10.11ECh. 10 - Prob. 10.12ECh. 10 - Prob. 10.13ECh. 10 - Prob. 10.14ECh. 10 - Nonmonetary exchange LO106 [This is a variation...Ch. 10 - Prob. 10.16ECh. 10 - Nonmonetary exchange LO106 [This is a variation...Ch. 10 - Prob. 10.18ECh. 10 - Prob. 10.19ECh. 10 - Prob. 10.20ECh. 10 - FASB codification research LO101, LO106, LO107,...Ch. 10 - Prob. 10.22ECh. 10 - Interest capitalization LO107 On January 1, 2018,...Ch. 10 - Interest capitalization LO107 On January 1, 2018,...Ch. 10 - Interest capitalization; multiple periods LO107...Ch. 10 - Research and development LO108 In 2018, Space...Ch. 10 - Prob. 10.27ECh. 10 - IFRS; research and development LO108, LO109...Ch. 10 - IFRS; research and development LO109 IFRS NXS...Ch. 10 - Prob. 10.30ECh. 10 - Software development costs LO108 Early in 2018,...Ch. 10 - Prob. 10.32ECh. 10 - Intangibles; start-up costs LO101, LO108 Freitas...Ch. 10 - Prob. 10.34ECh. 10 - Prob. 10.1PCh. 10 - Prob. 10.2PCh. 10 - Prob. 10.3PCh. 10 - Prob. 10.4PCh. 10 - Acquisition costs; journal entries LO101, LO103,...Ch. 10 - Prob. 10.6PCh. 10 - Nonmonetary exchange LO106 On September 3, 2018,...Ch. 10 - Prob. 10.8PCh. 10 - Interest capitalization; specific interest method ...Ch. 10 - Prob. 10.10PCh. 10 - Research and development LO108 In 2018,...Ch. 10 - Prob. 10.12PCh. 10 - Judgment Case 101 Acquisition costs LO101, LO103,...Ch. 10 - Research Case 102 FASB codification; locate and...Ch. 10 - Judgment Case 103 Self-constructed assets LO107...Ch. 10 - Judgment Case 104 Interest capitalization LO107...Ch. 10 - Prob. 10.6BYPCh. 10 - Prob. 10.7BYPCh. 10 - Judgment Case 108 Research and development LO108...Ch. 10 - Prob. 10.9BYPCh. 10 - Prob. 10.11BYPCh. 10 - Ethics Case 1012 Research and development LO108...Ch. 10 - Prob. 10.13BYPCh. 10 - Prob. 10.14BYPCh. 10 - Prob. 10.15BYPCh. 10 - Prob. 10.16BYPCh. 10 - Continuing Cases Target Case LO101, LO105 Target...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4. A purchase of equipment for cash will:A. Increase assetsB. Decrease total assetsC. Have no effect on assetsD. Increase liabilitiesarrow_forwardWhen a company collects cash from a customer in advance, it should:A. Recognize revenue immediatelyB. Record a liabilityC. Record it as equityD. Ignore it until revenue is earnedarrow_forwardThe journal entry to record the purchase of office supplies on account would include:A. Debit Supplies, Credit CashB. Debit Supplies, Credit Accounts PayableC. Debit Cash, Credit SuppliesD. Debit Accounts Payable, Credit Suppliesarrow_forward

- 7. Which of the following is an adjusting entry?A. Payment of salariesB. Depreciation expenseC. Purchase of suppliesD. Payment of rent in advancearrow_forward5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forward6. Which of the following transactions decreases stockholders' equity?A. Issuing sharesB. Paying dividendsC. Earning net incomeD. Receiving customer paymentsarrow_forward

- Accounting?arrow_forward9. If a company fails to adjust for accrued interest expense, what is the effect on the financial statements?A. Assets overstatedB. Liabilities understatedC. Revenues understatedD. Equity overstated need helllparrow_forward9. If a company fails to adjust for accrued interest expense, what is the effect on the financial statements?A. Assets overstatedB. Liabilities understatedC. Revenues understatedD. Equity overstatedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License