Accounting

27th Edition

ISBN: 9781337272094

Author: WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 10.5CP

Communication

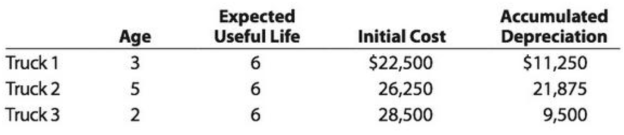

Godwin Co. owns three delivery trucks. Details for each truck at the end of the most recent year follow:

• At the beginning of the year, a hydraulic lift is added to Truck 1 at a cost of $4,500. The addition of the hydraulic lift will allow the company to deliver much larger objects than could previously be delivered.

• At the beginning of the year, the engine of Truck 2 is overhauled at a cost of $5,000. The engine overhaul will extend the truck’s useful life by three years.

Write a short memo to Godwin’s chief financial officer explaining the financial statement effects of the expenditures associated with Trucks 1 and 2.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

HELP ?

Can you solve this financial accounting problem with appropriate steps and explanations?

None

Chapter 10 Solutions

Accounting

Ch. 10 - ONeil Office Supplies has a fleet of automobiles...Ch. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Keyser Company purchased a machine that has a...Ch. 10 - Is it necessary for a business to use the same...Ch. 10 - a. Under what conditions is the use of the...Ch. 10 - Prob. 7DQCh. 10 - Immediately after a used truck is acquired, a new...Ch. 10 - For some of the fixed assets of a business, the...Ch. 10 - a. Over what period of time should the cost of a...

Ch. 10 - Straight-line depreciation A building acquired at...Ch. 10 - Straight-line depreciation Equipment acquired at...Ch. 10 - Units-of-activity depreciation A truck acquired at...Ch. 10 - Units-of-activity depreciation A tractor acquired...Ch. 10 - Double declining-balance depreciation A building...Ch. 10 - Double-declining-balance depreciation Equipment...Ch. 10 - Revision of depreciation Equipment with a cost of...Ch. 10 - Revision of depreciation A truck with a cost of...Ch. 10 - Capital and revenue expenditures On February 14,...Ch. 10 - Capital and revenue expenditures On August 7,...Ch. 10 - Sale of equipment Equipment was acquired at the...Ch. 10 - Sale of equipment Equipment was acquired at the...Ch. 10 - Prob. 10.7APECh. 10 - Prob. 10.7BPECh. 10 - Prob. 10.8APECh. 10 - Prob. 10.8BPECh. 10 - Fixed asset turnover ratio Financial statement...Ch. 10 - Fixed asset turnover ratio Financial statement...Ch. 10 - Costs of acquiring fixed assets Melinda Stoffers...Ch. 10 - Prob. 10.2EXCh. 10 - Prob. 10.3EXCh. 10 - Nature of depreciation Tri-City Ironworks Co....Ch. 10 - Straight-line depreciation rates Convert each of...Ch. 10 - Straight-line depreciation A refrigerator used by...Ch. 10 - Depreciation by units-of-activity method A...Ch. 10 - Depreciation by units-of-activity method Prior to...Ch. 10 - Depreciation by two methods A Kubota tractor...Ch. 10 - Depreciation by two methods A storage tank...Ch. 10 - Partial-year depreciation Equipment acquired at a...Ch. 10 - Revision of depreciation A building with a cost of...Ch. 10 - Capital and revenue expenditures US Freight Lines...Ch. 10 - Prob. 10.14EXCh. 10 - Capital and revenue expenditures Quality Move...Ch. 10 - Capital expenditure and depreciation; parital-year...Ch. 10 - Entries for sale of fixed asset Equipment acquired...Ch. 10 - Disposal of fixed asset Equipment acquired on...Ch. 10 - Prob. 10.19EXCh. 10 - Amortization entries Kleen Company acquired patent...Ch. 10 - Book value of fixed assets Apple Inc. designs,...Ch. 10 - Balance sheet presentation List the errors you...Ch. 10 - Fixed asset turnover ratio Amazon.com, Inc. is the...Ch. 10 - Fixed asset turnover ratio Verizon Communications...Ch. 10 - Fixed asset turnover ratio FedEx Corporation and...Ch. 10 - Fixed asset turnover ratio The following table...Ch. 10 - Asset traded for similar asset A printing press...Ch. 10 - Prob. 10.28EXCh. 10 - Entries for trade of fixed asset On July 1, Twin...Ch. 10 - Entries for trade of fixed asset On October 1,...Ch. 10 - Allocating payments and receipts to fixed asset...Ch. 10 - Comparing three depreciation methods Dexter...Ch. 10 - Depreciation by three methods; partial years...Ch. 10 - Depreciation by two methods; sale of fixed asset...Ch. 10 - Transactions for fixed assets, including sale The...Ch. 10 - Amortization and depletion entries Data related to...Ch. 10 - Allocating payments and receipts to fixed asset...Ch. 10 - Comparing three depreciation methods Waylander...Ch. 10 - Depreciation by three methods; partial years...Ch. 10 - Depreciation by two methods; sale of fixed asset...Ch. 10 - Transactions for fixed assets, including sale The...Ch. 10 - Amortization and depletion entries Data related to...Ch. 10 - Ethics in Action Hard Bodies Co. is a fitness...Ch. 10 - Prob. 10.2CPCh. 10 - Communication Godwin Co. owns three delivery...Ch. 10 - Prob. 10.6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the first and second years, the odometer registered 27,000 and 46,000 miles, respectively.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease provide the answer to this financial accounting question with proper steps.arrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License