EBK MANAGERIAL ACCOUNTING

5th Edition

ISBN: 8220103613811

Author: TIETZ

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 10.31BE

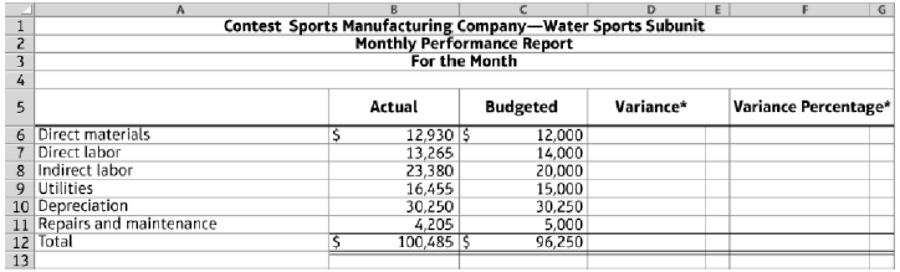

Complete and analyze a performance report (Learning Objective 2)

One subunit of Contest Sports Manufacturing Company had the following financial results last month:

10.3-21 Full Alternative Text

Requirements

- 1. Complete the performance evaluation report for this subunit (round to four decimals).

- 2. Based on the data presented, what type of responsibility center is this subunit?

- 3. Which items should be investigated if part of management’s decision criteria is to investigate all variances exceeding $2,900 or 13%?

- 4. Should only unfavorable variances be investigated? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

In a recent year, Adobe Inc. reports net income of $4,756 million. Its stockholders’ equity is $14,051 million and $14,797 million at the start and end of the fiscal year, respectively.

a. Compute its return on equity (ROE) for the year. Round answers to the nearest whole dollar amount.

Numerator

Denominator

Result

Return on equity

Answer 1

Answer 2

b. Adobe repurchased $6,550 million of its common stock during the year. Did this repurchase increase or decrease ROE? NOTE: Assume there was no change in net income related to the stock repurchase.

c. If Adobe had not repurchased common stock during the year, what would ROE have been? Note: Enter answer as a percentage rounded to the nearest one decimal place (ex: 24.8%).

Computing Return on Assets and Applying the Accounting Equation

Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%).

ROA Answer

Computing and Interpreting Financial Statement RatiosFollowing are selected ratios of Norfolk Southern.

Return on Assets (ROA) Component

FY4

FY3

Profitability (Net income/Sales)

25.7%

27.0%

Productivity (Sales/Average assets)

0.329

0.291

a. Was the company profitable in FY4? Answer 1b. In which year was the company more profitable? Answer 2c. Is the change in productivity a positive or negative development? Answer 3d. Compute the company’s ROA for both years. Note: Enter your answer as a percentage rounded to one decimal place (Ex: 29.4%).FY4 Answer 4%FY3 Answer 5%e. From the information, which of the following best explains the change in ROA during FY4?

Chapter 10 Solutions

EBK MANAGERIAL ACCOUNTING

Ch. 10 - (Learning Objective 1) Companies often...Ch. 10 - (Learning Objective 1) Which of the following is...Ch. 10 - (Learning Objective 1) In terms of responsibility...Ch. 10 - (Learning Objective 2) Which of the following is...Ch. 10 - (Learning Objective 2) A segment margin is the...Ch. 10 - Prob. 6QCCh. 10 - Prob. 7QCCh. 10 - Prob. 8QCCh. 10 - Prob. 9QCCh. 10 - Prob. 10QC

Ch. 10 - Identify and understand responsibility centers...Ch. 10 - Identify types of responsibility centers (Learning...Ch. 10 - Identify centralized and decentralized...Ch. 10 - Prob. 10.4SECh. 10 - Prob. 10.5SECh. 10 - Prob. 10.6SECh. 10 - Calculate ROI (Learning Objective 3) Refer to Epic...Ch. 10 - Prob. 10.8SECh. 10 - Prob. 10.9SECh. 10 - Prob. 10.10SECh. 10 - Prob. 10.11SECh. 10 - Interpret a performance report (Learning Objective...Ch. 10 - Prob. 10.13SECh. 10 - Classify KPIs by balanced scorecard perspective...Ch. 10 - Use vocabulary terms (Learning Objectives 1, 2, 3,...Ch. 10 - Prob. 10.16SECh. 10 - Identify type of responsibility center (Learning...Ch. 10 - Complete and analyze a performance report...Ch. 10 - Prepare a segment margin performance report...Ch. 10 - Compute and interpret the expanded ROI equation...Ch. 10 - Prob. 10.21AECh. 10 - Prob. 10.22AECh. 10 - Comparison of ROI and residual income (Learning...Ch. 10 - Prob. 10.24AECh. 10 - Comprehensive flexible budget problem (Learning...Ch. 10 - Prepare a flexible budget performance report...Ch. 10 - Work backward to find missing values (Learning...Ch. 10 - Construct a balanced scorecard (Learning Objective...Ch. 10 - Sustainability and the balanced scorecard...Ch. 10 - Identify type of responsibility center (Learning...Ch. 10 - Complete and analyze a performance report...Ch. 10 - Prob. 10.32BECh. 10 - Prob. 10.33BECh. 10 - Prob. 10.34BECh. 10 - Prob. 10.35BECh. 10 - Prob. 10.36BECh. 10 - Prob. 10.37BECh. 10 - Prob. 10.38BECh. 10 - Prob. 10.39BECh. 10 - Prob. 10.40BECh. 10 - Prob. 10.41BECh. 10 - Sustainability and the balanced scorecard...Ch. 10 - Prepare a budget with different volumes for...Ch. 10 - Prepare and interpret a performance report...Ch. 10 - Prob. 10.45APCh. 10 - Prob. 10.46APCh. 10 - Prob. 10.47APCh. 10 - Evaluate subunit performance (Learning Objectives...Ch. 10 - Prob. 10.49BPCh. 10 - Prob. 10.50BPCh. 10 - Evaluate divisional performance (Learning...Ch. 10 - Prob. 10.52BPCh. 10 - Determine transfer price at a manufacturer under...Ch. 10 - Evaluate subunit performance (Learning Objectives...Ch. 10 - Prob. 10.55SC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Expand upon it and add to itarrow_forwardDefine these terms: A) Information Asymmetry. B) Material misstatement in the audited financial statements. C) The term "Professional Skepticism." D) Contribution margin ratio. E) Gross Margin, also known as Gross Profit Margin.arrow_forwardNo Ai Which of the following errors will cause the trial balance to not balance?A. Omission of a transactionB. Entry posted twiceC. Transposing digits in one sideD. Debiting one account and crediting anotherarrow_forward

- Don't use ChatGPT!! Which of the following errors will cause the trial balance to not balance?A. Omission of a transactionB. Entry posted twiceC. Transposing digits in one sideD. Debiting one account and crediting anotherarrow_forwardWhich of the following is a temporary account?A. Retained EarningsB. Service RevenueC. Accounts PayableD. Inventoryarrow_forwardWhich of the following errors will cause the trial balance to not balance?A. Omission of a transactionB. Entry posted twiceC. Transposing digits in one sideD. Debiting one account and crediting anotherarrow_forward

- Mime Delivery Service is owned and operated by Pamela Kolp. The following selected transactionswere completed by Mime Delivery Service during October:1. Received cash from the owner as an additional investment, $7,500.2. Paid creditors on account, $815.3. Billed customers for delivery services on account, $3,250.4. Received cash from customers on account, $1,150.5. Paid cash to the owner for personal use, $500.Required:Indicate the effect of each transaction on the accounting equation elements (Assets, Liabilities,Owner’s Equity, Drawing, Revenue, and Expense) by listing the numbers identifying the transactions,(1) to (5). Also, indicate the specific item within the accounting equation element that is affected, i.e.(1) Asset (Cash) increases by $; Owner’s Equity (Pamela Kolp, Capital) increases by $.arrow_forwardWhen a company incurs an expense but does not yet pay it, what is the entry?A. Debit Expense, Credit CashB. Debit Liability, Credit ExpenseC. Debit Expense, Credit LiabilityD. No entry needed helparrow_forwardWhen a company incurs an expense but does not yet pay it, what is the entry?A. Debit Expense, Credit CashB. Debit Liability, Credit ExpenseC. Debit Expense, Credit LiabilityD. No entry neededarrow_forward

- Dont use ai What is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesi need help ..arrow_forwardGet the Correct Answer with calculation of this General Accounting Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY