Record equity transactions and indicate the effect on the

Nautical has two classes of stock authorized: $10 par preferred, and $1 par value common. As of the beginning of 2018, 125 shares of

| March 1 | Issue 3,000 additional shares of common stock for $10 per share. |

| April 1 | Issue 175 additional shares of preferred stock for $40 per share. |

| June 1 | Declare a cash dividend on both common and preferred stock of $0.25 per share to all stockholders of record on June 15. |

| June 30 | Pay the cash dividends declared on June 1. |

| August 1 | Purchase 175 shares of common |

| October 1 | Reissue 125 shares of treasury stock purchased on August 1 for $9 per share. |

Nautical has the following beginning balances in its stockholders’ equity accounts on January 1, 2018: Preferred Stock, $1,250. Common Stock, $3,000, Additional Paid-in Capital, $19,500; and

Required:

1. Record each of these transactions.

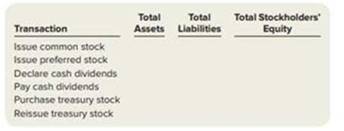

2. Indicate whether each of these transactions would increase (+), decrease (–), or have no effect (NE) on total assets, total liabilities, and total stockholders’ equity by completing the following chart.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

FINANCIAL ACCOUNTINGLL W/CONNECT >IC<

- Financial accountingarrow_forwardHow can the results from the accounts receivable visualizations be used to estimate bad debts expense and allowance for doubtful accounts? Using the Top 5 Customers by Accounts Receivable Amount Due visualization, which customer has the lowest allowance for doubtful accounts value?arrow_forwardBased on the results of the Sales Order Aging as of December 31, 2022 visualization, what conclusion can be made regarding the outstanding sales orders? a. The sales aging group with the highest value of outstanding sales orders is 90+ days and the sales aging group with the lowest value of outstanding sales orders is 31-60 days. b. The 90+ days sales aging group had a value of outstanding sales orders that was twice as much as the 31-60 days sales aging group. c. The 61-90 days sales aging group had a value of outstanding sales orders that was twice as much as the 31-60 days sales aging group. d. The sales aging group with the highest value of outstanding sales orders is 90+ days and the sales aging group with the lowest value of outstanding sales orders is 61-90 days.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning