Bundle: Accounting, Loose-Leaf Version, 26th + LMS Integrated for CengageNOW, 2 terms Printed Access Card

26th Edition

ISBN: 9781305715967

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 10.5CP

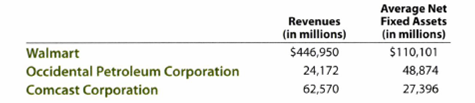

Fixed asset turnover: three industries

The following table shows the revenues and average net fixed assets for a recent fiscal year for three different companies from three different industries: retailing, manufacturing, and communications.

a. For each company, determine the fixed asset turnover ratio. Round to two decimal places.

b. Explain Walmart’s ratio relative to the other two companies.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

None

I need help with this general accounting question using standard accounting techniques.

None

Chapter 10 Solutions

Bundle: Accounting, Loose-Leaf Version, 26th + LMS Integrated for CengageNOW, 2 terms Printed Access Card

Ch. 10 - ONeil Office Supplies has a fleet of automobiles...Ch. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Prob. 4DQCh. 10 - Immediately after a used truck is acquired, a new...Ch. 10 - Keyser Company purchased a machine that has a...Ch. 10 - Is it necessary for a business to use the same...Ch. 10 - Prob. 8DQCh. 10 - For some of the fixed assets of a business, the...Ch. 10 - a. Over what period of time should the cost of a...

Ch. 10 - Straight-line depreciation A building acquired at...Ch. 10 - Straight-line depreciation Equipment acquired at...Ch. 10 - Units-of-activity depreciation A truck acquired at...Ch. 10 - Units-of-activity depreciation A tractor acquired...Ch. 10 - Double declining-balance depreciation A building...Ch. 10 - Double-declining-balance depreciation Equipment...Ch. 10 - Revision of depreciation Equipment with a cost of...Ch. 10 - Revision of depreciation A truck with a cost of...Ch. 10 - Capital and revenue expenditures On February 14,...Ch. 10 - Capital and revenue expenditures On August 7,...Ch. 10 - Sale of equipment Equipment was acquired at the...Ch. 10 - Sale of equipment Equipment was acquired at the...Ch. 10 - Prob. 10.7BPECh. 10 - Prob. 10.7APECh. 10 - Prob. 10.8BPECh. 10 - Prob. 10.8APECh. 10 - Prob. 10.9APECh. 10 - Prob. 10.9BPECh. 10 - Costs of acquiring fixed assets Melinda Stoffers...Ch. 10 - Prob. 10.2EXCh. 10 - Determining cost of land Northwest Delivery...Ch. 10 - Prob. 10.4EXCh. 10 - Prob. 10.5EXCh. 10 - Capital and revenue expenditures Quality Move...Ch. 10 - Nature of depreciation Tri-City Ironworks Co....Ch. 10 - Prob. 10.8EXCh. 10 - Prob. 10.9EXCh. 10 - Prob. 10.10EXCh. 10 - Depreciation by units-of-output method Prior to...Ch. 10 - Depreciation by two methods A John Deere tractor...Ch. 10 - Depreciation by two methods A storage tank...Ch. 10 - Partial-year depreciation Sandblasting equipment...Ch. 10 - Revision of depreciation A building with a cost of...Ch. 10 - Capital expenditure and depreciation; parital-year...Ch. 10 - Entries for sale of fixed asset Equipment acquired...Ch. 10 - Prob. 10.18EXCh. 10 - Depletion entries Big Sky Mining Co. acquired...Ch. 10 - Prob. 10.20EXCh. 10 - Book value of fixed assets Apple Inc. designs,...Ch. 10 - Balance sheet presentation List the errors you...Ch. 10 - Prob. 10.24EXCh. 10 - Prob. 10.23EXCh. 10 - Asset traded for similar asset A printing press...Ch. 10 - Prob. 10.26EXCh. 10 - Entries for trade of fixed asset On July 1, Twin...Ch. 10 - Entries for trade of fixed asset On October 1,...Ch. 10 - Allocating payments and receipts to fixed asset...Ch. 10 - Comparing three depreciation methods Montes Coffee...Ch. 10 - Depreciation by three methods; partial years...Ch. 10 - Prob. 10.4APRCh. 10 - Transactions for fixed assets, including sale The...Ch. 10 - Amortization and depletion entries Data related to...Ch. 10 - Allocating payments and receipts to fixed asset...Ch. 10 - Comparing three depreciation methods Waylander...Ch. 10 - Depreciation by three methods; partial years...Ch. 10 - Depreciation by two methods; sale of fixed asset...Ch. 10 - Transactions for fixed assets, including sale The...Ch. 10 - Amortization and depletion entries Data related to...Ch. 10 - Prob. 10.1CPCh. 10 - Prob. 10.2CPCh. 10 - Effect of depreciation on net income Tuttle...Ch. 10 - Fixed asset turnover: three industries The...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License