Evaluate divisional performance (Learning Objective 3)

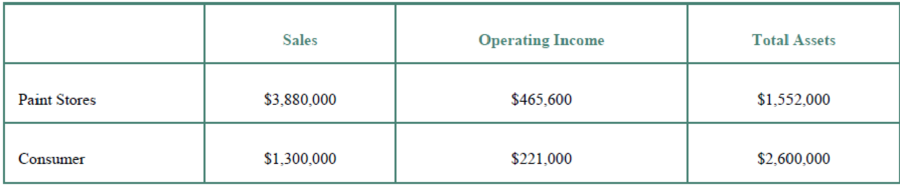

Sacramento Paints is a national paint manufacturer and retailer. The company is segmented into five divisions: Paint Stores (branded retail locations), Consumer (paint sold through stores like Sears, Home Depot, and Lowe’s), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for its two largest divisions: Paint Stores and Consumer (in thousands of dollars).

Assume that management has specified a 21% target

Requirements

Round all calculations to four decimal places.

- 1. Calculate each division’s

ROI . - 2. Calculate each division’s sales margin. Interpret your results.

- 3. Calculate each division’s capital turnover. Interpret your results.

- 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results.

- 5. Calculate each division’s RI. Interpret your results and offer recommendations for any division with negative RI.

- 6. Total asset data were provided in this problem. If you were to gather this information from an annual report, how would you measure total assets? Describe your measurement choices and some of the pros and cons of those choices.

- 7. Describe some of the factors that management considers when setting its minimum target rate of return.

- 8. Explain why some firms prefer to use RI rather than ROI for performance measurement.

- 9. Explain why budget versus actual performance reports are insufficient for evaluating the performance of investment centers.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

Additional Business Textbook Solutions

FUNDAMENTALS OF CORPORATE FINANCE

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Principles of Microeconomics (MindTap Course List)

Intermediate Accounting (2nd Edition)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Horngren's Accounting (12th Edition)

- 19. Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyarrow_forward19. Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyhelparrow_forwardYou invest 60% of your money in Asset A (expected return = 8%, standard deviation = 12%) and 40% in Asset B (expected return = 5%, standard deviation = 8%). The correlation coefficient between the two assets is 0.3. What is the expected return and standard deviation of the portfolio?correct solutarrow_forward

- You invest 60% of your money in Asset A (expected return = 8%, standard deviation = 12%) and 40% in Asset B (expected return = 5%, standard deviation = 8%). The correlation coefficient between the two assets is 0.3. What is the expected return and standard deviation of the portfolio?need jelparrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.no aiarrow_forward1) Identify whethere the company is paying out dividends based on the attached statement. 2) Describe in detail how that the company’s dividend payouts have changed over the past five years. 3)Describe in detail the changes in “total equity” (representing the current “book value” of the company).arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning