Record equity transactions and indicate the effect on the

Nautical has two classes of stock authorized: $10 par preferred, and $1 par value common. As of the beginning of 2018, 125 shares of

| March 1 | Issue 3,000 additional shares of common stock for $10 per share. |

| April 1 | Issue 175 additional shares of preferred stock for $40 per share. |

| June 1 | Declare a cash dividend on both common and preferred stock of $0.25 per share to all stockholders of record on June 15. |

| June 30 | Pay the cash dividends declared on June 1. |

| August 1 | Purchase 175 shares of common |

| October 1 | Reissue 125 shares of treasury stock purchased on August 1 for $9 per share. |

Nautical has the following beginning balances in its stockholders’ equity accounts on January 1, 2018: Preferred Stock, $1,250. Common Stock, $3,000, Additional Paid-in Capital, $19,500; and

Required:

1. Record each of these transactions.

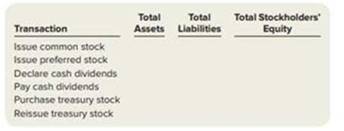

2. Indicate whether each of these transactions would increase (+), decrease (–), or have no effect (NE) on total assets, total liabilities, and total stockholders’ equity by completing the following chart.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Financial Accounting

- The Indiana corporation manufacturers a product that goes through three processing departments.arrow_forwardIf a company has total liabilities of $143,800 and stockholders' equity of $162,700, what is the value of its total assets? helparrow_forwardWhat are the net purchase for the month of September ?arrow_forward

- Sequoia Corporation had a pre-tax accounting income of $68 million during the current year. The company's only temporary difference for the year was warranty expenses accrued for the next year in the amount of $24 million. What would be Sequoia Corporation's taxable income for the year?arrow_forwardYour firm's DSO isarrow_forwardI am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning