Concept explainers

Analyzing

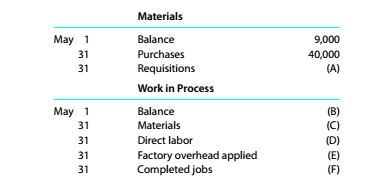

Summer Boards Company manufactures surf boards in a wide variety of sizes and styles. The following incomplete ledger accounts refer to transactions that are summarized for May:

In addition, the following information is available:

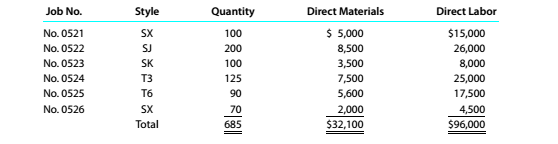

- Materials and direct labor were applied to six jobs in May:

b.Factory

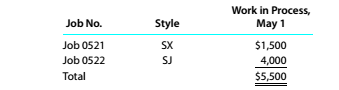

c.The May 1 Work in Process balance consisted of two jobs, as follows:

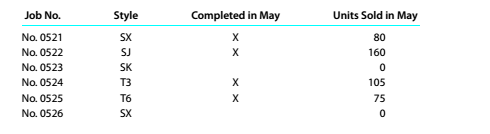

d. Customer jobs completed and units sold in May were as follows:

Instructions

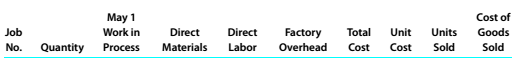

Determine the missing amounts associated with each letter. Provide supporting calculations by completing a table with the following headings:

Concept Introduction:

Direct Cost:

The cost which is directly related to the product and affects those items directly which contribute to the revenue generation in the business is referred as direct cost.It makes a direct relation to the manufacturing cost.

Indirect Cost:

The cost which is not directly related to the product and does not affect those items directly which contribute to the revenue generation in the business is referred as indirect cost. These can be fixed costs or such costs that are incurred as a whole and cannot be related to manufacturing cost.

The missing items in regard to the manufacturing costs SB Company.

Answer to Problem 10.4.1P

The following table represents items in regard to the manufacturing costs SB Company:

| Job no. | Quantity | May work in process | Direct Material | Direct Labor | Factory overhead | Total cost | Unit cost | Units sold | Cost of goods sold |

Explanation of Solution

The material requisition will be the cost of direct material incurred during the year. So, the material requisition is

The work in process at the beginning is given which is

The material work in process balance will be the cost of direct material incurred during the year for the jobs not completed i.e. job no.

The direct labor work in process balance will be the cost of direct labor incurred during the year for the jobs not completed i.e. job no.

The factory overhead work in process balance will be the factory overhead incurred during the year for the jobs not completed i.e. job no.

The factory overhead balance applied in total will be the factory overhead incurred during the year i.e.

| Job no. | Quantity | Units sold | Unsold quantity | Direct Material | Direct Labor | Factory overhead | Total cost | Unit cost | Cost of goods sold |

The balance of completed jobs is

| Job no. | Quantity | Total cost | Unit cost | Units sold | Cost of goods sold |

The balance of cost of goods sold of finished goods is

The balance of indirect labor to be transferred to the factory overhead will be the difference of the total wages payable and the direct labor i.e.

Want to see more full solutions like this?

Chapter 10 Solutions

Bundle: Survey of Accounting, Loose-Leaf Version, 8th + CengageNOWv2, 1 term Printed Access Card

- Please explain the solution to this financial accounting problem with accurate principles.arrow_forwardHello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- Based on the results of the Accounts Receivable Aging as of December 31, 2022 visualization, what conclusion can be made regarding the outstanding accounts receivables? a. The count of unpaid invoices was the highest for invoices within the 90+ days aging group and the lowest for invoices in the 31-60 days aging group. b. The count of unpaid invoices was the highest for invoices within the 31-60 days aging group and the lowest for invoices in the 90+ days aging group. c. The outstanding accounts receivable value for the 90+ days aging group is approximately the value of the other aging groups combined. d. The outstanding accounts receivable value for the 90+ days aging group is approximately twice the value of the other aging groups combined.arrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forwardBased on the results of the Sales Total vs Sales Order Counts by Channel in 2022 visualization, how do the sales channels compare with each other? a. Website sales had the lowest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. b. B2B sales had the highest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. c. Storefront sales had the highest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. d. Storefront sales had the highest number of sales orders, and the average value of the sales orders was higher compared to the other sales channels.arrow_forward

- Please explain this financial accounting problem by applying valid financial principles.arrow_forwardI want to this question answer for Financial accounting question not need ai solutionarrow_forwardI need help with this financial accounting question using accurate methods and procedures.arrow_forward

- Using the Sales Total vs Sales Order Counts by Channel in 2022 visualization, what trends are shown for the B2B sales channel? What recommendations do you have for management for the B2B strategy? What are some considerations when pursuing a B2B strategy?arrow_forwardCan you provide a detailed solution to this financial accounting problem using proper principles?arrow_forwardUsing the results of the Top 5 Customers by Accounts Receivable Amount Due and the Top 5 Customers by Outstanding Sales Order Amount visualization, what conclusion can be made regarding the outstanding sales orders? a. The high value of outstanding accounts receivable for Sanders Corp may be directly related to their high value of outstanding sales orders. b. The high value of outstanding accounts receivable for Williams Corp may be directly related to their high value of outstanding sales orders. c. The high value of outstanding sales orders for Roberts Corp has caused them not to pay a large value of invoices. d. Evans Corp has a high value of outstanding accounts receivable and outstanding sales orders.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,